Fri, Sep 26 13:46:59 GM Page 1 of 3

advertisement

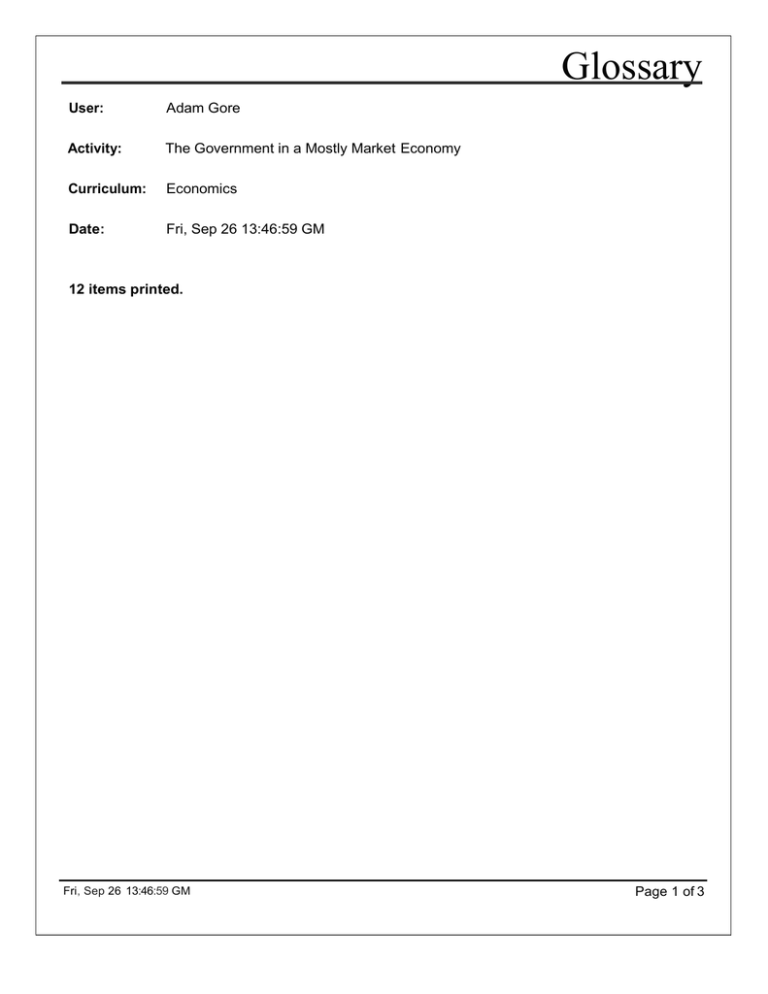

Glossary User: Adam Gore Activity: The Government in a Mostly Market Economy Curriculum: Economics Date: Fri, Sep 26 13:46:59 GM 12 items printed. Fri, Sep 26 13:46:59 GM Page 1 of 3 Glossary excise tax - a tax on a particular good or service. Theoretically, an excise tax can be assessed at any point -- when the good or service is produced, sold, or consumed. Most often, though, it is when the good or service is sold and is paid by the purchaser. An excise tax is in addition to the regular sales tax. Excise taxes are frequently assessed on goods that the government wishes to discourage the purchase of, such as gasoline, tobacco, or alcohol. They are also frequently assessed on what are not considered to be necessities, such as automobiles, motorcycles, airline tickets, and telephone services. externalities - indirect effects of markets that are not corrected within the markets; benefits or costs to those not buying or selling in the market. Externalities are also known as spillovers. They can be either positive or negative. Positive externalities are indirect benefits that occur from market actions. For example, a housing development opens near a store and the store gains new customers. Negative externalities are indirect costs that occur from market actions. For example, if a pig farm opens in the midst of a suburban housing development , the quality of life and the property values will be adversely affected. federal taxes - taxes imposed by the federal government of the United States. income tax - a tax on the income of a person or firm. market failure - when a market fails to establish fair prices and use resources efficiently or properly. market power - when a participant in a market has the ability to ignore competition and can demand and receive a price above the market price. This usually occurs because the market supplier controls enough resources or enough of an important resource to influence the market. progressive tax - a tax that varies depending on the income of the person being taxed; that is, the tax rate increases as income increases. The federal income tax is an example of a progressive tax. People with little income pay a lower tax rate, while those with more income pay a higher tax rate. Fri, Sep 26 13:46:59 GM Page 2 of 3 Glossary public goods and services - those goods and services available to all citizens from or through the government. Many public goods and services are available to the general public, regardless of citizenship. Different governments provide different goods and services, depending on whether the economy is primarily market or command. Some common public goods and services provided by all governments are national defense, police and fire protection, a justice system, and primary education. Public goods and services are seen as providing substantial benefits to the country and its citizens, but cannot be adequately supplied by using the markets. Therefore, the government guarantees their availability by supplying them. real estate tax - a tax on real estate (houses, other structures, and land) owned or sold. regressive tax - a tax that takes a larger share of your income as your income goes down. Sales taxes and the social security tax are both examples of regressive taxes. Regressive taxes are more of a hardship on the poor than the wealthy. sales tax - a general tax on purchases. Sales taxes are broad and apply to most purchases. Usually, a percentage of the price is added to the purchase to be paid in taxes. If there is a 10% sales tax and a chair costs $500, the consumer must pay $550 for that chair -- $500 for the chair itself and $50 in sales tax. The store is required to turn over the $50 paid in sales tax to the government. spillovers - see externalities. Fri, Sep 26 13:46:59 GM Page 3 of 3