pop quiz

advertisement

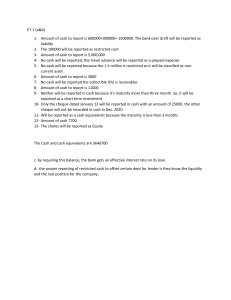

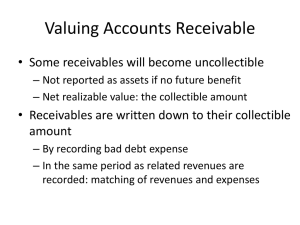

Name: _______________________________ Date: __________ S Row: ____________ Seat: ____________ PRINCIPLES OF FINANCIAL ACCOUNTING I Summer School Chapter 8 – Receivables "As a student of ORU I hereby pledge my full and hearty support to the Honor Code. I agree not only to be honest myself but to report all cases of dishonesty that are observed by me." 1. What is the classification of Allowance for Doubtful Accounts? 2. The interest on a $250 note at 6% for 60 days is $2.50 3. A 60-day note dated May 23 will be due on July 22 4. The maturity value of a 6%, 90-day, $800 note is $812 5. A 3-month note dated January 31 will be due on April 30 6. Which of the two methods of accounting for uncollectible accounts (allowance or direct write-off) provides for the best matching of expenses and revenue in the same period of time? 7. On December 31, after adjusting entries have been made, Accounts Receivable has a $70,000 balance, Allowance for Doubtful Accounts a $5,000 normal balance, and Bad Debts Expense a $3,000 balance. The “cash realizable value” of Accounts Receivable is 8. In writing off an uncollectible account by the direct write-off method, the account debited is 9. Allowance for Doubtful Accounts has a debit balance of $250 at the end of the year before adjustment. Sales for the year amounted to $305,400 and sales returns and allowances amounted to $5,400. If uncollectible accounts expense is estimated at 1% of net sales, the amount of the appropriate adjusting entry will be 10. If, instead of a percentage of net sales, the adjusting entry in number 9 is based on an analysis of receivables that indicates doubtful accounts of $4,500, the amount of the adjustment will be Contra asset or Contra receivables Allowance $65,000 Bad Debts Expense $3,000 $4,750 Name: _______________________________ Date: __________ S Row: ____________ Seat: ____________ PRINCIPLES OF FINANCIAL ACCOUNTING I Summer School Chapter 8 – Receivables "As a student of ORU I hereby pledge my full and hearty support to the Honor Code. I agree not only to be honest myself but to report all cases of dishonesty that are observed by me." 1. What is the classification of Allowance for Doubtful Accounts? 2. The interest on a $250 note at 6% for 60 days is 3. A 60-day note dated May 23 will be due on 4. The maturity value of a 6%, 90-day, $800 note is 5. A 3-month note dated January 31 will be due on 6. Which of the two methods of accounting for uncollectible accounts (allowance or direct write-off) provides for the best matching of expenses and revenue in the same period of time? 7. On December 31, after adjusting entries have been made, Accounts Receivable has a $70,000 balance, Allowance for Doubtful Accounts a $5,000 normal balance, and Bad Debts Expense a $3,000 balance. The “cash realizable value” of Accounts Receivable is 8. In writing off an uncollectible account by the direct write-off method, the account debited is 9. Allowance for Doubtful Accounts has a debit balance of $250 at the end of the year before adjustment. Sales for the year amounted to $305,400 and sales returns and allowances amounted to $5,400. If uncollectible accounts expense is estimated at 1% of net sales, the amount of the appropriate adjusting entry will be 10. If, instead of a percentage of net sales, the adjusting entry in number 9 is based on an analysis of receivables that indicates doubtful accounts of $4,500, the amount of the adjustment will be