MBA Module 4 PPTs

advertisement

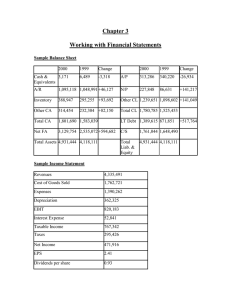

Week 4 Financial Statements Analysis Common Questions that F/S Analysis Can Help To Answer Creditor Investor Manager Can the company pay the interest and principal on its debt? Does the company reply too much on non-owner financing? Does the company earn an acceptable return on invested capital? Is the gross profit margin growing or shrinking? Does the company effectively use non-owner financing? Are costs under control? Are the company’s markets growing or shrinking? Do observed changes reflect opportunities or threats? Is the allocation of investment across different assets too high or too low? General Categories of Questions Solvency Liquidity Earnings Potential What we work with Financial Statements Balance Sheet Income Statement Statement of Cash Flows Other Parts of the 10K (Annual Report) MD&A Notes to the financial statements Ratio Analysis Examining various income statement and balance sheet components in relation to one another facilitates financial statement analysis. This type of examination is called ratio analysis. Garbage In At this point we will assume the numbers are worth using without adjustment Generally this is not a good assumption for a lot of analysis Apples to apples Persistent and transitory Some Limitations of Ratio analysis What is Good? The company earned $2,000,000 Does that mean it had a good year? Does management deserve a big bonus? Would you, as a shareholder, be happy? How about the lenders? Financial Statement Analysis Across time Within industry Within firm Common size statements Ratio analysis Comparisons Within the Financial Statements Common-size financial statements (vertical analysis) Compare to a base amount Ratio analysis Profitability ratios – Earnings potential Solvency and Liquidity ratios – Ability to pay creditors Asset Management Ratios (Turnover) Efficiency Market ratios – Stock price versus accounting Profitability Analysis Return on Assets (ROA): ROA = Net Income / Total Assets For example, if we invest $100 in a savings account yielding $3 at year-end, the return on assets is 3%. Disaggregating Return on Assets Profit Margin, Asset Turnover, and Return on Assets for Selected Industries Gross Profit Margin It allows a focus on average unit mark-ups A high gross profit margin is preferred to a lower one, which also implies that a company has relatively more flexibility in product pricing. Competition and product mix will affect it Turnover Turnover measures relate to the productivity of company assets. Such measures seek to answer the amount of capital required to generate a specific sales volume. As turnover increases, there is less need for cash since cash outflow for assets to support the current sales volume is reduced. Turnover ratios Total assets Sales / Assets Accounts receivable Sales / A/R Inventory COGS / Inventory Accounts Payable COGS / A/P Turnover ratios To convert turnovers to a period number divide into 365 Cash collection cycle ROE Analysis Structure Return on Equity Return on equity (ROE) is computed as: ROE = Net Income / Average Equity Financial Leverage and Risk LEV is the other component of ROE Is Debt a bad thing? Given that increases in financial leverage increase ROE, why are all companies not 100% debt financed? Leverage and Income Variability Liquidity and Solvency Measures Liquidity refers to cash: how much we have, how much is expected, and how much can be raised on short notice. Solvency refers to the ability to meet obligations; primarily obligations to creditors, including lessors. Current Ratio Current ratio is simply current assets divided by current liabilities. If we subtracted rather than divided we would have working capital A very rough gauge of the ability to service short-term obligations. What is a good number? Quick Ratio A refinement of the current ratio. Rather then using all current assets in the numerator, we limit it to cash, marketable securities, and accounts receivable. Why? Solvency Some combination of debt divided by either total assets or stockholders’ equity Long-term debt to assets Long-term debt to shareholders’ equity Total debt to assets Total debt to shareholders’ equity Times interest earned EBIT divided by interest expense Vertical and Horizontal Analysis Vertical and Horizontal Analysis