Acct 284 Worksheet chapter 3

advertisement

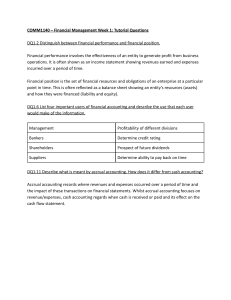

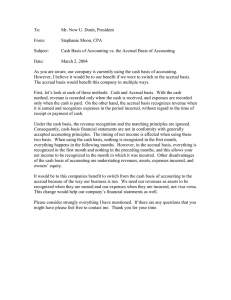

Acct 284 Worksheet chapter 3 1.Defination of Accrual base? 2.What is Income Statement principles? Rev: Matching: 3. .When a delivery of goods and services for $250,000 results in a cash receipt of $150,000 and the balance of $100,000 on account, the reported revenues for the time period are: A)$15,000 B)$25,000 C)$10,000 D)$5,000 4. Which of the following would NOT result from the payment for utilities for the current month? A) expenses would increase B) net income would increase C) assets would decrease D) stockholders’ equity would decrease 5. Expenses are defined as A) resources with possible future economic benefits owed by an entity as a result of past transactions. B) costs of business necessary to earn revenues. C) amounts earned by selling goods or services to customers. D) cash payments to suppliers. 6. Accrual basis accounting requires that revenues be recognized A) when they are paid. B) when cash is received. C) when they are earned. D) when they are incurred. 7. What financial statement would you look at to determine the revenues earned by a business? A) income statement. B) statement of retained earnings. C) statement of cash flows. D) balance sheet. 8. The requirement under accrual basis accounting to record expenses in the same period as the revenues they generate is called the A) cost principle. B) C) D) revenue principle. time period principle. matching principle. 9). If liabilities increase $35,000 during a given period and stockholders’ equity decreases $12,000 during the same period, assets must have A) decreased $47,000. B) increased $47,000. C) decreased $23,000. D) increased $23,000.