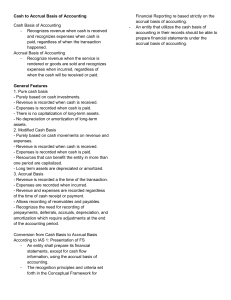

4 Bases of Accounting Part -4 Qus. 1 The method of accounting that recognizes revenue when money is received and expenses when bills are paid is called: 1. Managerial Accounting 2. Accrual Basis 3. Forensic Accounting 4. Cash Basis Qus2. Accrual concept is based on a. Matching principle b. Dual aspect c. Cost d. Going concern Qus3. Under cash basis of Accounting expenses are recorded A.)On payment . B.) On being incurred C.) Either (A) Or (B) . D.) None of these . Qus4. Accrual Basis of Accounting recognizes A.) outstanding and prepaid expenses. B.) Accrued income and income received in Advance. C.) Both A and B. D.) None of the above. Qus5. ----------- basis of accounting is Suitable for non profit organizations and professionals A.) Cash basis B.) Accrual Basis. C.) Both A and B. D.) None of the above. Qus.6 ----------- basis of accounting is recognized by companies Act 2013 A.) Cash basis B.) Accrual Basis. C.) Both A and B. D.) None of the above. Qus7. Accrual basis of accounting A.) does not give a true and fair view of profit and financial position. B.) gives a true and fair view of profit and financial position. C.) may or may not give a true and fair view of profit and financial position. D.) None of the above.