2008 Year in Review

advertisement

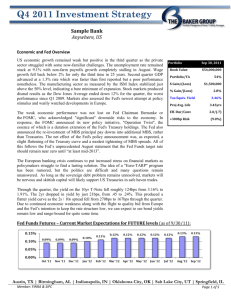

Q1 2014 Investment Strategy Sample Bank Anywhere, US Economic and Fed Overview The US economy enters 2014 with a good deal of momentum and upside growth potential. Steady job creation and a strong housing market, along with sharply rising stock prices have contributed to the highest year-end levels of consumer confidence since 2007. This, in turn, has spurred improvement in the allimportant consumption component of GDP. Moreover, the manufacturing sector, helped by improving global growth, has shown steady expansion as stronger demand boosted factory output. When the numbers are tallied, GDP growth for 2013 is likely to settle very close to 2%, but forecasts for the New Year are notably higher. Importantly, fiscal drag from all levels of government should also decline during the year. Despite these underpinnings of growth potential, there are reasons why the Fed will be very slow to adjust policy. Though they have begun the process of slowing or “tapering” QE asset purchases, Fed officials have clearly communicated to markets the fact that “tapering is not tightening”. Indeed, for a variety of reasons, the Fed does not want to make a policy mistake that would interrupt the slow, steady progress that has been made. One reason for policymakers’ caution is the fact that inflation continues to be disturbingly weak. And though the growth trajectory appears to be stronger, it remains well below levels that could be considered robust. In fact, the pattern of the past three years has been one of growth spurts followed by retrenchment during the course of the year. The Fed doesn’t want to get ahead of itself in terms of normalizing policy until it is clear that the economy has reached “escape velocity”. Portfolio Book Value Portfolio/TA $ Gain/(Loss) % Gain/(Loss) Tax Equiv. Yield Dec 31, 2013 $54,000,000 54% ($442,800) (0.82%) 2.80% Proj Avg. Life 4.69yrs Eff. Dur/Conv 2.76/(0.61) +300bp Risk (11.0%) The benchmark 10yr T-Note yield ended 2013 at its high for the year. The yield curve remained very steep as the Fed successfully communicated to markets that any fed funds increase was still far in the future. To an extent, the steeper Treasury curve should translate into higher interest spread for the bank as yields on earning assets have risen while cost of funds has not. For many banks, this is only true for securities since pricing power remains weak for loans. Still, the bank is now able to fight margin compression much more successfully with investments as average portfolio yields are drifting higher with new purchases. Looking ahead, it is clear that the deleveraging cycle in the US is now in its later stages, and there is potential for healthier growth than we’ve seen in years. For now, bond yields have shifted upward to a higher range. The 10yr may define a yet higher upward limit, but will be ultimately tethered by a near-zero fed funds rate. This presents opportunities for the bank as we continue to deploy excess liquidity, taking advantage of the steep yield curve, repairing margin, and managing balance sheet cash flow. Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 1 of 8 Q1 2014 Investment Strategy March 2016 Fed Funds Futures – Current Market Expectations for FUTURE levels (as of 12/31/13): 0.200% 0.100% 0.000% 0.175% 0.150% 0.165% 0.125% 0.135% 0.140% 0.115% 0.110% 0.105% 0.085% 0.090% 0.095% Jan '14 Feb '14 Mar '14 Apr '14 May '14 Jun '14 Jul '14 Aug '14 Sep '14 Oct '14 Nov '14 Dec '14 Current Portfolio Position and Strategy The 10-year Treasury yield rose 42bp in the 4th quarter to finish the year at 3.03%, the highest level since July of 2011. The rise in yields came as stronger economic data provided the Federal Reserve with evidence suggesting the economy had improved enough to begin tapering their bond purchases by $10 billion a month in January. Despite the rise in Treasury yields during the quarter, the unrealized loss on the portfolio remained relatively unchanged (-0.8%) as spreads on Municipals and MBS/CMO tightened, softening the impact on prices. More importantly, the rise in rates has resulted in 5 consecutive months of increasing portfolio yield, which rose 3bp to 2.80% in December, the highest level since February 2013. The increase in portfolio yield is primarily due to two reasons: reinvesting cashflows at higher market yields and a slowdown in MBS/CMO prepayments. The Bank’s investment strategy has been focused on building a portfolio of stable cash flow and the higher yields available today are the perfect opportunity to continue deploying some of that cash flow to increase portfolio income and fight margin erosion. Sector Distribution CMO, 8% MBS/ CMO Other, FL, 7% 2% Agency, 14% Muni, 30% MBS, 35% Tax Muni, 4% The average life of the portfolio fell slightly during the quarter from 4.8 to 4.7yrs, reversing the recent trend of extension caused by slowing prepayments. However, Duration remains near the highest level on record and is above neutral at 2.76. Just as the Bank had to work hard to keep portfolio duration from contracting too much when rates were at a record low, the Bank must now work hard to keep the duration from extending too much as rates rise. For this reason, the current strategy will be to reduce duration toward neutral from its current above neutral position. The significant rise in yields in the 2nd half of 2013 combined with notable average life extension and falling portfolio values has attracted the attention of regulators. The OCC and FDIC have put out numerous advisories and articles highlighting the importance of prudent interest rate risk management and they have been focusing more attention than usual on IRR during exams. The Bank has worked hard to build a conservative portfolio and resisted the urge to “chase yield” in higher risk assets, so we are confident the drop in the value of our portfolio has been less than what other higher risk portfolios have experienced. Nevertheless, the Bank will continue to focus on managing the interest rate risk position of the portfolio and the entire balance sheet and making sure the bank remains within all requisite policy limits. Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 2 of 8 Q1 2014 Investment Strategy March 2016 The Bank will continue to build a cash flow barbell with a short-to-intermediate range ladder of MBS/CMO cashflow combined with longer maturity tax-exempt municipals. In order to achieve the goal of reducing portfolio duration towards neutral, the Bank will increase its allocation of shorter duration options including higher coupon MBS, high cash flow CMOs, Hybrid ARMs, floaters and shorter 1X callable agencies. Despite the desire to reduce duration to neutral, the relative value in longer municipals is the best it’s been in years and the Bank will look for opportunities to add longer municipals to increase and stabilize portfolio yield. Portfolio allocations will continue to be managed based on anticipated needs for liquidity, cash flow and earnings. With an understanding that the worst bonds are normally purchased at peaks and troughs in interest rates, security selection has never been more critical and the Bank will avoid high risk securities. Purchase decisions will be focused on structure, credit, loan attributes, cash flow volatility, price risk and optimal relative value between and among sectors. Historical U.S. Treasury Yield Curves 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 3/31/2013 6/30/2013 9/30/2013 1.0% 12/31/2013 0.5% 0.0% Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 3 of 8 Q1 2014 Investment Strategy March 2016 Sector Strategies Agencies Agency spreads tightened across the curve in Q4, reaching all-time lows in the 2-5-year sector. 2-year bullet agencies are flat to treasuries and 5-years are +12 basis points. The Bank will continue to moderate sector duration by primarily purchasing securities with 3- to 7-year maturities. Favored structures will continue to be premium one-time callable securities with at least one year of call protection and deeply discounted callables with decent spread to matchedmaturity bullets and a significant yield kick if called. The Bank will look to add 510-year maturity step-ups with solid coupon and call structures that limit extension risk and provide a high likelihood of being called prior to maturity. Favored structures will continue to be those with a “bullet” feature on the backend of the call schedule, including 1x call/1x step and Canary call structures (usually quarterly callable for 2-5 years, then a high-coupon bullet for 2-5 years). The Bank will avoid sacrificing structure and cash flow stability for marginal increases in yield. The Bank will continue to look for opportunities to sell short maturities and deploy the proceeds on the intermediate portion of the curve. In general, the Bank will look to take advantage of market fluctuations by adding slightly longer duration instruments (discounted callables and intermediatematurity bullets) when rates rise, and focusing on premium 1x-calls in the lower part of the trading range. Agency % Curr/Last Target 14%/13% 10-25% Eff. Duration / Convexity Curr/Last Target 2.9/(0.8) 2.9/(0.8) 1.5-2.5 /(0.5)(1.0) CDs The bank’s CD sector remains quite small. Spreads on CDs have also tightened in Q4, so it is important for the bank to focus on buying only CDs that offer some spreads to bullet agencies. Which currently will have the bank focusing on CDs with 1- to 7-year maturities. The Bank will buy only marketable FDIC-insured CDs, where it can expect to pick up 5-40 bps to bullet agencies in the desired maturity range. Like agencies, the Bank will avoid longer-maturity, option-heavy structures. FDIC insurance covers up to $250,000 per issuer, including accrued interest. The bank will limit holdings of CDs under these constraints per issuer. The supply of unique issuers remains limited, so the Bank will look to take advantage quickly when new opportunities arise. CD % Curr/Last Target 2%/2% 0-5% Eff. Duration / Convexity Curr/Last Target 1.3/(0.3) 1.3/(0.3) 1.52.5/(0.5)(1.0) Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 4 of 8 Q1 2014 Investment Strategy March 2016 Municipals Municipals continued to be attractive to investors during the fourth quarter as demand outpaced issuance. During the fourth quarter municipals remained under pressure from mutual fund redemptions and the treasury sell off. The Bank will deploy funds in the 7 to 15 year range taking advantage of the market sell off. As a percentage of treasuries, municipals continue to be 90 to 120% along the curve. The historical percentage has been around 75 to 80%. The Bank has made an extensive effort to analyze and monitor the credit metrics of all municipal holdings and will be diligent in reviewing the creditworthiness of all future purchases. Given prudent credit analysis, the environment continues to offer excellent opportunities to add to the Municipal sector. As the Bank continues to employ a barbell strategy, the Bank will maximize longer municipal holdings and explore opportunities to swap out of shorter maturities and deploy the proceeds out on the preferred range of the curve. The Bank will continue to buy general obligation municipals and will purchase essential-purpose revenue municipals with a minimum of 1.25x coverage and preferring a 1.5x or higher coverage. The Bank will also purchase taxables with 510 year maturities, preferring shorter maturities because they do not have the same reduced duration benefit as the tax-free issues. The Bank will carefully review the creditworthiness of all municipal issuers in addition to assessing the strength of the bond insurer. Preferred insurers of municipal holdings will be the Texas and Nevada Permanent School Funds, State Aid Withholding, Qualified School Bond Funds, and issues rated A or better on their own. The Bank will purchase municipals with AGM, Assured Guaranty, Build America Mutual, and Municipal Assurance Corp. insurance that have an A or better underlying rating. MBS Mortgage market volatility continued over the 4th quarter of 2013. The market spent the quarter trying to determine whether the Fed would taper any MBS purchases before the end of the year or wait until 2014 to reduce purchases. After Chairman Bernanke and committee surprised the market at both the September 18th and October 30th meetings by letting the nation know the Federal Reserve would not taper, they acquiesced in December when they announced they would reduce both Treasury and Agency MBS purchases by $5Billion per month beginning January 2014. Mortgage rates reacted by rising to just over 4.5% to end the year. Higher mortgage rates have resulted in reduced refinancing’s and given current rates the, the Mortgage Bankers Association refinancing index should continue to generate readings in the 1,000 – 1,500 range. This compares to a peak of over 5,000 in May of this year. Should current rates and conditions persist, prepayments ought to continue to slow and should remain restrained. Municipal % Curr/Last Target 30%/30% 25-35% Eff. Duration / Convexity Curr/Last Target 3.5/(0.3) 3.6/(0.3) 3.5-4.0/0-(0.5) Taxable Municipal % Curr/Last Target 4%/4% 0-10% Eff. Duration / Convexity Curr/Last Target 5.3/(0.1) 5.4/(0.1) 5.0-7.0/0.3-(0.3) MBS % Curr/Prev Target 35%/35% 30-45% Eff. Duration / Convexity Curr/Prev Target 2.4/(0.8) 2.2/(0.7) 1.5-2.0/ (0.7)-(1.3) While rates are higher and non-harp refinancing activity has essentially vanished, there is still risk to higher prepayments in the event of additional housing stimulus from the Government. The HARP 2 program has continued to be very successful in allowing eligible homeowners to take advantage of a tremendous opportunity to obtain an artificially low cost mortgage. The program was Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 5 of 8 Q1 2014 Investment Strategy March 2016 originally set to expire at the end of 2013 and will now be in place through Dec 31, 2015. Specifically, borrowers with loans packaged into FNMA or FHLMC MBS experiencing no delinquencies over the past 12 months and an underwater loan (>80LTV) originated before June 1, 2009, have the opportunity to streamline refinance, with very low costs. Even with higher rates, the program has shown only small signs of burning out and the FHFA has launched a marketing campaign focused on borrower awareness to encourage eligible borrowers to take action. In fact, given current mortgage rates with fewer overall borrowers having economic benefit from refinancing, HARP eligible borrowers have been targeted by mortgage bankers and prepayments in this sector may remain somewhat elevated into 2014. In GNMA space, the FHA streamline program continues to provide incentives to refinance for borrowers with loans also originated prior to June 1, 2009. These pre-June 2009 FHA loans are grandfathered from having to pay the higher current annual Mortgage Insurance Premiums (Grandfathered MIP = 55pb vs. 130-135bp currently) and the upfront premium is only 1 basis point (vs. 1.75% for non-grandfathered loans). To add to the potential risk of future prepayments is the fact that the Obama administration was able to push through the nomination of Mel Watt to head the FHFA. It is believed he will push for reducing barriers to allow more borrowers to access a low cost mortgage through government programs. The role of the MBS portfolio continues to provide steady front-end cash flow while maximizing risk/reward benefits. With the rise in mortgage rates countered by sustained Fed buying of MBS (still $35B per month), and a new pro credit FHFA director in Mel Watt, our strategy to balance both contraction and extension risk in all mortgage related investments will remain intact. To end the year, the MBS sector held steady with a 35% allocation and the effective duration extended slightly from 2.2 to 2.3??. The Bank continues to review all holdings in the MBS portfolio and will continue to evaluate the benefits of liquidating securities negatively impacted by current or potential future Government refinance programs or those that underperformed in the back-up in rates. Rate volatility over the second half of 2013 reinforces the Banks mantra of striving to hold securities that provide consistent prepay protection while offering more defensive price volatility characteristics. Higher coupon and/or shorter WAM are the primary attributes the Bank will employ to reduce depreciation risk. To counter the premium risk inherent in higher coupon MBS, the Bank will strive to find securities that should be less susceptible to faster prepayments. The #1 loan attribute to curtail fast prepayments, and also provide higher base case turnover rates, continues to be pools comprised of lower loan balance mortgages. These loan holders have less economic incentive to refinance into lower rates when they are low but have increased mobility due to smaller loan sizes when rates are higher. To balance extension and prepayment risks, the Bank will continue to focus on shorter-term (<=20yr) and relatively higher coupon (>=3.5%) specified agency MBS pools. 10-year MBS pools would be the exception to the coupon parameters, in that the shorter final maturity and high scheduled principal cash flow reduces the need for a higher coupon to limit price volatility risk. Pools will be selected with one or more of the following loan characteristics that should provide prepay protection: 1) low loan balance, 2) investor and vacation properties, 3) NY, TX, NJ, FL geographic concentrations, 4) Higher LTV (>90%), Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 6 of 8 Q1 2014 Investment Strategy March 2016 and 5) FHA Loans (GNMAs) originated after June 1, 2009 and prior to April 2011. Although the prepay protection may not be needed if rates continue to rise, the current cost for attaining these attributes has dropped significantly and would be good insurance should the economy falter and we experience a drop in rates. ARM/Float The Bank reinvested very little cash flow into the ARM sector over the second half of 2013, resulting in portfolio allocation ending the year at 6%. As the portfolio duration is approaching the upper end of the Banks target level, the Bank will continue to search for opportunities to enhance future rate sensitivity with minimal yield give up. As opportunities present, an additional focus for the sector will be seasoned post-reset ARMS. These loans may have had initial fixed-rate periods for 5 or 7-years, but were originated prior to 2007 and currently have annual resets with a 2% annual collar. Since the beginning of 2012, the Bank added newer GNMA 3x1 and 5x1 Hybrid ARMs with 2.0% to 3.5% coupons. Due to record low rates, a very steep yield curve and aggressive refinancing, this sector has prepaid faster than anticipated. However, an almost 100bp increase in 5x1 borrowing rates coupled with the increase in FHA Mortgage insurance Premiums should cause prepayments in this sector to decline significantly over the coming months. The Bank will look to find value and increase allocation in this sector if prices fall and premium risk can be minimize. ARM/Float % Curr / Prev Target 6%/6% 0-10% Eff. Duration / Convexity Current / Prev Target 0.7/(0.6) 0.7 / (0.6) 0.8-1.5/ (0.3)-(0.8) CMO The performance of the CMO sector has improved substantially as prepayments have slowed over the second half of 2014. However, with higher rates and slower prepayments, all CMO structures have been evaluated for potential extension risk and those identified with greater risk have been targeted for liquidation. The Bank will look to take advantage of higher rates and a steeper yield curve by pursuing CMO structures that have 2-5 year projected average lives with limited extension risk. To reduce overall premium risk in the portfolio, the Bank will look for opportunities to add these preferred cash flow structures with lower coupons back by higher WAC collateral. Additionally, very short average life CMOs (1-2yrs) will be utilized when available to provide a spread to cash alternatives over the next 24-30 months while the Fed keeps short-term rates anchored. To diversify mortgage prepayment exposure and take advantage of the more stable prepayment characteristics, 30 year GNMA MBS (post June1, 2009 origination) will be the preferred CMO collateral. Foremost, FHA loans originated after June 1, 2009 are not eligible to refinance under the FHA HARP program. FHA loans originated prior to April 2011 (and after June 1, 2009) have provided excellent prepayment protection as the FHA has increased the annual Mortgage Insurance Premium by 80bps. The increased premium results in an additional rate incentive needed for an FHA borrower to achieve the required 5% Net Tangible Benefit to refinance. Furthermore, GNMA collateral can offer superior extension protection as base case turnover should remain brisk due to ongoing buyouts of lesser credit FHA borrowers. Preferred FNMA/FHLMC collateral will have underlying loan attributes as stressed in the MBS sector (low loan balance, investor and vacation CMO % Curr/Prev Target 8%/8% 5-15% Eff. Duration / Convexity Current/Prev Target 2.1/(1.0) 2.1/(0.9) 1.2-2.0/ (0.5)-(1.2) Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 7 of 8 Q1 2014 Investment Strategy March 2016 properties, NY, TX, NJ, FL geographic concentrations, higher LTV MHA loans, etc.) that should provide prepay protection. Additionally, the Bank will begin to search for opportunities in FNMA and FHLMC Commercial mortgage products. These instruments have very stable intermediate cash flows with shorter final maturities and could provide and prudent instrument for balancing extension and contraction risks. We continue to see a significant number of CMO securities being liquidated at depressed levels because they have experience a large increase in prepayments as a result of the FNMA/FHLMC HARP II or the FHA Streamline programs. The Bank will evaluate and consider those CMO structures that may have elevated cash flows, but are now trading and much lower premiums and may well be on the cusp of slowing down significantly. All CMO’s will be prudently analyzed and continually monitored for both extension and call risks and will be managed to maximize risk/reward benefits. Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 8 of 8