Unit 4 Bus Man

advertisement

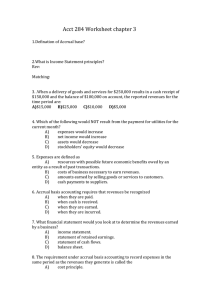

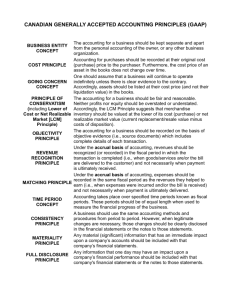

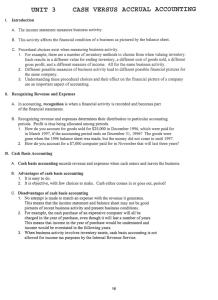

BUSINESS MANAGEMENT Unit 4 Income Statements Business Analysis Risk Solvency Feasibility Liquidity Repayment Capacity Statement of Cash flows Balance Sheet Statement of Owners’s Equity Income Statement Profitability Financial Efficiency Income Statement Definition: A summary of income and expenses for a given period of time. Uses of the Income Statement Reporting income and expenses on tax returns Required on loan applications Financial analysis of business Explain changes in Owner’s Equity Reporting Income and Expenses Cash Method Accrual Method Cash Method Income must be reported in the year the cash, or its equivalent is received. Deductions for expenses are made in the year that the cash is paid out. Cash method- Advantages Flexibility- choose when to take income and deduct expenses. More favorable capital gains tax treatment than accrual method. If business shows a profit, cash is available to pay the income tax. Cash Method- Disadvantages Expenses are not deductible until cash is paid. Inventory adjustments must be made to compute an income statement and analysis information. Income reported is more erratic. Cash Transactions Cash Revenue Cash Expenses-summary and coded Depreciation Gain or Loss on Sales of Capital Assets- Capital Gains/Losses Cash Income Statement Do Assignment #1---Cash Income Statement for GYFS Information on Website Create a new page in your Excel spreadsheet assignment file. Accrual Method Inventories must be used to determine gross income. Sales are treated as income when the price of the item is recoverable. Expenses are deductible when payable. Accrual Method-Advantages Levels out peaks and valleys of income without year-end manipulations. Easier to determine net income and analyze strong and weak points of the business from year to year than with the cash method. Accrual Method-Disadvantages very detailed and complex records are required. Inventory must be valued by an approved IRS method. In some years profit may only appear on paper, and money may have to be borrowed to pay income tax. Difficult to determine actual cash position of the business. Variable Costs Costs that vary with production levels Fixed Costs Costs that remain constant with changes in production Analysis Operating ratio= Fixed ratio= Gross ratio=