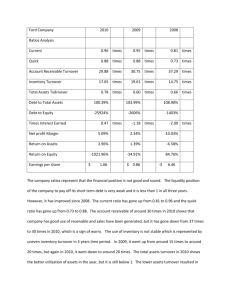

Financial Ratios - High Point University

advertisement

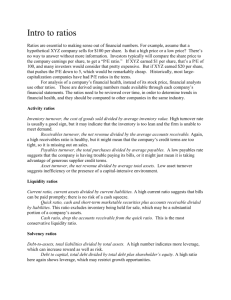

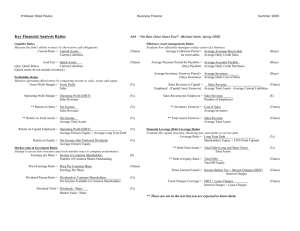

Example Financial Ratios Liquidity Ratios 1. Current Ratio = Current Assets/Current Liabilities Example: A current ratio of 3.0: For every dollar of current liabilities, the company has $3 of current assets. General Rule: The greater the current ratio, the better—financially stronger. Profitability Ratios 1. Gross Profit Margin = Gross Profit/Sales Example: A Gross Profit Margin of 35%: For every dollar of sales, the company has gross profit of 65 cents. General Rule: The greater the gross profit margin, the better. 2. Profit Margin or Net Profit Margin = Net Profit/Sales or Net Profit After Taxes/Sales Net Income = Net Profit = Net Earnings = Net Profit after Taxes Example: A net profit margin of 10%: For every dollar of sales, the company has net income of 10 cents. General Rule: The greater the net profit margin, the better. 3. Return on Assets (ROA) = Net Income/Total Assets Example: ROA of 7 percent: For every dollar of assets, the company generates 7 cents of net income General Rule: The greater the ROA, the better. 4. Return on Equity (ROE) = Net Income/Stockholder Equity Stockholder equity = owner’s equity = equity Example: ROE of 15 percent: For every dollar of stockholder equity, the company generates 15 cents of net income. General Rule: The greater the ROE, the better. 5. EPS or Earnings Per Share = Net Income/Shares Outstanding Example: EPS of $3.50: For every share of common stock, the company earns $3.50 General Rule: None—EPS is not comparable. It is driven by the number of shares outstanding. Solvency Ratios (aka Debt or Leverage Ratios) 1. Debt Ratio = Total Liabilities/Total Assets Example: Debt Ratio = 65%: For every dollar of assets, the company is financed with 65 cents of debt and 35 (1-.65) cents of equity. Total financing must equal 100% (65% + 35%) General Rule: The greater the debt ratio, the riskier the company. 2. Times Interest Earned = Earnings Before Interest & Taxes/Interest Expense EBIT = Earnings Before Interest & Taxes = roughly equals operating income Example: Times interest earned = 4.0: For every dollar of interest expense, the company’s operating income equals $4. General Rule: The lower the times interest earned, the riskier the company. It may imply that the company has too much debt. Asset Utilization Ratios (aka Activity or Asset-Management Ratios) 1. Inventory Turnover = Cost of Goods Sold/Inventory Example: Inventory Turnover of Apples = 180: Say, you have one apple in inventory. You pay $1 per apple. Every time you sell an apple, your order and receive another apple. Therefore, your inventory will equal $1. You sell an apple every other day. Using 360 (not 365—finance oftentimes uses 360 days in a year) days in a year, you would sell 180 apples per year. Multiplying 180 X 1 = COGS of $180. Inventory Turnover interpretation: You turn your inventory over 180 times a year. General rule: The greater your inventory turnover, the better. It implies the product is “moving off the shelf”. 2. Accounts Receivable Turnover = Sales/Accounts Receivable-Accounts Receivable Turnover—this leads us to average collection period 3. Average Collection Period (days) = 365/Accounts Receivable Turnover Example: Average Collection Period = 30: This means that on average, it takes 30 days to collect your receivables. General Rule: The longer the collection period, the longer your money is tied up. If your collection period exceeds your terms (e.g., 2/10 net 30), this may be a sign that you have credit risk . . . that you have some receivables that may never be collected. Note: All ratios assume no preferred stock