Pratical Midterm 2-254

advertisement

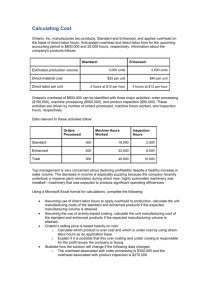

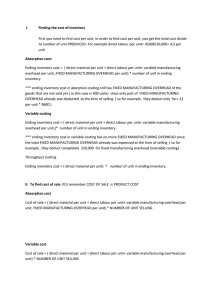

Pratical Midterm 2 1. Huish Awnings makes custom awnings for homes and businesses. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity cost pools: Overhead Costs: The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows: Required: a) Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below: b) Compute the activity rates (i.e., cost per unit of activity) for the Making Awnings and Job Support activity cost pools by filling in the table below: 2. Lionel Corporation manufactures two products, Product B and Product H. Product H is of fairly recent origin, having been developed as an attempt to enter a market closely related to that of Product B. Product H is the more complex of the two products, requiring two hours of direct labour time per unit to manufacture, compared to one hour of direct labour time for Product B. Product H is produced on an automated production line. Overhead is currently assigned to the products on the basis of direct labour hours. The company estimated it would incur $450,000 in manufacturing overhead costs and produce 7,500 units of Product H and 30,000 units of Product B during the current year. Unit costs for materials and direct labour are: Required: a) Compute the predetermined overhead rate under the current method of allocation, and determine the unit product cost of each product for the current year. b) The company's overhead costs can be attributed to four major activities. These activities and the amount of overhead cost attributable to each for the current year are given below: Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year. 3. Selected data about Pitkin Company's manufacturing operations at two levels of activity are presented below: Required: Using the high-low method, estimate the cost formula for manufacturing overhead. Assume that both direct material and direct labour are variable costs. 124. The following is Arkadia Corporation's contribution format income statement for last month: The company has no beginning or ending inventories and produced and sold 20,000 units during the month. Required: a) What is the company's contribution margin ratio? b) What is the company's break-even in units? c) If sales increase by 100 units, by how much should operating income increase? d) How many units would the company have to sell to attain target operating income of $125,000? e) What is the company's margin of safety in dollars? f) What is the company's degree of operating leverage? 124. Pabbatti Company, which has only one product, has provided the following data concerning its most recent month of operations: The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month. Required: a) What is the unit product cost for the month under variable costing? b) Prepare an income statement for the month using the contribution format and the variable costing method. c) Without preparing an income statement, determine the absorption costing operating income for the month. (Hint: Use the reconciliation method.)