ACG 2021 - FinancialAccounting

advertisement

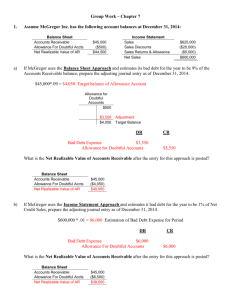

3 Transactions › Initial purchase › Period End Adjustment › Sale of Investment Year of Purchase › Balance Sheet Market Value of Investment › Income Statement Unrealized Gain or Loss Dividend Revenue (if received) Year of Sale › Balance Sheet Investment balance is removed -0› Income Statement Gain or Loss on Sale Based on Ending Market Value from previous period 3 Transactions › Issuance of Note › Accrual of Interest › Collection of Note Year of Issuance › Balance Sheet Note Receivable owed to Company Interest Receivable › Income Statement Interest Revenue for Accrued Interest Year of Collection › Balance Sheet Note Receivable is collected -0 Interest Receivable is collected -0› Income Statement Interest Revenue for partial period Represents Amount owed from Customers Allowance for Doubtful Accounts › Contra- Asset Account › Represents Amount we Expect NOT to collect from Customers Net Accounts Receivable or Net Realizable Value › Accounts Receivable – Allowance for Doubtful Accounts › Represents what we Expect to collect Matching Principle Requires Estimate › Expense: Amount of Sales NOT collected Two Estimation Techniques: › % of Sales › Aging of Accounts Receivable One Non-Estimation Technique › Direct-Write Off Estimates the amount of the Expense › Amount of Credit Sales that we expect NOT to collect › Once computed (Credit Sales x %) Uncollectible Accounts Expense xxxxxx Allowance for Doubtful Accounts xxxxxxx Estimates the Amount of Receivables we expect NOT to collect › That is a definition of what? › Once Computed: You have estimated the ENDING Balance of the Allowance for Doubtful Accounts Determine the Beginning Balance Make the adjustment Usually Uncollectible Accounts Expense xxxxxx Allowance for Doubtful Accounts xxxxxxx We know with Certainty that we won’t be collecting a certain account: Reduce the Allowance Account & Reduce the Accounts Receivable Account › Allowance for Uncollectible Accounts xxxxx › Accounts Receivable xxxx Acid-Test › Similar to Current Ratio but…. › (Cash + ST Investments + Accounts Receivable) / Current Liabilities Day’s Sales in Receivable › Average Accounts Receivable / Day’s Avg. Sales