Group Work Solutions

advertisement

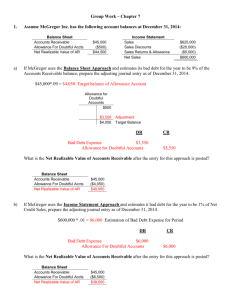

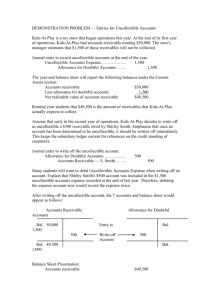

Group Work – Chapter 7 1. Assume McGregor Inc. has the following account balances at December 31, 2011 – before adjusting entries: Accounts Receivable Allowance For Doubtful Accounts Sales Revenue $54,000 500 (credit balance) $225,000 Refer to the information above for McGregor a. If McGregor uses the Balance Sheet Approach and estimates its bad debt for the year to be 6% of the Accounts Receivable balance, prepare the adjusting journal entry as of December 31, 2011. Allowance For Doubtful Accounts 500 Beg Bal 2,740 Adjustment Required 3,240 Target Balance $54,000 * .06 = $3,240 DR CR Bad Debt Expense 2,740 Allowance For Doubtful Accounts 2,740 b. What is the Net Realizable Value of Accounts Receivable that will be reported on the December 31, 2011 Balance Sheet after the adjusting entry is posted? Accounts Receivable Allowance for Doubtful Accounts Net Realizable Value of AR 54,000 (3,240) 50,760 c. Assume, on January 8, 2012, JD Rhimes Inc. contacts McGregor Inc and says they have declared bankruptcy and will not be able to pay their Accounts Receivable debt of $2,000. Prepare the journal entry to write-off this customer’s account. DR Allowance For Doubtful Accounts Accounts Receivable CR 2,000 2,000 d. What is the Net Realizable Value of Accounts Receivable on January 8, 2012 after the customer write off? [Assume no other activity has affected those accounts since December 31, 2011.] Accounts Receivable Allowance for Doubtful Accounts Net Realizable Value of AR 52,000 (1,240) 50,760 e. Does the write off affect the Net Realizable Value of Accounts Receivable? No f. Does the write off affect Net Income? No 2. Assume instead, McGregor Inc. has the following account balances at December 31, 2011 – before adjusting entries: Accounts Receivable Allowance For Doubtful Accounts Net Sales Revenue $33,000 400 (credit balance) 453,000 [Assume all Sales are Credit Sales) Refer to the information above for McGregor a. If McGregor uses the Income Statement Approach instead of the Balance Sheet approach and estimates it bad debt for the year to be 1% of Net Credit Sales, prepare the adjusting journal entry as of December 31, 2011. Allowance For Doubtful Accounts 400 Beg Bal 4,530 Adjustment Required [$453,000 * .01] 4,930 Ending Balance after Adjustment DR Bad Debt Expense 4,530 Allowance For Doubtful Accounts CR 4,530 b. What is the Net Realizable Value of Accounts Receivable that will be reported on the December 31, 2011 Balance Sheet after the adjusting entry is posted? Accounts Receivable Allowance for Doubtful Accounts Net Realizable Value of AR 33,000 (4,930) 28,070 c. Assume, on January 8, 2012, JD Rhimes Inc. contacts McGregor Inc and says they have declared bankruptcy and will not be able to pay their Accounts Receivable debt of $800. Prepare the journal entry to write-off this customer’s account. DR Allowance For Doubtful Accounts Accounts Receivable CR 800 800 d. What is the Net Realizable Value of Accounts Receivable on January 8, 2012 after the customer write off? [Assume no other activity has affected those accounts since December 31, 2011.] Accounts Receivable Allowance for Doubtful Accounts Net Realizable Value of AR 3. 32,200 (4,130) 28,070 XYZ Inc. had a January 1, 2011 [Beginning Credit Balance] in Allowance for Doubtful Accounts of $16,000. For the year 2011, XYZ Inc. reported $74,400 of Bad Debt Expense on the Income Statement. If the December 31, 2011 [Ending Credit Balance] in Allowance for Doubtful Accounts is $12,900, how much did XYZ write off as uncollectible for the year 2011? Allowance For Doubtful Accounts 16,000 Beginning Balance Write-Offs 77,500 74,400 Bad Debt Expense 12,900 Ending Balance 4. During 2012, Dawson Inc. wrote off uncollectible accounts in the amount of $21,500. The January 1, 2012 balance in Allowance for Doubtful Accounts is $15,000, and the December 31, 2012 balance in Allowance for Doubtful Accounts is $42,000. What amount must be reported as Bad Debt Expense on the Income Statement for Dawson Inc. for the year 2012? Allowance For Doubtful Accounts 15,000 Beginning Balance Write-Offs 21,500 48,500 Bad Debt Expense 42,000 Ending Balance 5. a. On August 1, 2011, McGregor Inc. loaned $90,000 to a key financial officer. The loan is due in 8 months, and it has a 7% rate. The principal and interest are due at maturity. Prepare a journal entry necessary to recognize the loan on August 1. DR Note Receivable Cash b. CR $90,000 $90,000 December 31, 2011 is the fiscal year-end for McGregor Inc., and they record adjusting journal entries on this date before preparation of financial statement. Prepare an adjusting entry necessary for the loan at year-end. DR Interest Receivable Interest Revenue CR $2,625 $2,625 ($90,000 * .07 * 5/12 = $2,625) c. On April 1, 2012, McGregor received both the Principal and Interest due on the Note. Prepare a journal entry to record this transaction. DR Cash $94,200 Interest Receivable Note Receivable Interest Revenue ($90,000 * .07 * 3/12 = $1,575) CR $ 2,625 $90,000 $ 1,575