File

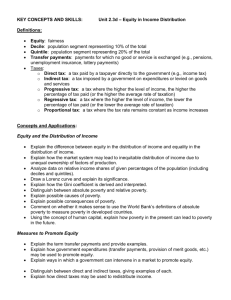

advertisement

KEY CONCEPTS AND SKILLS: Ch. 11 – Economic Growth and Equity Definitions: Economic Growth: and increase in real output over time, as measured by an increase in real GDP Productivity: the quantity of output produced for each hour of work of the working population Equity: fairness Decile: population segment representing 10% of the total Quintile: population segment representing 20% of the total Transfer payments: payments for which no good or service is exchanged (e.g., pensions, unemployment insurance, lottery payments) Taxes: o Direct tax: a tax paid by a taxpayer directly to the government (e.g., income tax) o Indirect tax: a tax imposed by a government on expenditures or levied on goods and services o Progressive tax: a tax where the higher the level of income, the higher the percentage of tax paid (or the higher the average rate of taxation) o Regressive tax: a tax where the higher the level of income, the lower the percentage of tax paid (or the lower the average rate of taxation) o Proportional tax: a tax where the tax rate remains constant as income increases Concepts and Applications: The Meaning of Economic Growth (pgs. 293 – 294) Explain why we should use real GDP rather than nominal GDP to calculate economic growth. Explain the advantage of examining per capita growth rather than (on in addition to) total growth. (HL) Calculate the rate of economic growth from a set of data. The PPF Model and the Causes of Economic Growth (pgs. 295 – 296) Using a production possibilities frontier (PPF), distinguish between economic growth due to more efficient use of available resources and economic growth due to an increase in the quality or quantity of resources. Describe, using a production possibilities frontier (PPF), the effect of a recession on economic growth. Describe how a PPF will adjust if a technological change affects one sector/good more than the other sector/good. Describe how more efficient resource usage and increased quantity and/or quality of resources will affect the LRAS curve. Investment, Capital and Productivity (pgs. 296 – 300) Outline the relation between investment and the three types of capital. Explain the role of investment in economic growth. Give examples of investments in each of the three types of capital and explain how each type of capital can lead to economic growth. Explain the importance of improved productivity for economic growth. Explain productivity using PPF and LRAS diagrams. Explain why investment has an opportunity cost in terms of consumption in the present. Equity and the Distribution of Income (pgs. 301 – 309) Explain the difference between equity in the distribution of income and equality in the distribution of income. Explain how the market system may lead to inequitable distribution of income due to unequal ownership of factors of production. Analyze data on relative income shares of given percentages of the population (including deciles and quintiles). Draw a Lorenz curve and explain its significance. Explain how the Gini coefficient is derived and interpreted. Distinguish between absolute poverty and relative poverty. Explain possible causes of poverty. Explain possible consequences of poverty. Comment on whether it makes sense to use the World Bank’s definitions of absolute poverty to measure poverty in developed countries. Using the concept of human capital, explain how poverty in the present can lead to poverty in the future. Measures to Promote Equity (pgs. 309 – 319) Explain the term transfer payments and provide examples. Explain how government expenditures (transfer payments, provision of merit goods, etc.) may be used to promote equity. Explain ways in which a government can intervene in a market to promote equity. Distinguish between direct and indirect taxes, giving examples of each. Explain how direct taxes may be used to redistribute income. Distinguish between progressive, regressive and proportional taxation. Identify the “Canons of taxation” that can be used to judge a tax’ efficiency and equity. Explain how income taxes can be used to lower income inequality. Explain why indirect taxes are regressive. Explain how exclusion of certain necessities from indirect taxation impacts how regressive the tax is. (HL) Calculate the marginal rate of tax and the average rate of tax from a set of data. Evaluate the various government measures to promote equity in terms of their potential effects on efficiency in the allocation of resources. Explain whether decisions regarding taxation and other government programs are related to positive economics, normative economics, or both.