word

advertisement

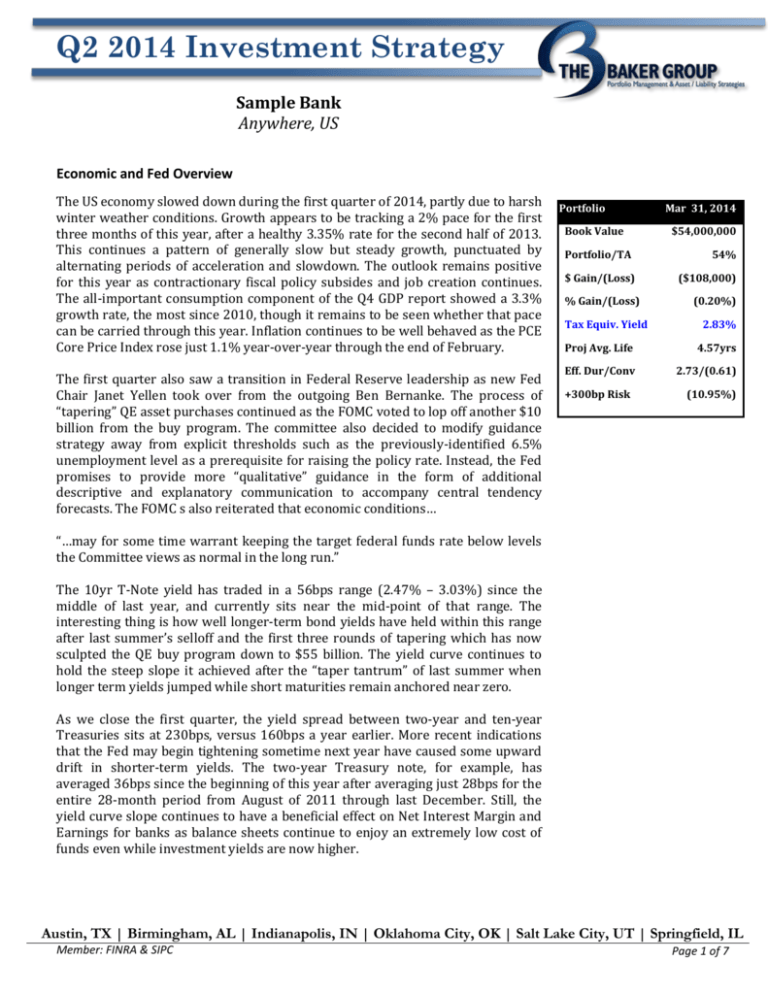

Q2 2014 Investment Strategy Sample Bank Anywhere, US Economic and Fed Overview The US economy slowed down during the first quarter of 2014, partly due to harsh winter weather conditions. Growth appears to be tracking a 2% pace for the first three months of this year, after a healthy 3.35% rate for the second half of 2013. This continues a pattern of generally slow but steady growth, punctuated by alternating periods of acceleration and slowdown. The outlook remains positive for this year as contractionary fiscal policy subsides and job creation continues. The all-important consumption component of the Q4 GDP report showed a 3.3% growth rate, the most since 2010, though it remains to be seen whether that pace can be carried through this year. Inflation continues to be well behaved as the PCE Core Price Index rose just 1.1% year-over-year through the end of February. The first quarter also saw a transition in Federal Reserve leadership as new Fed Chair Janet Yellen took over from the outgoing Ben Bernanke. The process of “tapering” QE asset purchases continued as the FOMC voted to lop off another $10 billion from the buy program. The committee also decided to modify guidance strategy away from explicit thresholds such as the previously-identified 6.5% unemployment level as a prerequisite for raising the policy rate. Instead, the Fed promises to provide more “qualitative” guidance in the form of additional descriptive and explanatory communication to accompany central tendency forecasts. The FOMC s also reiterated that economic conditions… Portfolio Book Value Portfolio/TA $ Gain/(Loss) % Gain/(Loss) Tax Equiv. Yield Mar 31, 2014 $54,000,000 54% ($108,000) (0.20%) 2.83% Proj Avg. Life 4.57yrs Eff. Dur/Conv 2.73/(0.61) +300bp Risk (10.95%) “…may for some time warrant keeping the target federal funds rate below levels the Committee views as normal in the long run.” The 10yr T-Note yield has traded in a 56bps range (2.47% – 3.03%) since the middle of last year, and currently sits near the mid-point of that range. The interesting thing is how well longer-term bond yields have held within this range after last summer’s selloff and the first three rounds of tapering which has now sculpted the QE buy program down to $55 billion. The yield curve continues to hold the steep slope it achieved after the “taper tantrum” of last summer when longer term yields jumped while short maturities remain anchored near zero. As we close the first quarter, the yield spread between two-year and ten-year Treasuries sits at 230bps, versus 160bps a year earlier. More recent indications that the Fed may begin tightening sometime next year have caused some upward drift in shorter-term yields. The two-year Treasury note, for example, has averaged 36bps since the beginning of this year after averaging just 28bps for the entire 28-month period from August of 2011 through last December. Still, the yield curve slope continues to have a beneficial effect on Net Interest Margin and Earnings for banks as balance sheets continue to enjoy an extremely low cost of funds even while investment yields are now higher. Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 1 of 7 Q2 2014 Investment Strategy March 2016 Fed Funds Futures – Current Market Expectations for FUTURE levels (as of 3/31/14): 0.300% 0.200% 0.100% 0.000% 0.130% 0.145% 0.100% 0.110% 0.120% 0.075% 0.080% 0.085% 0.085% 0.095% 0.175% 0.205% Apr '14 May '14 Jun '14 Jul '14 Aug '14 Sep '14 Oct '14 Nov '14 Dec '14 Jan '15 Feb '15 Mar '15 Current Portfolio Position and Strategy The Federal Reserve finally began to wind down their 3rd round of quantitative easing during the 1st quarter, reducing monthly bond purchases by $30 billion (from $85b to $55b). Despite the significant drop in longer term asset purchases, the 10-year Treasury yield actually fell 30bp during the 1st quarter and mortgages spreads tightened another 20bp. This seemingly counterintuitive market move shows that the Fed is not acting in a vacuum and the recent drop in MBS issuance (given the significant decline in refinance activity) has far outweighed the drop in Fed purchases. On the shorter end of the curve, 2- and 3-year yields actually rose slightly as the market began to anticipate the eventual Fed tightening cycle expected to begin mid-2015, resulting in a flatter yield curve. The combination of lower long-term yields and tighter spreads helped to reduce the unrealized loss on the portfolio to 0.2%. The yield of the portfolio also showed improvement, rising another 5bp to 2.83% and marking the 8th consecutive month of improving yields. The increase in portfolio yield is primarily due to two reasons: reinvesting cashflows at higher market yields and a slowdown in MBS/CMO prepayments. The Bank’s investment strategy has been focused on building a portfolio of stable cash flow and the higher yields available today are the perfect opportunity to continue deploying some of that cash flow to increase portfolio income and fight margin erosion. Sector Distribution CMO, 8% MBS/ CMO FL, 7% Other, 4% Agency, 14% Muni, 30% MBS, 34% Tax Muni, 3% The portfolio’s average life, duration and price volatility all fell slightly during the 1st quarter as the Bank has actively fought extension risk and worked to push duration toward a more neutral level. Just as the Bank had to work hard to keep portfolio duration from contracting too much when rates were at a record low, the Bank must now work hard to keep the duration from extending too much as rates rise. For this reason, the current strategy will be to reduce duration toward neutral from its current above neutral position. The significant rise in yields in the 2nd half of 2013 combined with notable average life extension and falling portfolio values has attracted the attention of regulators. The OCC and FDIC have put out numerous advisories and articles highlighting the importance of prudent interest rate risk management and they have been focusing more attention than usual on IRR during exams. The Bank has built a conservative portfolio and resisted the urge to “chase yield” in higher risk assets, so we are confident the drop in the value of our portfolio has been less than what other higher risk portfolios have experienced. Nevertheless, the Bank will continue to focus on managing the interest rate risk position of the portfolio and Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 2 of 7 Q2 2014 Investment Strategy March 2016 the entire balance sheet and making sure the bank remains within all requisite policy limits. The Bank will continue to build a cash flow barbell with a short-to-intermediate range ladder of MBS/CMO cashflow combined with longer maturity tax-exempt municipals. In order to achieve the goal of reducing portfolio duration towards neutral, the Bank will increase its allocation of shorter duration options including higher coupon MBS, short high cash flow CMOs, Hybrid ARMs, floaters and shorter 1X callable agencies. Despite the desire to reduce duration to neutral, the relative value in longer municipals is the best it’s been in years and the Bank will look for opportunities to add longer municipals to increase and stabilize portfolio yield. Portfolio allocations will continue to be managed based on anticipated needs for liquidity, cash flow and earnings. With an understanding that the worst bonds are normally purchased at peaks and troughs in interest rates, security selection has never been more critical and the Bank will avoid high risk securities. Purchase decisions will be focused on structure, credit, loan attributes, cash flow volatility, price risk and optimal relative value between and among sectors. Historical U.S. Treasury Yield Curves 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 6/30/2013 9/30/2013 12/31/2013 1.0% 3/31/2014 0.5% 0.0% Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 3 of 7 Q2 2014 Investment Strategy March 2016 Sector Strategies Agencies In Q1 agency spreads remained at all-time lows in the 0-6-year maturity sector. 2year bullet agencies are flat to treasuries and 5-year bullets are +6 basis points. The Bank will continue to moderate sector duration by primarily purchasing securities with 3- to 7-year maturities. Favored structures will continue to be premium one-time callable securities with at least one year of call protection and deeply discounted callables with some spread to matched-maturity bullets and a significant yield kick if called. The Bank will look to add 5-10-year maturity stepups with coupon and call structures that limit extension risk and provide a high likelihood of being called prior to maturity. Favored structures will continue to be those with a “bullet” feature on the back-end of the call schedule, including 1x call/1x step and Canary call structures (usually quarterly callable for 2-5 years, then a high-coupon bullet for 2-5 years). The Bank will avoid sacrificing structure and cash flow stability for marginal increases in yield. The Bank will continue to look for opportunities to sell short maturities and deploy the proceeds on the intermediate portion of the curve. In general, the Bank will look to take advantage of market fluctuations by adding slightly longer duration instruments (discounted callables and intermediate-maturity bullets) when rates rise, and focusing on premium 1x-calls in the lower part of the trading range. Agency % Curr/Last Target 14%/14% 10-25% Eff. Duration / Convexity Curr/Last Target 2.9/(0.8) 2.9/(0.8) 1.5-2.5 /(0.5)(1.0) CDs The bank’s CD sector remains quite small. Spreads on CDs also remained very low in Q1, so it is important for the bank to focus on buying only CDs that offer some spread to bullet agencies. Which currently will have the bank focusing on CDs with 1- to 7-year maturities. The Bank will buy only marketable FDIC-insured CDs, where it can expect to pick up 5-40 bps to bullet agencies in the desired maturity range. Like agencies, the Bank will avoid longer-maturity, option-heavy structures. FDIC insurance covers up to $250,000 per issuer, including accrued interest. The bank will limit holdings of CDs under these constraints per issuer. The supply of unique issuers remains limited, so the Bank will look to take advantage quickly when new opportunities arise. CD % Curr/Last Target 2%/2% 0-5% Eff. Duration / Convexity Curr/Last Target 1.3/(0.3) 1.3/(0.3) 1.52.5/(0.5)(1.0) Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 4 of 7 Q2 2014 Investment Strategy March 2016 Municipals Municipals continued to be attractive to investors during the first quarter as demand outpaced issuance. As a result Municipal bonds returned 3% during this period. The Bank will deploy funds in the 6 to 13 year range taking advantage of any market sell-off. The Bank will purchase higher coupons preferring a 3.50% or higher to reduce price volatility. As a percentage of treasuries, municipals continue to be 80% to 90% along the curve. The historical percentage has been around 75% to 80%. The Bank has made an extensive effort to analyze and monitor the credit metrics of all municipal holdings and will be very diligent in reviewing the creditworthiness of all future purchases. Given prudent credit analysis, the environment continues to offer excellent opportunities to add to the Municipal sector. As the Bank continues to employ a barbell strategy, the Bank will maximize longer municipal holdings and explore opportunities to swap out of shorter maturities and deploy the proceeds out on the preferred range of the curve. The Bank will continue to buy general obligation municipals and will purchase essential-purpose revenue municipals with a minimum of 1.25x coverage and preferring a 1.5x or higher coverage. The Bank will also purchase taxables with 510 year maturities, preferring shorter maturities because they do not have the same reduced duration benefit as the tax-free issues. The Bank will carefully review the creditworthiness of all municipal issuers in addition to assessing the strength of the bond insurer. Preferred insurers of municipal holdings will be the Texas PSF, State Aid Withholding, Qualified School Bond Funds, and issues rated A or better on their own. The Bank will purchase municipals with AGM, Assured Guaranty, Build America Mutual, and Municipal Assurance Corp. insurance that have an A or better underlying rating. MBS The Federal Reserve has continued to taper announcing a reduction of Treasury and Agency MBS purchases by $5Billion each per month at both the January 29 and March 19 FOMC meetings. After mortgage rates reacted to the initial taper announcement in Dec 2013 by rising to just over 4.5% to end the year, the current 30yr conventional mortgage rate stands 16 basis points lower at 4.34% Severe winter weather and higher mortgage rates relative to a year ago have resulted in a continued slowdown in refinancing activity. The Mortgage Bankers Association refinancing index averaged just over 1,500 in Q1 2014 versus an average of 3,070 in 2013 with a peak reading of 5,230 in May of last year. Overall, prepayments on MBS have followed suit, slowing about 50% from the peak last year. As we move into the Spring and Summer months, it is expected by many analysts that prepayments should pick up roughly 20% given the current rate scenario. Municipal % Curr/Last Target 30%/30% 25-35% Eff. Duration / Convexity Curr/Last Target 3.4/(0.4) 3.5/(0.3) 3.5-4.0/0-(0.5) Taxable Municipal % Curr/Last Target 4%/4% 0-10% Eff. Duration / Convexity Curr/Last Target 5.1/(0.2) 5.3/(0.1) 5.0-7.0/0.3-(0.3) MBS % Curr/Prev Target 34%/35% 30-45% Eff. Duration / Convexity Curr/Prev Target 2.4/(0.8) 2.4/(0.8) 1.5-2.0/ (0.7)-(1.3) While current refinancing activity has essentially vanished, there is still risk to higher prepayments if the recovery from The Great Recession was to stall and the Fed was to increase stimulus. Additionally, risk of stimulus from the Government is still elevated as the Obama administration was able to push through the nomination of Mel Watt to head the FHFA at the end of 2013. Watt indicated he Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 5 of 7 Q2 2014 Investment Strategy March 2016 would take 90 days to evaluate the situation, but it is believed he will push for reducing barriers to allow more borrowers to access a low cost mortgage through government programs. The HARP 2 program has continued to be successful in allowing eligible underwater homeowners to take advantage of a tremendous opportunity to obtain an artificially low cost mortgage. The program was originally set to expire at the end of 2013 and will now be in place through Dec 31, 2015. Specifically, borrowers with loans packaged into FNMA or FHLMC MBS experiencing no delinquencies over the past 12 months and an underwater loan (>80LTV) originated before June 1, 2009, have the opportunity to streamline refinance, with very low costs. In GNMA space, the FHA streamline program continues to provide incentives to refinance for borrowers with loans also originated prior to June 1, 2009. These pre-June 2009 FHA loans are grandfathered from having to pay the higher current annual Mortgage Insurance Premiums (Grandfathered MIP = 55pb vs. 130-135bp currently) and the upfront premium is only 1 basis point (vs. 1.75% for non-grandfathered loans The role of the MBS portfolio continues to provide steady front-end cash flow while maximizing risk/reward benefits. With the slowdown in current prepayments, but the risk of a potential stall in the recovery and a pro credit FHFA director in Mel Watt, our strategy to balance both contraction and extension risk in all mortgage related investments will remain intact. The MBS sector allocation dropped 1% to 34%, while the effective duration and convexity remained at 2.2 and (0.8) respectively. The Bank continues to review all holdings in the MBS portfolio and will continue to evaluate the benefits of liquidating securities that underperformed in the back-up in rates or could be negatively impacted by current or potential future Government refinance programs. Higher mortgage rates and slower prepayments reinforces the Banks mantra of striving to hold securities that provide consistent prepay protection while offering extension mitigation and more defensive price volatility characteristics. Higher coupon and/or shorter weighted average maturities are the primary attributes the Bank will employ to reduce depreciation risk. To counter the premium risk inherent in higher coupon MBS, the Bank will strive to find securities that should be less susceptible to faster prepayments. The #1 loan attribute to curtail fast prepayments, and also provide higher base case turnover rates, continues to be pools comprised of lower loan balance mortgages. These low loan balance mortgagees have less economic incentive to refinance into lower rates when they are low but have increased mobility due to smaller loan sizes when rates are higher. To balance extension and prepayment risks, the Bank will continue to focus on shorter-term (<=20yr) and relatively higher coupon (>=3.5%) specified agency MBS pools. 10-year MBS pools would be the exception to the coupon parameters, in that the shorter final maturity and high scheduled principal cash flow reduces the need for a higher coupon to limit price volatility risk. Pools will be selected with one or more of the following loan characteristics that should provide prepay protection: 1) low loan balance, 2) investor and vacation properties, 3) NY, TX, NJ, FL geographic concentrations, 4) Higher LTV (>90%), and 5) FHA Loans (GNMAs) originated after June 1, 2009 and prior to April 2011. Although the prepay protection may not be needed if rates continue to rise, the current cost for attaining these attributes has dropped significantly and should be good insurance if the economy falters and we experience a drop in rates. Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 6 of 7 Q2 2014 Investment Strategy March 2016 ARM/Float The Bank reinvested very little cash flow into the ARM sector over the second half of 2013 and the 1st quarter of 2014, resulting in portfolio allocation ending the year at 6%. As the overall portfolio duration is approaching the upper end of the Banks target level, the Bank will continue to search for opportunities to enhance future rate sensitivity with minimal yield give up. As opportunities present, an additional focus for the sector will be seasoned post-reset ARMS. These loans may have had initial fixed-rate periods for 5 or 7-years, but were originated prior to 2007 and currently have annual resets with a 2% annual collar. Over the past two years, the Bank added a small allocation of newer GNMA 3x1 and 5x1 Hybrid ARMs with 2.0% to 3.5% coupons. Due to record low rates, a very steep yield curve and aggressive refinancing, this sector has prepaid faster than anticipated. However, an almost 100bp increase in 5x1 borrowing rates coupled with the increase in FHA Mortgage insurance Premiums should cause prepayments in this sector to decline significantly over the coming months. The Bank will look to find value and increase allocation in this sector if prices fall and premium risk can be minimized. ARM/Float % Curr / Prev Target 6%/6% 0-10% Eff. Duration / Convexity Current / Prev Target 0.7/(0.6) 0.7 / (0.6) 0.8-1.5/ (0.3)-(0.8) CMO The performance of the CMO sector has improved substantially as prepayments have slowed over the second half of 2013 and into 2014. Given the slowdown in prepayments, all CMO structures continue to be evaluated for potential extension risk and those identified with greater risk have been/will be targeted for liquidation. The Bank will look to take advantage of higher rates and a steeper yield curve by pursuing CMO structures that have 2-5 year projected average lives with limited extension risk. To reduce overall premium risk in the portfolio, the Bank will look for opportunities to add these preferred cash flow structures with lower coupons backed by higher WAC collateral. Additionally, very short average life CMOs (1-2yrs) will be utilized when available to provide a spread to cash alternatives over the next 18-24 months while the Fed keeps short-term rates anchored. To diversify mortgage prepayment exposure and take advantage of the more stable prepayment characteristics, 30 year GNMA MBS (post June1, 2009 origination) will be the preferred CMO collateral. Foremost, FHA loans originated after June 1, 2009 are not eligible to refinance under the FHA HARP program. FHA loans originated prior to April 2011 (and after June 1, 2009) have provided excellent prepayment protection as the FHA has increased the annual Mortgage Insurance Premium by 80bps. The increased premium results in an additional rate incentive needed for an FHA borrower to achieve the required 5% Net Tangible Benefit to refinance. Furthermore, GNMA collateral can offer superior extension protection as base case turnover should remain brisk due to ongoing buyouts of lesser credit FHA borrowers. Preferred FNMA/FHLMC collateral will have underlying loan attributes as stressed in the MBS sector (low loan balance, investor and vacation properties, NY, TX, NJ, FL geographic concentrations, higher LTV MHA loans, etc.) that should provide prepay protection. All CMO’s will be prudently analyzed and continually monitored for both extension and call risks and will be managed to maximize risk/reward benefits. CMO % Curr/Prev Target 8%/8% 5-15% Eff. Duration / Convexity Current/Prev Target 2.1/(0.9) 2.1/(1.0) 1.2-2.0/ (0.5)-(1.2) Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 7 of 7