6 Taxable Income from Business Operations Chapter

advertisement

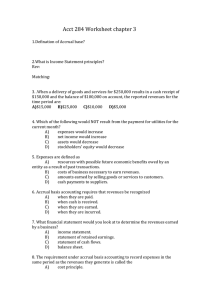

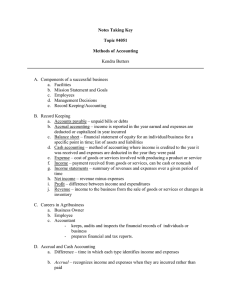

Chapter 6 Taxable Income from Business Operations Accrual Method of Accounting Under the accrual method, report income when the right to the income and the amount of the income can be determined with reasonable accuracy. Is usually triggered by a transaction. Called the Realization Principle: Recall from ACCT 5301 that this can lead to abusive behavior for financial reporting purposes—there is a tax cost associated with accelerating revenue. This can be a very significant issue See Shea Homes v. Commissioner (http://www.reuters.com/article/usa-tax-sheaidUSL2N0LH24C20140214) Deduction Of Expenses Under Accrual Method Of Accounting MATCH expenses against revenues. Deduct when ALL EVENTS have occurred that determine the existence of the liability and the amount of the liability can be determined with reasonable accuracy. Important exception—allowance method for bad debts and warranties not allowed for tax purposes, regardless of taxpayer’s method of accounting.