4361t5_sampleproblems

advertisement

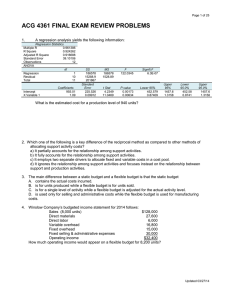

Test 5 practice problems Problem 1 Mason, Inc. uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include: Direct materials purchased 50,000 lbs. @ $12 per lb. Direct materials used 49,000 lbs. Budgeted production 11,800 units Actual production 12,000 units Standard quantity of direct materials 3.75 lbs. Direct materials standard price $12.50 per lb. Direct labor costs incurred 75,000 hours @ $12 per hour Direct labor standard 6.4 hours Standard direct labor cost $11 per hour Variable overhead costs incurred $77,070 Fixed overhead costs incurred $181,000 1. 2. 3. 4. How much is budgeted variable overhead? Budgeted fixed overhead? How much overhead was applied during the year? Calculate all direct labor, direct materials, and overhead variances. Assuming a 1.4% materiality threshold, identify which variances should be investigated under management by exception. 5. Identify who is responsible for each variance. Problem 2 Finish-It-Yourself Furniture Company manufactures replicas of antique oak filing cabinets. Additional information is as follows: Selling price $500 per filing cabinet Variable production cost $170 per filing cabinet Fixed production costs $8,000 per month Variable selling and administration $20 per filing cabinet Fixed selling and administration $3,000 per month a. In good form, prepare a variable costing income statement for a month in which 100 filing cabinets are manufactured and 90 are sold, if the firm uses variable costing. Assume no beginning inventory. b. In good form, prepare an absorption costing income statement for a month 100 filing cabinets are manufactured and 90 are sold, if the firm uses absorption costing and actual costing. Assume no beginning inventory. c. What is the cost assigned to ending inventory under each of the above costing methods? d. Explain the differences between the two ending inventory valuations (do not perform a computation for this answer). e. Prepare a reconcile of operating incomes between variable costing and absorption costing. f. If the manager of Finish-It-Yourself Furniture Company is given a bonus based on income, which type of costing income statement would you recommend for evaluating manager performance? Justify your choice. Problem 3 A company believes it can sell 2,000,000 units of its proposed new can opener at a price of $16.00 each. A. If the company desires to make a markup of 30% on cost, how much is the target cost per can opener? B. If the company desires to make a markup of 30% on selling price, how much is the target cost per can opener? Problem 4 A company believes it can sell 500,000 of its proposed new laser mouse at a price of $11.00 each There will be $800,000 in fixed costs associated with the mouse. If the company desires to make a profit $200,000, how much is the target variable cost per mouse?