Q4 2012 Investment Strategy Q4 2012 Investment Strategy

advertisement

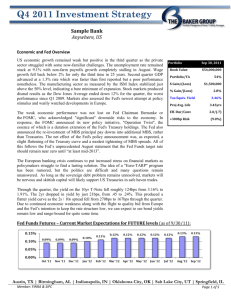

Q4 2012 Investment Strategy Sample Bank Anywhere, US Economic and Fed Overview US economic growth in the third quarter continued to come in fits and starts, taking two steps forward, then one step back. The most notable area of sluggishness is clearly the jobs market where the unemployment rate remains stuck above 8%. The persistent joblessness has curbed wage gains and limited consumer spending, further impeding an economy facing a slowdown in manufacturing as global demand cools and businesses curtail investments. Bright spots in the economy include the housing and auto sectors which are now showing signs of sustainable improvement. Still, the rate of growth is barely expected to be 2% for calendar year 2012. This weak performance was underscored by the recent downward revision of 2nd quarter growth to just 1.3%. In addition to generally weak growth, financial markets must also cope with dangerous uncertainties in US fiscal policy and ongoing problems in the Eurozone. Portfolio Book Value Portfolio/TA $ Gain/(Loss) % Gain/(Loss) Tax Equiv. Yield Sept 30, 2012 $54,000,000 54% $1,587,600 2.9% 3.01% Proj Avg. Life 3.64yrs Eff. Dur/Conv 1.98/(0.6) +300bp Risk (8.8%) As for Fed policy, the big news during the quarter was of course the announcement by the FOMC that it would hold its target interest rate near zero until at least mid-2015 as it began a third round of stimulus, buying $40 billion in mortgage bonds a month. Chairman Bernanke cited a lack of “ongoing, sustained improvement in the labor market” as justification for the open-ended Quantitative Ease (QE) program. Not all FOMC members agreed with this point as some worried that the positive effect will be quite small and transitory, and that it could risk higher inflation and harm to the Fed’s credibility when the time comes to unwind the stimulus.” Nonetheless, the voting members counted only one dissent (Jeffrey Lacker from Richmond) among them. The average yield on the 10yr T-Note during the third quarter was 1.62%, twenty basis points lower than the average of the second quarter, and sharply below the high for the year of 2.38%. In light of the prospects for continued weak growth, the weakness in inflation measures, and the Fed’s aggressive monetary policy stance, we anticipate continued low and range-bound behavior for US Treasury yields. Spreads of other bond market sectors, however, are behaving quite differently, and for good reason. Without the Fed’s various QE programs, some estimates suggest that the 10yr yield would now be in a 2.5% to 3% range. But we know that without QE the economy would be somewhat weaker and therefore bond yields would naturally be lower as well. One thing that is clearly distorted is the spread relationships between and among certain bond market sectors. The unusual circumstances created by market yields in a world of QE mean that scrutinizing relative value among security sectors and types is perhaps more important than ever before. Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 1 of 7 Q4 2012 Investment Strategy March 2016 Fed Funds Futures – Current Market Expectations for FUTURE levels (as of 9/30/12): 0.15% 0.14% 0.14% 0.14% 0.14% 0.13% 0.13% 0.13% 0.13% 0.12% 0.11% Oct '12 Nov '12 Dec '12 Jan '13 0.12% 0.12% 0.13% Feb '13 Mar '13 Apr '13 May '13 Jun '13 0.13% 0.13% 0.13% Jul '12 Aug '13 Sep '13 Current Portfolio Position and Strategy Despite the unprecedented steps taken by the Federal Reserve in the 3rd quarter, US Treasury yields on the short and long ends of the curve finished the quarter relatively unchanged while the “belly” of the curve fell about 10bp. The Fed’s commitment to keep rates at zero through mid-2015 continues to depress bond market yields and has contributed to another 10bp drop in portfolio yield to a cycle low of 3.01% and an unrealized gain on the portfolio near records highs at around 3%. The Bank has continued to resist the urge to “chase yield” in higher risk securities and this strategy has led to a drop in our +300bp price risk to less than 9%. Portfolio average life and duration have also fallen as MBS/CMO prepayments have risen with record low mortgage rates. The Bank may need to work hard to maintain duration in the face of faster prepayments and the rising numbers of Agency bonds being called. With continued strength in deposit growth and relatively tepid loan demand, a top priority will be to fully deploy excess liquidity, while building a diversified portfolio that fits within the Bank’s overall balance sheet risk. Sector Distribution Other, CMO, 3% 12% Agency 16% Muni, 27% MBS, 41% Tax Muni, 3% Yield spreads on Agency and Municipal bonds remained relatively flat during the quarter while MBS spreads fell to record lows. The Fed’s announcement that they will be buying $40 billion a month of Agency MBS indefinitely has put unprecedented upward pressure on prices and led to a 50bp drop in spreads during the quarter. Market yields on certain Fixed Rate MBS have now fallen to a point where some Hybrid ARMs may provide better relative value and the Bank will consider building that sector. Municipal bonds will continue to be the favored sector for increasing portfolio yield and purchases will be focused on the long-end, assuming risk and tax positions warrant. With an understanding that the worst bonds are normally purchased at peaks and troughs in interest rates, security selection has never been more critical and the Bank will avoid high risk securities. Purchase decisions will be focused on structure, credit, loan attributes, cashflow volatility, price risk and optimal relative value between and among sectors. The Bank will seek to build a cash flow barbell with a short-to-intermediate range ladder of taxable combined with longer maturity tax-exempt municipals. The liquidity ladder should be anchored with well-structured MBS pass-throughs, Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 2 of 7 Q4 2012 Investment Strategy March 2016 short-to intermediate maturity agencies, and clean CMO tranches. Portfolio allocations will be managed based on anticipated needs for liquidity, cashflow and earnings. Overall portfolio yield will likely continue to fall in the coming weeks as older bonds pay off or mature. Current re-investment rates remain at historic lows making it difficult to maintain earning asset yield targets. This simply underscores the necessity of keeping excess liquidity deployed. The cost of sitting in fed funds becomes greater the longer we remain locked in the low rate environment. Historical U.S. Treasury Yield Curves 3.5% 3.0% 2.5% 2.0% 12/31/2011 1.5% 3/31/2012 1.0% 6/30/2012 0.5% 9/30/2012 0.0% Sector Strategies Agencies Agency spreads to Treasuries remained tight in Q2 as the treasury curve steepened; 2-year bullet agencies are +5 basis points to treasuries and 5-years are +15 basis points. The Bank will continue to moderate sector duration by primarily purchasing securities with 3- to 7-year maturities. Favored structures will continue to be premium one-time callable securities with at least one year of call protection. Step-ups with 1x-call, 1x-step structures will also be utilized when the step coupon provides sufficient probability of call. The Bank will also look to add multi-step structures with mid-term maturities when the step coupon schedule provides ample cushion and the yield pickups warrant. Step-up issuance remains high and with a varying range of structures. The Bank will avoid chasing yield and refrain from buying longer maturity bonds in favor of shorter maturity 1x-step, and 1x-callable bonds with higher back-end coupons. The Bank will continue to look for opportunities to sell short maturities and deploy the proceeds on the intermediate portion of the curve. In general, the Bank will look to take advantage of market fluctuations by adding slightly longer duration instruments when rates rise, and focusing on premium 1x-calls in the lower part of the trading range. Agency % Curr/Last Target 15%/16% 15-25% Eff. Duration / Convexity Curr/Last Target 1.9/(0.9) 2.0/(0.8) 1.52.5/(0.5)(1.0) Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 3 of 7 Q4 2012 Investment Strategy March 2016 CDs The bank’s CD sector remains quite small. However, with Agency yields and spreads near all-time lows, the Bank will add to the sector as appropriate securities become available. The Bank will focus on buying short-to-mid-term marketable FDIC-insured CDs, where it can expect to pick up 10-25 bps vs. 2-year maturity and 15-50 bps vs. 5-year maturity bullet agencies. Like agencies, the Bank will avoid longer-maturity, option-heavy structures. FDIC insurance covers up to $250,000 per issuer, including accrued interest. The bank will limit holdings of CDs under these constraints per issuer. The supply of unique issuers remains limited, so the Bank will look to take advantage quickly when new opportunities arise. CD % Curr/Last Target 1%/0% 0-5% Eff. Duration / Convexity Curr/Last Target 1.1/(0.3) 1.2/(0.3) 1.52.5/(0.5)(1.0) Municipals Municipals continued with solid returns in the third quarter as demand outpaced issuance and this trend should continue in the future. The percentage ratio between 10 year municipals and treasuries is 100%. The historical ratio is 80% and the Bank will purchase municipals when the ratio is above 80%. The Bank has made an extensive effort to analyze and monitor the credit metrics of all municipal holdings and will be very diligent in reviewing the creditworthiness of all future purchases. Given prudent credit analysis, the environment continues to offer excellent opportunities to add to the Municipal sector. As the Bank continues to employ a barbell strategy, the Bank will maximize longer municipal holdings and explore opportunities to swap out of shorter maturities and deploy the proceeds out on the preferred range of the curve. The Bank will continue to buy general obligation municipals and will purchase essential-purpose revenue municipals with a minimum of 1.25x coverage and preferring a 1.50x or higher coverage. The Bank will also purchase taxables with 5-10 year maturities, preferring shorter maturities because they do not have the same reduced duration benefit as the tax-free issues. The Bank will buy taxables with make whole calls tied to the treasury market or redemption provisions that are not affected by Sequestration Transparency Act of 2012. The Bank will carefully review the creditworthiness of all municipal issuers in addition to assessing the strength of the bond insurer. Preferred insurers of municipal holdings will be the Texas PSF, State Aid Withholding and Qualified School Bond Funds, and issues rated A or better on their own. The Bank will purchase municipals with AGM or Assured Guaranty insurance that have an A or better underlying rating. Municipal % Curr/Last Target 26%/25% 20-30% Eff. Duration / Convexity Curr/Last Target 3.4/(0.4) 3.4/(0.4) 3.5-4.0/0-(0.5) Taxable Municipal % Curr/Last Target 3%/3% 5-10% Eff. Duration / Convexity Curr/Last Target 5.6/0.2 5.8/0.1 5.0-7.0/0.3-(0.3) Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 4 of 7 Q4 2012 Investment Strategy March 2016 MBS On September 13th, The Federal Reserve announced another round of quantitative easing measures (QE3) by saying they will invest $40 Billion per month in the MBS market while continuing to reinvest portfolio cash flows into Agency MBS securities This program has been extended until the FOMC believes the unemployment rate has fallen to acceptable levels. The role of the MBS portfolio continues to be to provide steady front-end cash flow while maximizing risk/reward benefits. Over the third quarter, MBS holdings declined another 1%, and sits at the low end of the target, while sector duration contracted from 1.6 to 1.2 as mortgage rates reached new record lows below 3.50%. This further drop in rates reinforces our strategy to balance both contraction and extension risk in all mortgage related investments. On one hand, the White House continues to push stimulative packages to allow more homeowners to refinance. At the same time private mortgage lending remains non-existent and the FHFA continues to raise fees for government mortgage insurance. They recently announced guarantee fees will increase another 10bp before the end of the year nationally, while certain states face the prospect of additional increases. The Home Affordable Refinance Program (HARP 2) has continued to gain traction and has elevated prepayments for certain securities. HARP eligible homeowners continue to take advantage of a tremendous opportunity to obtain an artificially low cost mortgage. Specifically, borrowers with no delinquencies over the past 12 months and an underwater loan (>80LTV) originated before June 1, 2009, have the opportunity to streamline refinance, with limited LLPA fees, through Dec 31, 2013. Currently, over 30% of all mortgage refinancing is under the HARP 2 program. It is expected these speeds will remain elevated for at least the remainder of 2012 before we may see some burnout. MBS % Curr/Prev Target 35%/36% 35-45% Eff. Duration / Convexity Curr/Prev Target 1.2/(0.8) 1.6/(0.7) 1.5-2.0/ (0.7)-(1.3) During the first 9 months of the year, the Bank reviewed all holdings in the MBS portfolio and liquidated all securities deemed to be negatively impacted by these changes. Specifically, the portfolio was filtered to find loans originated after 2003 (+ before June 1, 2009) with >80% estimated current LTV. Of those securities, pools with longer terms (e.g. 30yr), higher loan balances (>$150k), higher FICO scores (>700) were liquidated as deemed necessary. More recently, the FHA has initiated a similar refinancing program, commencing June 11, 2012, to provide incentives to refinance borrowers with loans also originated prior to June 1, 2009. These specific FHA loans are grandfathered from having to pay a 70 basis points increase in annual Mortgage Insurance Premiums (MIPs) and the upfront premium is only 1 basis point (vs. 1.75% for nongrandfathered loans). The Bank has performed a similar review of all GNMA holdings to determine if any items should be liquidated prior to any accelerated prepayments resulting from the new program. Prepayments on FHA HARP eligible loans have accelerated at a very fast pace (starting with August payments), however, it is believed the very fast prepayments should be somewhat short-lived. Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 5 of 7 Q4 2012 Investment Strategy March 2016 MBS Con’t Over the past few years of elevated refinance activity, the Bank has strived to hold securities that provide consistent prepay protection while offering more defensive price volatility characteristics. The #1 loan attribute to curtail fast prepayments, and also provide higher base case turnover rates, continues to be pools comprised of lower loan balance mortgages. These loan holders have less economic incentive to refinance into lower rates when they are low but have increased mobility due to smaller loan sizes when rates are higher. To balance extension and prepayment risks, the Bank will continue to focus on shorter-term (<=20yr) and higher coupon (>=4.0%) specified agency MBS pools. With current production coupons now falling to 3.5% and below, this is becoming more difficult to do. Pools will be selected with one or more of the following loan characteristics that should provide prepay protection: 1) low loan balance, 2) investor and vacation properties, 3) NY, TX, NJ, FL geographic concentrations, 4) Higher LTV (>85%), and 5) FHA Loans (GNMAs) originated after June 1, 2009 and prior to April 2011. MBS ARM As fixed rate MBS yields continue to fall, the Bank has increased emphasis on the MBS ARM sector. The yield differential between fixed and floating rate instruments has continued to narrow significantly, leading to potential opportunities to enhance future rate sensitivity with minimal yield give up. Specifically, the Bank has added newer GNMA 3x1 and 5x1 Hybrid ARMs. GNMA hybrids are the primary focus of the ARM strategy as the underlying FHA loans have shown to provide similar prepayment protection offered by GNMA 30yr fixed mortgages (Post June1, 2009). Longer first resets provided by these structures, 24-60 months, could coincide well with the FOMC stated bias toward keeping short term rates into 2015. Additionally, the Bank will evaluate 7x1 and 10x1, low coupon, FNMA and FHLMC Hybrid ARMS. Newer production loans should provide some prepayment protection in the near-term, while escalating cash flows towards future reset dates could provide liquidity in harmony with forward rates. MBS ARM % Curr / Prev Target 5%/5% 10-20% Eff. Duration / Convexity Current / Prev Target 0.77/(0.5) 1.0-1.5/ (0.3)-(0.8) 0.9 / (0.3) CMO After peaking at 15% allocation in Q3 2011, the CMO sector has declined 3% to stand at 12% of the total portfolio. With the continued decline in mortgage rates, the effective duration of the CMO portfolio has contracted to 1.2 from 1.7 at the end of Q1, 2012. Given the growing impact of HARP 2 and the FHA HARP program, CMO structures must continue to be evaluated with heightened scrutiny towards faster prepayment rates over the near term. The Bank will continue to pursue CMO structures that have 3-5 year projected average lives with limited extension risk. Additionally, very short average life CMOs (1-2yrs) will be utilized to provide a spread to cash alternatives over the next 24-30 months while the Fed keeps short-term rates anchored. To diversify mortgage prepayment exposure and take advantage of the more stable prepayment characteristics, GNMA MBS, post June1, 2009 origination, will be the preferred CMO collateral. Foremost, FHA loans originated after June 1, 2009 are not eligible to refinance under the FHA HARP program. CMO % Curr/Prev Target 12%/14% 10-20% Eff. Duration / Convexity Current/Prev Target 1.3/(0.6) 1.3/(0.7) 1.2-1.7/ (0.5)-(1.2) Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 6 of 7 Q4 2012 Investment Strategy March 2016 CMO Con’t Additionally, FHA loans originated prior to April 2011 have provided excellent prepayment protection as the FHA has increased the annual Mortgage Insurance Premium by 70bps since October1, 2010. The increased premium results in an additional 40-70bp rate incentive needed for an FHA borrower to achieve the required 5% Net Tangible Benefit to refinance. Furthermore, GNMA collateral can offer superior extension protection as base case turnover should remain brisk due to ongoing buyouts of lesser credit FHA borrowers. Alternatively, preferred FNMA/FHLMC collateral will have underlying loan attributes that should provide prepay protection (low loan balance, investor and vacation properties, NY, TX, NJ, FL geographic concentrations, higher LTV MHA loans, etc.). A new strategy for the CMO sector this quarter will be to search for securities being liquidated at depressed levels because they have been adversely impacted by the FNMA/FHLMC HARP II or the FHA HARP programs. All CMO’s will be prudently analyzed and continually monitored for both extension and call risks and will managed to maximize risk/reward benefits. Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 7 of 7