Financial Statements and Ratios: Notes

advertisement

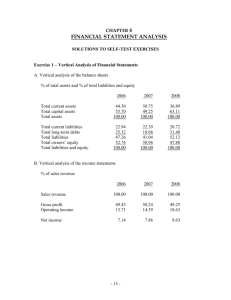

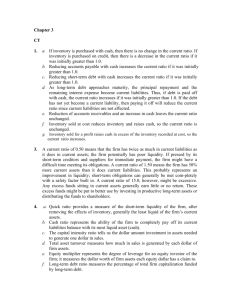

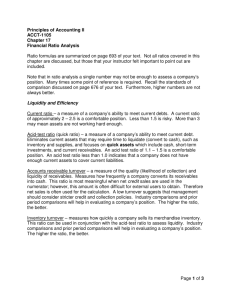

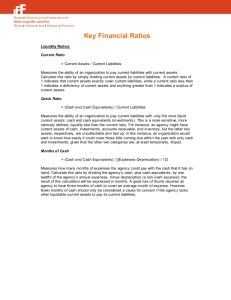

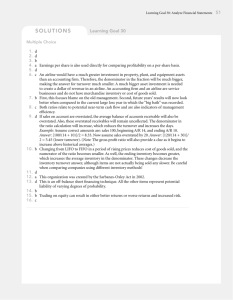

Financial Statements and Ratios: Notes 1. Uses of the income statement for evaluation Investors use the income statement to help judge their return on investment and creditors (lenders) use it to help make loan decisions. To make their business decisions financial statement users evaluate a firm’s risk , operating capability and financial flexibility. Risk is the uncertainty about the future earnings potential of a firm. A firm’s risk factor affects the expected investment return that is needed to attract investors and affects the interest rate that lenders charge on that firm’s loans. External users evaluate a firm’s operating capability and financial flexibility because these factors help determine the firm’s level of risk. Operating capability refers to a firm’s ability to continue a given level of operations in the future. Financial flexibility refers to a firm’s ability to adapt to change in the future. 1. Ratios (income statement) Managers and external users may perform ratio analysis to help evaluate a firm’s operating performance. Ratios can be used as benchmarks to compare a firm’s performance with that of previous periods and with that of other firms. Two ratios that reflect profitability and are therefore related to risk, operating capability and financial flexibility are the firm’s profit margin and gross profit margin. The formula for a firm’s profit margin or return on sales is: Profit Margin = Net Income Net Sales The formula for a firm’s gross profit margin or gross profit percentage is: Gross Profit Margin = Gross Profit Net Sales 2. Statement of Changes in Owner’s Equity The statement of changes in owner’s equity summarises the transactions that affected owner’s equity during the accounting period. The statement bridges the gap between the income statement and the amount of owner’s capital reported on the balance sheet. 3. Why the Balance Sheet is important Although the income statement provides useful information for business decision-making managers and external users also study the balance sheet or statement of financial position. A balance sheet provides information that helps internal and external users evaluate a firm’s ability to achieve its primary goals of earning a satisfactory profit and remaining solvent. The income statement and the balance sheet provide different types of information. The income statement reports on a firm’s actions over period of time. The balance sheet presents a firm’s financial position on a specific date allowing users to evaluate the firm’s assets, liabilities and owner’s equity as at that date. Supposing you were trying to determine whether a firm can earn a satisfactory profit. You would need to determine whether the firm has the assets, liabilities and owner’s equity needed to earn a satisfactory profit. You would also need to evaluate whether the firm has been able to use its resources in the past to earn such a profit. Because a firm’s income statement and balance sheet provide this financial information, analysing both statements will help you make an informed decision. Using the balance sheet for evaluation A manager is concerned with a firm’s balance sheet because it is used to evaluate his or her own performance. External users analyse a firm’s balance sheet to determine whether a firm has the right amount and mix of assets, liabilities and owner’s equity to justify making an investment in the firm. 3. Evaluating liquidity Liquidity is a measure of how quickly a firm can convert its assets into cash to pay its bills. The need for adequate liquidity is a major reason a firm prepares a cash budget. External users assess how well a firm manages its liquidity by assessing its working capital. Working capital = Current Assets – Current Liabilities The Current (Working Capital) ratio and the Quick ratio are commonly used to assess a firm’s liquidity. The Current Ratio shows the relationship between current assets and current liabilities. The current ratio is calculated as follows: Current Ratio = Current Assets Current Liabilities The use of a ratio allows the comparison of different sized firms. When assessing the current ratio users should pay attention to factors such as: • • • industry structure, the length of the firm’s operating cycle, and the ‘mix’ of current assets. The Quick Ratio (or Acid-Test) is a more convincing indicator of a firm’s short-term debt paying ability. The quick ratio uses only those current assets that can be quickly converted into cash. Quick assets include cash, short-term marketable securities, accounts receivable and short-term notes receivable. Quick assets typically exclude inventory and prepaid expenses because they cannot be quickly converted into cash. The quick ratio is calculated as follows: Quick Ratio = Quick Assets Current Liabilities The quick ratio shows potential liability problems when a firm has a poor mix of current assets. When assessing the quick ratio users should pay attention to factors such as: • • industry structure, and the length of the firm’s operating cycle. 4. Evaluating financial flexibility Financial flexibility is the ability of a firm to adapt to change. The current ratio and the acid test ratio can be used to assess short-term financial flexibility. To assess long-term financial flexibility, financial statement users use the Debt Ratio to evaluate the firm’s debt levels. The debt ratio shows the percentage of total assets provided by debt finance (outside borrowings). The debt ratio is calculated as follows: Debt Ratio = Total Liabilities Total Assets The higher a firm’s debt ratio, the lower its financial flexibility: because a higher debt ratio indicates that a firm may not be able to borrow money as easily or cheaply to adapt to business opportunities. Generally, the higher the debt ratio, the higher the ‘risk’ and the higher the ‘returns’ to owners. The desired mix between debt and owner’s equity depends on factors such as: • • • the type of business, the country in which the firm is located, the state and expected state of the local economy, and • the world economic climate. 5. Relationship between the income statement and the balance sheet It is very important to know that many important business questions can only be answered by analysing a firm’s income statement and balance sheet together. For example, both statements must be included when analysing whether a firm has made a satisfactory return to its owners 6. Evaluations using the income statement and the balance sheet Managers, investors and lenders use information from a firm’s financial statements to calculate ratios for measuring a firm’s financial success. The numerator of each ratio is an income statement amount showing a ‘flow’ into or out of the firm during the accounting period. The denominator is a balance sheet amount showing the ‘resources’ used to obtain the ‘flow’. 7. Evaluating profitability Decision-makers use profitability ratios to assess how well a firm has met its profit objectives in relation to the resources invested. Return on Total Assets compares net income earned with total assets to show whether a firm has used its economic resources efficiently. Return on total assets is calculated as follows: Return on Total Assets = Net Income + Interest Expense Average Total Assets Interest expense is added back to net income because interest is a financing cost paid to lenders and not an operating expense of earning revenue. Average total assets are used as the denominator because a firm uses its assets to earn income over the entire accounting period. Return on Owner’s Equity measures whether a firm’s managers have earned a satisfactory return on the owner’s investment in the firm. Return on owner’s equity is calculated as follows: Return on Owner’s Equity = Net Income Average Owner’s Equity Interest is not added back to net income because net income is a measure of a firm’s profits available to owners after incurring the financial cost relating to lenders. 8. Evaluating operating capability Operating capability refers to a firm’s ability to sustain a given level of operations. Activity ratios are used to measure the duration of the parts of the firm’s operating cycle. This analysis allows users to evaluate the liquidity of selected current assets. Inventory Turnover measures how quickly a firm purchases, sells and replaces inventory throughout its accounting period. Inventory turnover is calculated as follows: Inventory Turnover = Cost of Goods Sold Average Inventory As a general rule, the higher the inventory turnover, the more efficient the firm is in its purchasing and sales activities and the less cash it needs to invest in inventory. We can also calculate the Number of Days in the Selling Period as follows: No of Days in the Selling Period = No of Days in Business Year Inventory Turnover This ratio measures the average time it takes the firm to sell its inventory Accounts Receivable Turnover measures how efficiently a firm collects cash from its credit customers. Accounts receivable turnover is calculated as follows: Accounts Receivable = Net Credit Sales Turnover Average Accounts Receivable We can also calculate the Number of Days in the Collection Period as follows: No of Days in the Collection = Period No of Days in Business Year Accounts Receivable Turnover This ratio measures the average time it takes the firm to collect its accounts receivable. The number of days in the firm’s operating cycle can be calculated by adding the number of days in the firm’s selling period to the number of days in the firm’s collection period. 9. Limitations of the income statement and the balance sheet When using ratio analysis we must remember the limitations of the concepts and principles that underly a firm’s financial statements. This is particularly relevant with relation to how firms value their assets and measure revenues and expenses. Income statements and balance sheets are based on accrual accounting and do not provide much information about a firm’s cash management. Thus, firms often prepare a cash flow statement to allow users to better assess their cash management performance.