Environmental Accounting

advertisement

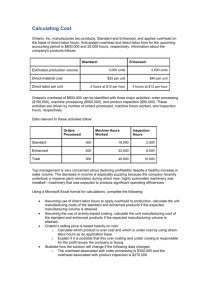

Environmental Accounting Discussion • Environmental Accounting Overview – What is environmental accounting – Why do environmental accounting – What is an environmental cost • System Strategies – Reactive, Proactive, Leadership • Business Purpose and Application – Example - Cost Allocation • Methodologies Environmental Accounting Overview What is environmental accounting? – A flexible tool to provide information not necessarily provided in traditional managerial systems. Goal • Goal of environmental accounting is to increase the amount of relevant data for those who need or can use it. • “Relevant data ” depends on the scale and scope of coverage Scale and Scope • Applicable at different scales of use and scopes (types) of coverage. – Application at an individual process level (production line), a system, a product, a facility, or an entire company level. – Coverage (focus) may include specific costs, avoidable costs, future costs and/or social external costs Scale and Scope • Decisions on scale and scope of application significantly impact ability to assess and measure environmental costs – Process vs Facility – Discreet costs vs Hidden vs Contingent vs Image Costs Why do Environmental Accounting ? • Environmental cost can be significantly reduced or eliminated as a result of business decisions. • Environmental costs may provide no added value to a process, system or product (i.e. waste raw material ) • Environmental costs may be obscured in general overhead accounts and overlooked during the decision making process. Why do Environmental Accounting ? • Understanding environmental costs can lead to more accurate costing and pricing of products. • Competitive advantage with customers is possible where processes and products can be shown as environmentally preferable. Environmental Costs • Major challenge in application of environmental accounting as a management tool is identifying relevant costs. • Cost definition determined by intended use of data (i.e. cost allocation, budgeting, product/process design or other management decision support). Environmental Costs • Types of Environmental Costs – Conventional: material, supplies, structure and capital costs need to be examined for environmental impact on decisions. – Potentially Hidden: • Regulatory (fees, licenses, reporting, training, remediation) • Upfront and back end (site prep, engineering, installation, closure and disposal) • Voluntary (training, audits, monitoring and reporting) – Contingent: penalties/fines, property liability, legal) – Image: Relationship with employees, customers, suppliers, regulators and shareholders Overview Summary • Flexible tool to provide relevant data not ordinarily captured in traditional systems. • Successful application requires up-front understanding of scale and scope of application. • Once identified, information needs to be communicated/distributed to decision makers and considered as a component of management’s decision making criteria System Strategies • Environmental Accounting systems typically fall into one of three categories: – Reactive – Proactive – Leadership Reactive Systems • Typically spread costs (capital and expense) across various overhead categories. • Environmental costs typically not assigned to specific line/process or activity. • Reactive system fails to provide indication or quantification of environmental costs. • As a result it fails to identify cost drivers and minimizes opportunity to develop tactics to reduce these costs. Proactive systems • Costs are categorized and assigned to specific process and activities. • Costs incurred can be identified, classified and quantified but are limited to discreet costs. • Decisions typically focus on incremental activities ( i.e. minimize waste, etc.). Leadership Systems • Includes both financial and non-financial issues in the relevant data used in the business decision process. • Systems are designed to include value chain perspectives. • Both the process as well as the product are evaluated for relationship between inputs and overall value provided to minimize “total costs”. Application • Utilization of data generated from application of environmental accounting tool can be used for a variety of decision classes including: – – – Cost allocation Capital budgeting Product design Cost Allocation an example • Goal - Bring environmental costs to attention of corporate stakeholders. • Four steps in environmental cost allocation: – – – – Determine scale and scope of the application Identify environmental costs Quantify those costs Allocate those costs to responsible product, process or system Traditional Cost System Other Overhead Toxic Waste Product B Allocated Overhead Product A Product B Modified Allocation System Other Overhead Toxic Waste Product B Allocated Overhead Product A Product B Methodologies Related Accounting Topics • Application of Environmental Accounting typically used in conjunction with: – – – – Activity Based Costing (ABC) Total Quality Management (TQM) Business Process Re-engineering Balanced Score Card