Taxing Questions!

advertisement

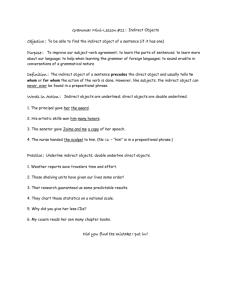

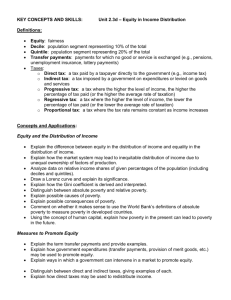

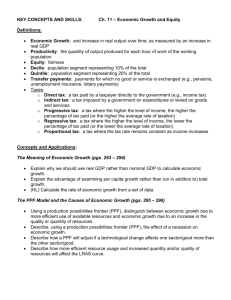

Taxing Questions! Questions 11.7 - Taxation 1.) Distinguish between direct and indirect taxes, and provide examples of each. 2.) Define and explain, using examples, the difference between proportional, progressive and regressive taxation. 3.) Explain how income taxes can be used to lower income inequalities. 4.) a.) Explain why indirect taxes are regressive b.) What is the reason for excluding some goods and services considered to be necessities from payment of indirect taxes (such as VAT and Sales Tax)? c.) What impact does this have on how regressive the indirect taxes are 5.) Why do you think the issue of using taxes to redistribute income is partly a normative issue? 6.) What is likely to happen to a country’s Lorenz curve and Gini coefficient if its government: a.) increases tax rates applied to higher incomes b.) places a greater emphasis on idirect taxes relative to direct taxes as sources of tax revenue c.) reduces transfer payments d.) introduces a system of free education and health care Test your understanding 11.9 1. Make a distinction between income taxes and indirect taxes, explain how each of these can affect the allocation of resources. 2. Why do we find some countries around the world using general expenditure/sales taxes, even though these are regressive and do not help achieve greater equality in income distribution. 3. Explain some arguments according to which greater income equality may make the allocation of resources (a) more efficient, and (b) less efficient 4. Explain the possible negative/positive effects of (a) transfer payments, (b) provision of merit goods, and ( c) government intervention in the markets on the allocation of resources