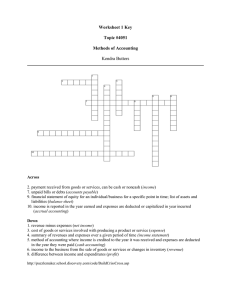

Q1 Exchange transactions are defined by one party to the transaction who receives a store of value in exchange for surrendering a store of value or taking on liabilities to acquire a good or service. For example, this type of transaction fits what are called program service fees in the NPO world. These types of revenue sources are characterized by services provided to customers or beneficiaries in exchange for payment. NPOs will set fees for these services, similarly to a private enterprise or for-profit business and it could include: tuition, admission fees, or counseling services, among others. In contrast, non-exchange transactions, or contributions, are unconditional transfers of stores of value without receiving anything of similar value in return. Examples of these transactions include voluntary donations of cash and other noncash assets to an NPO without receiving anything of substantial value in return. Some transactions may have elements of both types of transactions, an example of this would be tickets for an annual dinner event banquet. The organization may charge a fee for this banquet that exceeds the actual value of the benefit to the participant. If so, the excess benefit over the value is treated as a non-exchange voluntary contribution, while the other portion is treated as an exchange transaction fee for service. Q2 Accrual accounting means revenue and expenses are recognized and recorded when they occur, revenues are reported in the income statement before the cash is received from customers. And expenses are reported in the income statement when they occur or when they expire. Cash accounting means these line items aren't documented until cash exchanges hands. Revenues are reported in the income statement when received form the customer, expenses are reported in the income statement when the expenses are paid out. Cash basis accounting is easier, but accrual accounting portrays a more accurate portrait of a company's health by including accounts payable and accounts receivable. The accrual method is the most commonly used method, especially by publicly-traded companies as it smooths out earnings over time. The cash method is mostly used by small businesses and for personal finances. Q3 Malaysian Public Sector Accounting Standards (MPSASs) are drawn by IPSASs. It is used to establish an accounting policy to govern the preparation of governmental financial reporting. And the Accountant General’s Department is responsible in issuing MPSASs which apply to the accrual basis of accounting and sets out requirements dealing with transactions and other events in the general-purpose financial reports. Reports are intended to meet the information needs of users who are unable to require the preparation of financial reports tailored to meet their specific information needs. What’s more, all of public sector entities other than government business entities (GBEs) should follow the general-purpose financial reports that designed by MPSASs. Q4 重的比较多 Federal Government Financial Statements are prepared annually by the Accountant Generals of Malaysia: according to the requirements of Section 16(1) of the Financial Procedure Act, 1957, Government Accounting Standards and International Public Sector Accounting Standards. And Financial Reporting under the Cash Basis of Accounting. They are prepared by consolidating financial information from all accounting offices of the Accountant General’s Department of Malaysia as well as Ministries. In addition, they are audited by the Auditor General before being tabled in Parliament according to the requirements of Section 16[2] of the Financial Procedure Act, 1957. PKKP consists of Financial Status Statements, Cash Receipt and Payment Statements, Financial Performance Statements, Memorandum Account Statements as well as Notes to the Financial Statements. Q5 The objective of MPSAS 1 is to stipulate the manner in which general purpose financial statements should be presented to ensure similarity both with the entity’s financial statements of previous periods and with the financial statements of other entities. For this purpose, MPSAS 1 sets out overall considerations for the presentation of financial statements, and the requirements for the content of financial statements prepared under the accrual basis of accounting. The recognition, measurement and disclosure of specific transactions and other events are dealt with in other MPSASs. The components of the financial statements in the Malaysian public sector include the following: Notes to the Financial Statements; Statement of Financial Status; Statement of Financial Performance; Statement of Cash Receipts and Payments; Statement of Memorandum Accounts. Q6 These statements present the government's overall financial position, and they offer some insight into its ability to continue to deliver services in the future. And it shows the amount of cash and investments held in respect of three accounts of the consolidated fund, consolidated loan account and consolidated trust account. In addition, there reports are the standard that citizens, oversight bodies, and other stakeholders use to judge their government's efficiency, effectiveness, and overall financial condition. The public sector presents its financial statements on the cash basis of accounting principles adopted by the federal government. This is to better reflect the information of the financial statements. So only investments held for specific income and fiduciary purposes are disclosed in the statement of financial position. For other investments, it is disclosed in the memorandum account in the financial statements.