Financial Literacy Study Guide: EverFi Unit Questions

advertisement

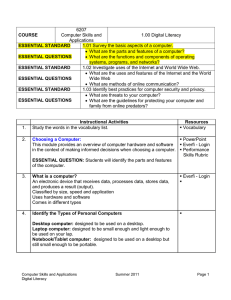

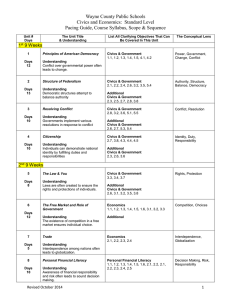

Study Guide Financial Literacy Unit As you complete the EverFi Financial Literacy units at www.everfi.net, answer the following questions. Submit your questions and answers at the completion of the unit as a Summative Assessment of your understanding. Module 2 Module 7 Module 3 Module 8 Module 4 Module 9 Module 5 Module 10 Module 6 Module # 1: Introduction In module 1, students are introduced to the expert narrators who speak directly to the students throughout the entire course. The students are also given an interactive tutorial on how to maximize their experience on the portal. In addition to serving as a launching pad for the courses and simulation, the portal serves as an ongoing resource and support tool, to keep learners engaged and provides additional learning opportunities. Module #2: Savings 1. What is interest? How is interest different from compound interest? 2. Why is it important for young people to start saving as early as possible given the Principles of Interest? 3. What is the purpose of a budget? 4. How can people make sure their budgets remain balanced? Module #3: Banking 1. What are the different types of banking institutions? 2. How is a checking account different than a savings account? 3. How can you monitor your checking account balance and what are the risks of spending more money than you have? Module #4: Payment Types, Interest Rates, and Credit Cards 1. What is credit, and how can it be useful to consumers? 2. What features of a credit card do you need to research when considering a credit card? 3. How can people make sure they are using credit cards responsibly? 4. What is the difference between a debit card and a credit card? Module #5: Credit Scores 1. What information goes into a credit score, and what information does not? 2. Why would you want a good credit score? How are credit scores used? 3. What can you do to help make your credit score strong? 4. What can you do if you have a low credit score, to help increase it? Module #6: Financing Higher Education 1. How is education an investment in yourself? 2. Explain why it might be a good idea to borrow money for college if you might not otherwise afford to go. 3. What are the steps in the student loan process? 4. Why is it important to repay your student loans on time? Module #7: Renting vs. Owning 1. What is a mortgage? 2. What causes a mortgage foreclosure? 3. What are the advantages of renting vs. owning a home? What are the advantages of owning vs. renting a home? 4. Is buying a house always a solid investment? Module #8: Insurance and Taxes 1. What is tax revenue used for? 2. What is the difference between sales tax and property tax? 3. What types of insurance do people use and what are the benefits to having insurance? 4. How does one pay for insurance? Module #9: Consumer Fraud 1. What is identity theft, and what can people do to protect themselves from it? 2. Why should people check their credit report once a year? 3. What are some examples of consumer fraud? Module #10: Investing 1. Why do people take financial risks? 2. What is a stock, and why might stocks be a good investment? 3. What is a mutual fund and how is it different than stock? 4. How are bonds different than stock? How does their risk profile differ? 5. How can you lower risks when it comes to investing? EverFi Life Game Print screen the ending slide after completing the three games modes provided. EverFi Life is an interactive, virtual world game that students play through a customized avatar character at three different life stages. Each of the three game modes include: High School, College and Post College. Each includes a different set of mission objectives. The end users must construct a budget for their character within each game mode. They select a budget that includes cell phone plans, groceries, car insurance, savings, investments, rent, entertainment, utilities and more. Throughout each stage, the characters earn points in the game by making wise financial decisions within a variety of real-life scenarios. These objectives include opening a checking account, paying off student loans, applying for summer jobs, paying taxes and utilities and making basic investment decisions. This enables students to apply what they’ve learned in the modules within the courses.