Aim: Which type of tax is “ideal”?

advertisement

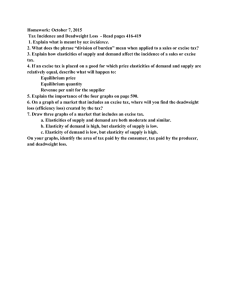

Brainstorm different types of taxes. What makes a tax “ideal”? Fair Abililty to pay Benefits received Gressivity Tax rate relative to income What makes a tax “ideal”? Effective Easy to understand Easy to collect Difficult to evade “incidence of taxation” What makes a tax “ideal”? Neutral Shouldn’t change behavior Personal income tax Gressivity Level of government Social Security tax Gressivity Level of government Sales Gressivity Level of government Excise Gressivity Level of government OTHER TAXES Property Estate Gift Tariff 1. 2. 3. 4. What are three characteristics of an “ideal” tax? What is “gressivity”? A __________ tax is one in which tax rate increases as income increases. A __________ tax is one in which tax rate decreases as income increases. 1. 2. 3. 4. A proportional tax is one in which tax rate __________ regardless of income. When is a tax not effective? What does “neutrality” mean in regard to taxes? What is meant by the “incidence of taxation”? 1. Identify an example of a progressive tax, a proportional tax, and a regressive tax. 2. Why is an excise tax sometimes referred to as a “sin tax”? Advantages Hard to avoid Incidence is widely spread Not visible to consumer Easy to collect Even small VAT can raise tremendous revenue Disadvantages Invisible to consumers Can’t be vigilant Competes with states sales tax Double sales tax Regressive tax Using our list of taxes in the U.S., which tax seems to best meet the criteria for being “ideal”? Explain. If you were an elected official who wanted to increase tax revenues, which of the following would you prefer to use – individual income, sales, property, corporate income, user fees, or VAT (national sales tax)? Explain.