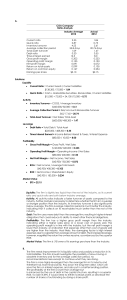

Ford Company 2010 2009 2008 Ratios Analysis Current 0.96 times

advertisement

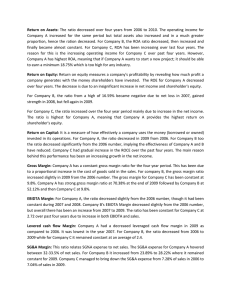

Ford Company 2010 2009 2008 Current 0.96 times 0.95 times 0.81 times Quick 0.88 times 0.88 times 0.73 times Account Receivable Turnover 29.88 times 30.75 times 37.29 times Inventory Turnover 17.65 times 19.61 times 14.75 times 0.78 times 0.60 times 0.66 times Ratios Analysis Total Assets Tu8rnover Debt to Total Assets 100.39% 103.99% 108.90% Debt to Equity -25924% -2606% -1403% Times Interest Earned 0.47 times -1.18 times -2.00 times Net profit Margin 5.09% 2.34% -10.03% Return on Assets 3.96% 1.39% -6.58% Return on Equity -1021.96% -34.91% 84.76% Earnings per share $ 1.66 $ 0.86 -$ 6.46 The company ratios represent that the financial position is not good and sound. The liquidity position of the company to pay off its short term debt is very weak and it is less than 1 in all three years. However, it has improved since 2008. The current ratio has gone up from 0.81 to 0.96 and the quick ratio has gone up from 0.73 to 0.88. The account receivable of around 30 times in 2010 shows that company has good use of receivable and sales have been generated, but it has gone down from 37 times to 30 times in 2010, which is a sign of worry. The use of inventory is not stable which is represented by uneven inventory turnover in 3 years time period. In 2009, it went up from around 15 times to around 20 times, but again in 2010, it went down to around 20 times. The total assets turnover in 2010 shows the better utilization of assets in the year, but it is still below 1. The lower assets turnover resulted in lower return on assets despite a profit margin of around 5% in 2010. Debt to total assets represent that almost all assets have been financed from liabilities and in first two year it is more than 1000% as the shareholders equity has negative balance, it means that in addition to assets the negative balance of shareholders equity has also been financed from debt source. The net profit margin has improved since 2008, which shows that company could control its cost and expenses to improve the net profit margin. For this improved net profit margin, the return on assets has also improved since 2008. The return on equity ratios are showing the negative balance as the shareholders equity is in negative. Earnings per share of the company has improved since 2008, it was showing negative earnings per share, but it improved to positive 0.86 in 2009 and then 1.66 in 2010. Keeping in view the above analysis of company financial position, company should inject finance from equity sources by issuing new common stock and debt financing should be replaced, which will decrease the debt burden and will also reduce the interest cost and expenses of the company, thus increasing the profit margin. If total assets turnover can be further increased by using the total assets efficiently, it will result in healthy and good return on assets. The sales may be increased by better marketing strategy and change in the quality of the product according to the need and requirement of the customers. The intrinsic value based on the FCF, is around $12, which is more than the current market price of $10.65. The value is on lower side because of inability of the company to pay dividends.