Group Work Solutions 10/16/14

advertisement

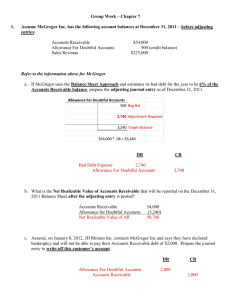

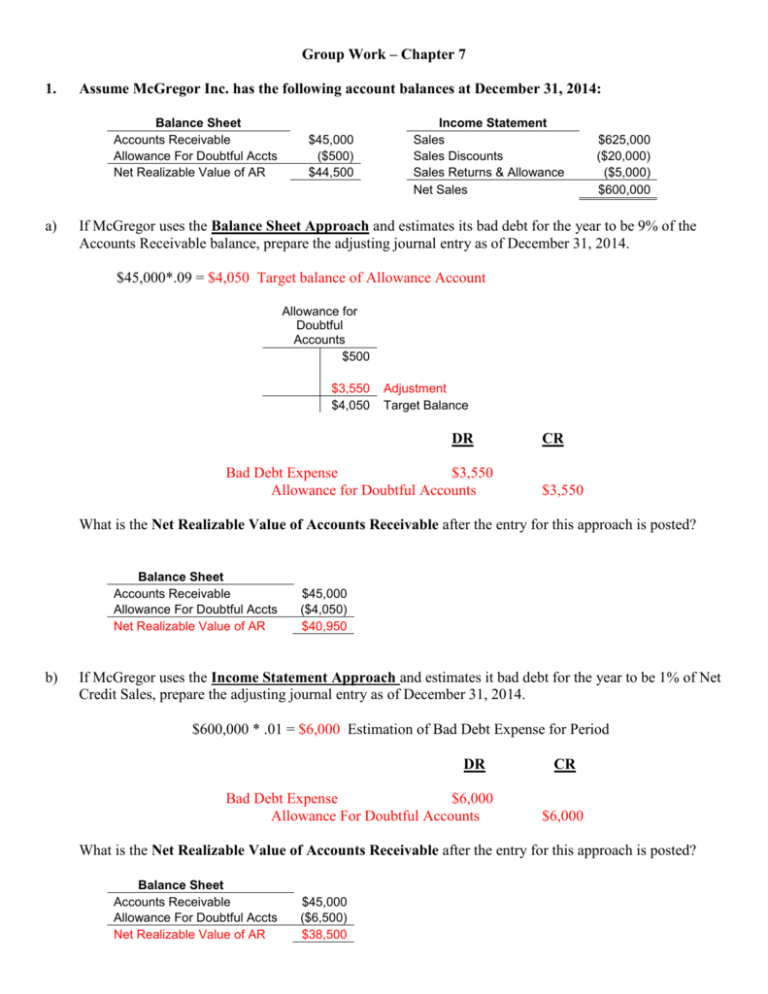

Group Work – Chapter 7 1. Assume McGregor Inc. has the following account balances at December 31, 2014: Balance Sheet Accounts Receivable Allowance For Doubtful Accts Net Realizable Value of AR a) $45,000 ($500) $44,500 Income Statement Sales Sales Discounts Sales Returns & Allowance Net Sales $625,000 ($20,000) ($5,000) $600,000 If McGregor uses the Balance Sheet Approach and estimates its bad debt for the year to be 9% of the Accounts Receivable balance, prepare the adjusting journal entry as of December 31, 2014. $45,000*.09 = $4,050 Target balance of Allowance Account Allowance for Doubtful Accounts $500 $3,550 $4,050 Adjustment Target Balance DR Bad Debt Expense $3,550 Allowance for Doubtful Accounts CR $3,550 What is the Net Realizable Value of Accounts Receivable after the entry for this approach is posted? Balance Sheet Accounts Receivable Allowance For Doubtful Accts Net Realizable Value of AR b) $45,000 ($4,050) $40,950 If McGregor uses the Income Statement Approach and estimates it bad debt for the year to be 1% of Net Credit Sales, prepare the adjusting journal entry as of December 31, 2014. $600,000 * .01 = $6,000 Estimation of Bad Debt Expense for Period DR Bad Debt Expense $6,000 Allowance For Doubtful Accounts CR $6,000 What is the Net Realizable Value of Accounts Receivable after the entry for this approach is posted? Balance Sheet Accounts Receivable Allowance For Doubtful Accts Net Realizable Value of AR $45,000 ($6,500) $38,500 c) On April 2nd, 2015, JD Rhimes comes to you and says they have declared bankruptcy and will not be able to pay their Accounts Receivable debt of $400. Prepare the journal entry to write-off this specific account. DR Allowance For Doubtful Accounts Accounts Receivable CR $400 $400 How will the write-off of JD Rhimes account affect Net Income? No Effect How will the write-off of JD Rhimes affect the Net Realizable Value of Accounts Receivable? No Effect 2. During 2014, Dawson Inc. wrote off uncollectible accounts in the amount of $21,500. The January 1, 2014 balance in Allowance for Doubtful Accounts is $15,000, and the December 31, 2014 balance in Allowance for Doubtful Accounts is $42,000. What amount must be reported as Bad Debt Expense on the Income Statement for Dawson Inc. for the year 2014? Allowance For Doubtful Accounts $15,000 Write Offs 3. a. $21,500 Beg Bal $48,500 Bad Debt Expense $42,000 Ending Balance On August 1, 2014, McGregor Inc. loaned $90,000 to a key financial officer. The loan is due in 8 months, and it has a 7% rate. The principal and interest are due at maturity. Prepare a journal entry necessary to recognize the loan on August 1. DR CR Note Receivable Cash b. $90,000 $90,000 December 31, 2014 is the fiscal year-end for McGregor Inc., and they record adjusting journal entries on this date before preparation of financial statement. Prepare an adjusting entry necessary for the loan at year-end. DR CR Interest Receivable Interest Revenue ($90,000 * .07 * 5/12 = $2,625) $2,625 $2,625 c. On April 1, 2015, McGregor received both the Principal and Interest due on the Note. Prepare a journal entry to record this transaction. DR CR Cash Interest Receivable Note Receivable Interest Revenue ($90,000 * .07 * 3/12 = $1,575) $94,200 $ 2,625 $90,000 $ 1,575