Bad Debt Procedures

Bad Debt Procedures

Delinquent balances should be reviewed by the pastor and business manager to determine if a specific family balance should remain open for further collection efforts or written off as bad debt. In either case, the following examples will show how to properly record the transactions in QuickBooks.

Direct write-off method - Create a credit memo in the family account, tracking to 652100 Bad Debt

Expense

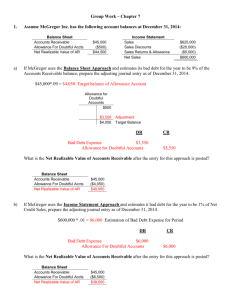

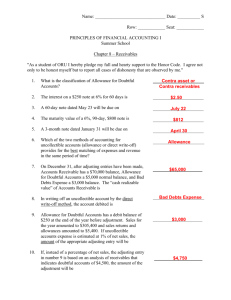

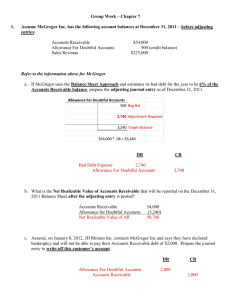

Allowance for Doubtful Accounts method – Throughout the year the parish may wish to accrue bad debt expense by setting up an Allowance rather than taking a one-time hit at year end for bad debt writeoffs. The parish may elect to establish an allowance for doubtful accounts at year end by projecting the amount of uncollectable amounts of remaining family balances while not specifically writing off any family balances.

1.

Create an account in QuickBooks named Allowance for Doubtful Accounts. This account should be created as an “Accounts Receivable” type of account and is to be assigned the GL number of

151300 according to the approved chart of accounts. Make sure you mark this new account as a sub account of the header 15. You will also need to create Allowance for Doubtful Accounts as an Accounts Receivable customer, as QuickBooks will not allow postings to Accounts

Receivable without the inclusion of a customer name.

2.

If you do not already have a bad debt expense account set up, it will be an “Other Expense” type of account assigned to # 652100 according to the approved chart of accounts. Make sure you mark it a sub account of the 65 Non-Cash Expense header account.

3.

You will then prepare a journal entry dated the last day of the fiscal year. ( ex: 6/30/14) debiting

Bad Debt # 652100 and crediting Allowance for Doubtful Accounts # 151300 making sure to use the customer name of Allowance for Doubtful Accounts in the name field of the journal entry.

Under this scenario, a review of the total Accounts Receivable balances at June 30 would be made with an estimate of what would be considered to be uncollectable. The purpose of the entry is to record the bad debt expense in the current year, while not removing the family balances.

4.

When the determination is made that a specific family balance is uncollectable, the school should remove the balance by use of a credit memo with an accompanying journal entry. The first step is to create a credit memo tracking to bad debt write off. After posting all of the credit memos to the specific families, a journal entry is necessary to reduce the Allowance for Doubtful Accounts.

The entry will debit # 151300 Allowance for Doubtful Accounts, again entering the customer name of Allowance for Doubtful Accounts, and credit # 652100 Bad Debt. Note: remember, bad debt expense had already been recorded in a prior fiscal year, so this journal entry is needed to avoid duplication of that expense. If you estimate uncollectable accounts to be $10,000 at

6/30/14 and later determine that you would like to write off $11,000, the entry would be for

$10,000 with the remaining $1,000 recorded as Bad Debt expense in the current year. If uncollectable amounts are $8,000 vs. your estimate of $10,000, your reversing entry will be for the $8,000 directly written off, and the remaining $2,000 would be used for future write offs.

The process of estimating uncollectable amounts and establishing the proper level of

Allowance for Doubtful Accounts should occur every year as part of the year end close process.

This will allow the school to show an Accounts Receivable balance on the financials which represents what is collectable and also allows for matching Bad Debt expense in the proper period.