Chapter 13 - Cost Management and Decision Making

advertisement

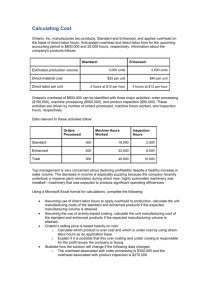

Cost Management and Decision Making Chapter 13 Decision making process Step 1: Goal setting Provides guidance Goals Tangible Quantifiable Target profit, market share, enrollment, etc. Decision making process Step 2: Gather information Relevant information Capable of influencing a decision Differs among alternatives Occurs now or in the future Sunk costs are never relevant Decision making process Tradeoffs Qualitative vs. quantitative Objective vs. subjective Accuracy vs. timeliness Quality vs. cost Decision making process Step 3: Identify and evaluate alternatives Stay as is or change? Consider the domino effect What other changes will this alternative necessitate? Decision making process Costs and benefits of each Qualitative vs. quantitative Numbers may not tell the whole story The past may be a guide Prototype or pilot project may be appropriate Common decisions Make or buy? Retain or drop? Keep or replace? Accept or reject? Make or buy? Make Qualitative factors Buy Qualitative factors Control Dependence Worker morale Time and distance Reputation Greater risk Reduced risk Cultural differences Make or buy? Material Labor Variable overhead Fixed overhead Total Unit cost based on 100,000 units $ 18.00 3.00 2.00 8.00 $ 31.00 Purchase price Shipping Inspection Unit cost based on 100,000 units $ 22.50 0.50 0.25 Total $ 23.25 100,000 units are required each year. Some special-purpose equipment can be eliminated, along with its operators, if the part is purchased, reducing fixed overhead by $80,000 per year. If purchased, the capacity freed up could be used to "insource" another component, saving the company $18,000 per year. Make or buy? Assume you chose to buy. Subsequent to your decision you discover you will need an interpreter ($30,000 per year) due to language differences. In addition, you incur travel costs ($60,000 per year) for your engineers to travel to the supplier to solve problems. Retain or drop? Retain Drop Profitable? Revenue lost Support other products, locations? Costs avoided Maintain image? Shift to other products, locations Impact on remaining workers, community Retain or drop? Sales revenue Cost of goods sold Gross margin Operating costs Wages Utilities Rent Fixture depreciation Insurance Operating profit Store A $ 7,800,000 6,240,000 1,560,000 Store B $ 3,800,000 3,040,000 760,000 530,000 63,000 210,000 114,000 75,000 568,000 300,000 47,000 115,000 87,000 60,000 151,000 $ $ Store C $ 1,700,000 1,360,000 340,000 $ Total $ 13,300,000 10,640,000 2,660,000 230,000 1,060,000 14,000 124,000 80,000 405,000 52,000 253,000 40,000 175,000 (76,000) $ 643,000 If store C is eliminated, 10% of its sales will migrate to the other two locations. In addition, one manager, paid $50,000, will be moved to another store. Should Store C be closed? Keep or replace? Keep Replace Serviceability Cost Operating costs Available financing Capacity Operating costs Obsolescence Capacity Useful life Market value of old asset Keep or replace? Existing machine Annual operating costs Materials Labor Utilities Maintenance Depreciation Total annual operating costs Other information Cost Accumulated depreciation Current resale value Remaining useful life - years $ $ $ Proposed machine 38,000 17,000 3,000 4,000 4,500 66,500 $ 50,000 22,500 18,000 5 $ $ $ 38,000 6,000 1,400 500 18,000 63,900 95,000 5 What costs are relevant? Should the machine be replaced? Accept or reject? Accept Does incremental revenue exceed incremental cost? Unit/batch Product/facility Impact on other products Impact on other customers Reject Not profitable Negative impact on current sales Discriminatory Negative impact on image Accept or reject? Annual capacity Current production, sales level Selling price per unit Cost per unit Materials Labor Variable overhead Fixed overhead Total fixed overhead Current production level Fixed overhead per unit Total cost per unit $ $ $ 200,000 170,000 25.00 12.00 3.50 1.80 391,000 170,000 $ 2.30 19.60 A potential new customer asks the company to produce 50,000 units in special packaging and offers to pay $20.00 per unit. The special packaging will increase material cost by $0.10 per unit. Due to capacity limitations, the company will have to reduce its current sales by 20,000 units if the special order is accepted. Should the order be accepted? What is the minimum acceptable unit price for the special order? Life cycle costing At some point, all costs must be recovered Previous examples only considered incremental costs Life cycle costing considers all of the costs related to owning and using the asset Costs are then charged to customers Life cycle costing Ownership costs Net cost consumed (cost – salvage value) Opportunity cost or cost of capital Ongoing fixed costs (insurance, taxes, etc.) Operating costs Utilities, repairs, maintenance, etc. related to using the asset