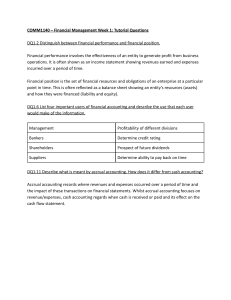

Cash to Accrual Basis of Accounting Cash Basis of Accounting - Recognizes revenue when cash is received and recognizes expenses when cash is paid, regardless of when the transaction happened. Accrual Basis of Accounting - Recognize revenue when the service is rendered or goods are sold and recognizes expenses when incurred, regardless of when the cash will be received or paid. General Features 1. Pure cash basis - Purely based on cash investments. - Revenue is recorded when cash is received. - Expenses is recorded when cash is paid. - There is no capitalization of long-term assets. - No depreciation or amortization of long-term assets. 2. Modified Cash Basis - Purely based on cash movements on revenue and expenses. - Revenue is recorded when cash is received. - Expenses is recorded when cash is paid. - Resources that can benefit the entity in more than one period are capitalized. - Long term assets are depreciated or amortized. 3. Accrual Basis - Revenue is recorded a the time of the transaction. - Expenses are recorded when incurred. - Revenue and expenses are recorded regardless of the time of cash receipt or payment. - Allows recording of receivables and payables. - Recognizes the need for recording of prepayments, deferrals, accruals, depreciation, and amortization which require adjustments at the end of the accounting period. Conversion from Cash Basis to Accrual Basis According to IAS 1: Presentation of FS - An entity shall prepare its financial statements, except for cash flow information, using the accrual basis of accounting. - The recognition principles and criteria set forth in the Conceptual Framework for - Financial Reporting re based strictly on the accrual basis of accounting. An entity that utilizes the cash basis of accounting in their records should be able to prepare financial statements under the accrual basis of accounting.