ACG 201 Chapter 8 Quiz: Receivables & Bad Debts

advertisement

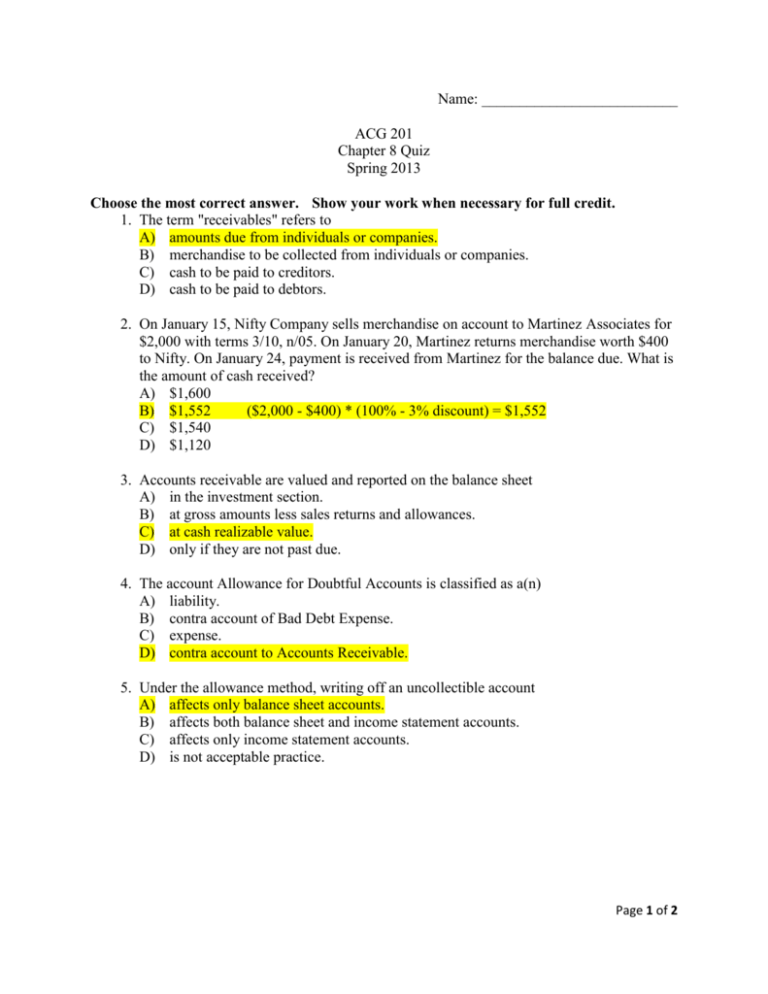

Name: __________________________ ACG 201 Chapter 8 Quiz Spring 2013 Choose the most correct answer. Show your work when necessary for full credit. 1. The term "receivables" refers to A) amounts due from individuals or companies. B) merchandise to be collected from individuals or companies. C) cash to be paid to creditors. D) cash to be paid to debtors. 2. On January 15, Nifty Company sells merchandise on account to Martinez Associates for $2,000 with terms 3/10, n/05. On January 20, Martinez returns merchandise worth $400 to Nifty. On January 24, payment is received from Martinez for the balance due. What is the amount of cash received? A) $1,600 B) $1,552 ($2,000 - $400) * (100% - 3% discount) = $1,552 C) $1,540 D) $1,120 3. Accounts receivable are valued and reported on the balance sheet A) in the investment section. B) at gross amounts less sales returns and allowances. C) at cash realizable value. D) only if they are not past due. 4. The account Allowance for Doubtful Accounts is classified as a(n) A) liability. B) contra account of Bad Debt Expense. C) expense. D) contra account to Accounts Receivable. 5. Under the allowance method, writing off an uncollectible account A) affects only balance sheet accounts. B) affects both balance sheet and income statement accounts. C) affects only income statement accounts. D) is not acceptable practice. Page 1 of 2 6. The financial statements of the Belfry Manufacturing Company reports net sales of $400,000 and accounts receivable of $80,000 and $40,000 at the beginning of the year and end of year, respectively. What is the average collection period for accounts receivable in days? A) 40 times B) 80 times C) 54.7 times $400,000 / [($80,000 + 40,000)/2] = 6.6666667; 365/6.6666667 D) 50 times 7. An aging of a company's accounts receivable indicates that $4,000 are estimated to be uncollectible. If Allowance for Doubtful Accounts has a $1,200 credit balance, the adjustment to record bad debts for the period will require a A) debit to Bad Debts Expense for $4,000. B) debit to Allowance for Doubtful Accounts for $2,800. C) debit to Bad Debts Expense for $2,800. D) credit to Allowance for Doubtful Accounts for $4,000. 8. The allowance method of accounting for uncollectible accounts is required if A) the company makes any credit sales. B) bad debts are significant in amount. C) the company is a retailer. D) the company charges interest on accounts receivable. 9. When the allowance method of accounting for uncollectible accounts is used, Bad Debt Expense is recorded A) in the year after the credit sale is made. B) in the same year as the credit sale. C) as each credit sale is made. D) when an account is written off as uncollectible. 10. The interest on a $8,000, 6%, 60-day note receivable is A) $480. B) $80. $8,000 * 6% * (60/360) C) $160. D) $240. Page 2 of 2