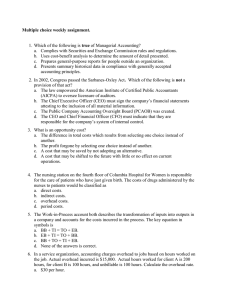

Calculating Cost

advertisement

Calculating Cost Ontario, Inc. manufactures two products, Standard and Enhanced, and applies overhead on the basis of direct-labor hours. Anticipated overhead and direct-labor time for the upcoming accounting period is $800,000 and 25,000 hours, respectively. Information about the company's products follows. Standard: Enhanced: 3,000 units 4,000 units Direct-material cost $25 per unit $40 per unit Direct labor per unit 3 hours at $12 per hour 4 hours at $12 per hour Estimated production volume Ontario's overhead of $800,000 can be identified with three major activities: order processing ($150,000), machine processing ($560,000), and product inspection ($90,000). These activities are driven by number of orders processed, machine hours worked, and inspection hours, respectively. Data relevant to these activities follow: Orders Processed Machine Hours Worked Inspection Hours Standard 300 18,000 2,000 Enhanced 200 22,000 8,000 Total 500 40,000 10,000 Top management is very concerned about declining profitability despite a healthy increase in sales volume. The decrease in income is especially puzzling because the company recently undertook a massive plant renovation during which new, highly automated machinery was installed—machinery that was expected to produce significant operating efficiencies. Using a Microsoft Excel format for calculations, complete the following: Assuming use of direct-labor hours to apply overhead to production, calculate the unit manufacturing costs of the standard and enhanced products if the expected manufacturing volume is attained. Assuming the use of activity-based costing, calculate the unit manufacturing cost of the standard and enhanced products if the expected manufacturing volume is attained. Ontario’s selling price is based heavily on cost: o Calculate which product is over cost and which is under cost by using directlabor hours as an application base. o Explain if it is possible that this over costing and under costing is responsible for the profit issues the company is facing. Illustrate how the solution will change if the following data changes: o The overhead associated with order processing is $300,000 and the overhead associated with product inspection is $270,000.