FIN 539 Formulas – Midterm.

advertisement

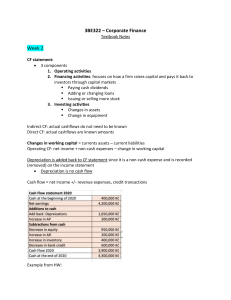

FIN 539 Formulas – Midterm. 𝐶𝐴 𝐶𝐿 𝐶𝑅 = 𝑇𝐷𝑅 = 𝑇𝐼𝐸 = 𝑄𝑅 = 𝑇𝐴 − 𝑇𝐸 𝑇𝐴 𝐸𝐵𝐼𝑇 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐶𝐴 − 𝐼𝑛𝑣 𝐶𝐿 𝐷 𝑇𝐷 = 𝐸 𝑇𝐸 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑅𝑇 = 𝑆 𝐴𝑅 𝐷𝑠𝑅 = 𝑃𝑀 = 𝑁𝐼 𝑆 𝑅𝑂𝐴 = 𝐶𝑜𝑣(𝑅𝑖 , 𝑅𝑀 ) 𝜎 2 (𝑅𝑀 ) 𝐼𝑛𝑣𝑒𝑛𝑡 𝑝𝑒𝑟𝑖𝑜𝑑 = 365/( 𝑃𝑎𝑦𝑎𝑏𝑙𝑒 𝑝𝑒𝑟𝑖𝑜𝑑 = 365 𝐼𝑇 𝑁𝐼 𝑇𝐴 𝑅𝑂𝐸 = 𝑁𝐼 𝑇𝐸 𝐶𝑡 (1 + 𝑟)𝑡 𝑅𝑂𝐴 ∗ 𝑏 1 − 𝑅𝑂𝐸 ∗ 𝑏 𝐶𝑂𝐺𝑆 ) 𝐴𝑣𝑔𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑎𝑣𝑔 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑝𝑎𝑦𝑎𝑏𝑙𝑒 𝑎𝑛𝑛𝑢𝑎𝑙 𝐶𝑜𝐺𝑆⁄ 365 𝐶𝑎𝑠ℎ 𝑐𝑦𝑐𝑙𝑒 = 𝑂𝑝𝑒𝑟. 𝑐𝑦𝑐𝑙𝑒 − 𝑝𝑎𝑦𝑎𝑏𝑙𝑒 𝑝𝑒𝑟. 𝑃𝑉 𝐴𝑛𝑛𝑢𝑖𝑡𝑦 𝑃𝑎𝑦. = 1⁄ [1 − 1⁄ 𝑟 (1 + 𝑟)𝑛 ] 𝐸𝐹𝑁 = ( 𝐷𝑠𝐼𝑛𝑣 = 𝑆 𝑇𝐴 𝑁𝑃𝑉 = 𝐶0 + ∑ 𝐼𝐺𝑅 = 𝑇𝐴 𝐷 =1+ 𝑇𝐸 𝐸 𝑇𝐴𝑇 = 𝑡=1 𝛽𝑖 = 𝐶 𝐶𝐿 365 𝑅𝑇 𝑁 𝑅𝑂𝐸 = 𝑃𝑀 ∗ 𝑇𝐴𝑇 ∗ 𝐸𝑀 𝐸𝑀 = 𝐶𝑜𝐺𝑆 𝐼𝑇 = 𝐶𝑎𝑅 = 𝐸𝐴𝑅 = (1 + 𝑞𝑢𝑎𝑡𝑒𝑑 𝑎𝑛𝑛𝑢𝑎𝑙 𝑖𝑟 𝑛 ) −1 𝑛 𝑆𝐺𝑅 = 𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 𝑝𝑒𝑟𝑖𝑜𝑑 = 𝑅𝑂𝐸 ∗ 𝑏 1 − 𝑅𝑂𝐸 ∗ 𝑏 𝐴𝑣𝑔 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑟𝑒𝑐𝑖𝑣 𝑎𝑛𝑛𝑢𝑎𝑙 𝑠𝑎𝑙𝑒𝑠⁄ 365 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑐𝑦𝑐𝑙𝑒 = 𝐼𝑛𝑣𝑒𝑛𝑡 𝑝𝑒𝑟. +𝑅𝑒𝑐𝑖𝑣. 𝑝𝑒𝑟. 𝐶𝑜𝑛𝑡𝑖𝑛𝑜𝑢𝑠 𝐸𝐴𝑅 = 𝑒 𝑟 − 1 𝑅𝑃 = 𝑅̅𝑃 + 𝛽𝑃 𝐹 𝐴𝑠𝑠𝑒𝑡𝑠 𝑆𝑝𝑜𝑛𝐿𝑖𝑎𝑏 ) ∗ ∆𝑆𝑎𝑙𝑒𝑠 − ∗ ∆𝑆𝑎𝑙𝑒𝑠 − (𝑃𝑀 ∗ 𝑃𝑟𝑜𝑗𝑒𝑐𝑡𝑒𝑑𝑆𝑎𝑙𝑒𝑠) ∗ (1 − 𝑑) 𝑆𝑎𝑙𝑒𝑠 𝑆𝑎𝑙𝑒𝑠 𝐷𝐼 = 𝐹𝑎𝑐𝑒 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑙𝑜𝑎𝑛 ∗ (1 − 𝑞𝑢𝑜𝑡𝑒𝑑 𝑎𝑛𝑛𝑢𝑎𝑙 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒 ) 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑝𝑒𝑟𝑖𝑜𝑑𝑠 𝑖𝑛 𝑡ℎ𝑒 𝑦𝑒𝑎𝑟 CR CA CL QR CaR C TDR TA TE D/E TD TE EM TIE EBIT IT COGS DSINV RT S AR DSR TAT PM NI ROA ROE NPV IGR SGR ROI B AP RP EFN DI Current Ratio: ability to pay of short term debt Current Assets Current Liquidity Quick Ratio: ability to pay of s-t debt right away by selling current assets (without inventory) Cash Ratio: ability to pay of s-t debt with cash only Cash T. debt ratio: % of total assets that were financed by liabilities, debt Total Assets Total Equity Debt/Equity ratio: indicates what proportions of debt and equity is used to finance assets Total Debt Total Equity Equity Multiplayer Times interest Earned Earnings before taxes and interest Inventory Turnover: how many times per year inventory is turned over Cost of Goods Sold Days sales inventory: how many days it take to sell inventory Receivables Turnover: how many times per year we collect the receivables. Sales Account receivables Days Receivables: how many days we need to collect the receivables Total assets Turnover means that company is getting better in utilizing their assets Profit Margin Net income Return on Assets Return on Equity Net present value Internal Growth Rate: highest growth achievable without outside financing Sustainable growth rate: highest growth without increasing the leverage of the comp. Return on investment: profitability of assets used by the firm Plowback ratio: 1- payout ratio (measures amount of money that stayed after dividends) Payout ratio: measures amount of money that been payout as dividend Accounts payable Systematic Risk External Financing Needed: how much ext. money is needed to increase sales Discount interest – effective rate that we pay on the loan