2015 PBEA Conference Teaching Kids About Social Media Dr

advertisement

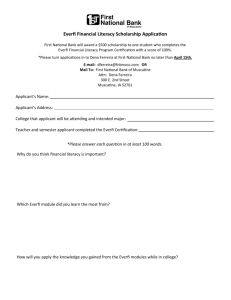

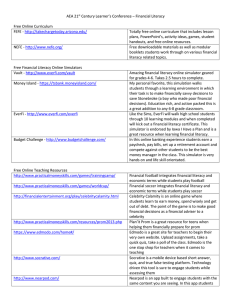

2015 PBEA Conference Teaching Kids About Social Media Dr. James Beeghley, Owner, Beeghley Tech Innovations This session will discuss how you can talk to your students about being good citizens online and the importance of making good online choices along with providing an overview of various social media tools. Why Digital Literacy Matters Now More Than Ever Kristin Giron & Roger Crider, Franklin Regional High School Ninety-six percent of working Americans use new communications technologies as part of their daily life. In this session, participants will learn the importance of an online digital literacy class in schools today. The session will focus on social media use, 21st Century research, Web 2.0 tools, cyberbullying, netiquette and digital writing. Practice What You Preach: Investing Basics, Students & You Doug Hassenbein, Assistant Investor Education Coordinator with the Pennsylvania Department of Banking and Securities Students who know the basics of investing will be better prepared to pursue life goals through their own financial means. Understanding your own investments and financial goals allows you to build a personal nest egg and deliver real world investment experiences to students. Learn why “practicing what you preach” and “preaching what you practice” can be a win-win for you and your students. Also learn about investor education resources for educators. Making Cents of Financial Education in Pennsylvania Hilary Hunt, Coordinator The Making Cents Project The Pennsylvania Department of Education and Penn State University have partnered to provide resources to support the teaching of personal finance in schools across Pennsylvania. Learn about a model high school personal finance course and a new collection of resources in iTunes U that can augment a standalone course in personal finance or units embedded in other courses. Further opportunities for professional development and other resources will also be shared. College Finance 101 Jason Linkes, Owner/ Jason Linkes Speaking I will use my background and business experience to discuss five key points: Credit Cards - The purpose of credit cards; the dangers; Interest Rates – What are they and how do they affect me?; Credit Score – What I do now will impact me later; Budgeting - How to properly set a realistic budget; Economizing - Keys to saving money in college and still having fun. Jason Graduated from Saint Leo University, Cum Laude, B.A. Marketing; Saint Leo University Alumni Board of Directors; Institute of Scrap Recycling Industries (ISRI) Financial and Career Readiness: EverFi’s Blended Learning Approach Amber Osuba, Pennsylvania Schools Implementation Manager Are your students equipped with the critical life skills they need to thrive beyond the classroom? From financial literacy, to digital citizenship, and business planning, EverFi courses help tackle the career and college preparedness issues facing students today. Participants will learn how to integrate EverFi's no cost, online courses to work in their classrooms to enhance current curriculum and student engagement. Featuring: Vault – Understanding Money (grades 4-6), Venture – Entrepreneurial Expedition (grades 7-10), Ignition – Digital Literacy (grades 5-8), and EverFi – Financial Literacy (grades 9-12). What every consumer needs to know about IDENTITY THEFT David P. Shallcross, Community Liaison for the Office of Attorney General Our community outreach program aimed at the “Dos & Don’ts” of ID Theft will provide citizens with the basics of protecting yourself from identity thieves and scam artists in a live presentation for your audience. Each year, more than 10 million Americans have their personal information -- including name, social security number, bank account or credit card number -- stolen. Often times, thieves use this information to open phony credit card, bank or utility accounts. Occasionally, the perpetrator will use the victim's identity to secure benefits such as healthcare or government assistance. Unfortunately, identity theft can have a far reaching and disastrous impact on victims - preventing them from purchasing a home or even getting a job - and those who fall prey often face an uphill battle to restore their good name. Teach a Cybersecurity Course at your School! Dr. Melanie B. Wiscount, IT Computer Science Teacher at the McKinley Technology STEM High School in the District of Columbia Public Schools system Prepare your students to be cybersecurity specialists. Teach lessons about password security, cryptography, cloud security, privacy, risk management, data loss prevention, and cyber espionage, as well as security measures against malware, advanced attacks, and social engineering. Help students develop practices of responsible, ethical, civil, and accountable behavior online. At the end of this course, they will be a great resource for their families, their teachers, their employers, and their peers. PRO FOOTBALL HALL OF FAME’S YOUTH & EDUCATION PROGRAM The Pro Football Hall of Fame-A Free Resource for your Business Education Classroom Andy Wise, Jerry Csaki The Pro Football Hall of Fame’s Youth and Educational Programs aim to inspire young people to achieve Hall of Fame Success on and off the field. These award-winning programs are not only designed to engage and educate young people on the Rich Tradition of professional football but to teach them the Positive Character Values of this game by Celebrating Excellence achieved by the Heroes of the Game. Federal Reserve Bank of Philadelphia Economic and Personal Finance Materials & Programs with an emphasis on the Keys to Financial Success Personal Finance Curriculum and Training Program Todd Zartman, Economic Education Specialist This session will rely heavily on active- and collaborative-learning teaching demonstrations, which will engage the participants in the lessons and materials used by the FRB of Philadelphia in the Keys to Financial Success curriculum. The participants will be introduced to the lessons and materials available to educators. The participants will leave the session with at least two full lessons available for immediate use in their classrooms and knowledge of the many resources, including the "Keys to Financial Success" high school personal finance program, which are available free of charge for use in classrooms..