ACCT 284 Worksheet Chapter 8(part 1)

advertisement

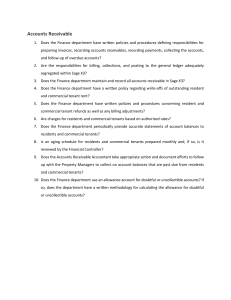

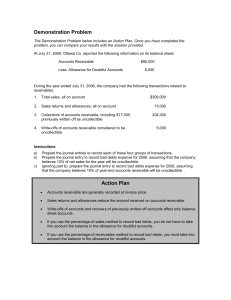

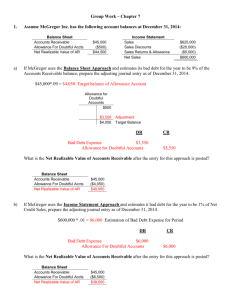

ACCT 284 Worksheet Chapter 8(part 1) 1). Net receivable = ? 2). Allowance method ( entry to record ) Bad Debt Expense: Account write off: 3). Difference between % of credit sales and Aging of Account receivable when you recording the bad debt expenses? 4). What impact gonna happen to your income statement and balance sheet if you did actual write off? 6). Before adjustment, the allowance for doubtful accounts has a credit balance of $1,900. The company had $210,000 of net credit sales during the period and historically fails to collect 3% of credit sales. The company uses the percentage of credit sales method of estimating doubtful accounts. After adjusting for estimated bad debts, the new balance in the allowance for doubtful accounts account will be: A) $3,700. B) $4,400. C) $6,300. D) $8,200 7). When a company using the allowance method write off a specific customer’s account receivable from the accounting system, how many of the following are true? Total SE remains the same Total asset remain the same Total expense remain the same A). None B). One C). Two D). Three 8). The unadjusted balance of the allowance for doubtful accounts of Johnstone Supplies, Inc., is a credit balance in the amount of $28,947 on July 31, 2005. Based on the accounts receivable aging report, bad debt expense will be: Johnstone Supplies, Inc. Accounts Receivable Aging Report, July 31, 2005 Accounts receivable Account Total by due date Note yet due $126,500 1-30 days past due $89,200 Estimated % uncollectible 2% 12% 31-60 pays past due Over 60 days past due A) B) C) D) $34,012. $5,065. $62,959. $50,434. $53,600 $31,800 18% 35%