Q1 2012 Investment Strategy

Q1 2013 Investment Strategy

Economic and Fed Overview

Sample Bank

Anywhere, US

The most likely scenario for the US economy in 2013 is one of modest improvement and continued mild inflation. Pent-up demand for housing and consumer durables should boost spending as the economy continues to work its way through the deleveraging cycle. Overall demand, however, is likely to remain well below the economy’s productive capacity for two or three more years. In such an environment, inflation should remain weak and the fed will see little reason to raise rates. Eventually the Fed will change its focus from growth to inflation, but not in 2013.

In the short-run, much depends on the eventual impact of fiscal policy changes.

Congress and the White House have already agreed to a multi-stage fiscal cliff resolution including tax increases and a postponement of sequestration. The effect will certainly be contractionary, perhaps causing GDP growth to slow to around

1% in Q1. However, we should see a rebound over the latter half of the year. For all of 2013, GDP growth will probably be close to 2.5%, and inflation should remain below 2% through the year.

In December, the FOMC announced a policy shift toward forward guidance based on explicit economic variables rather than a calendar-based approach. This is in order to tighten the linkage between employment growth, inflation and the timing of the next tightening cycle. The adoption of an “Evans rule” means that market expectations for the liftoff date should adjust immediately to new information on the economic outlook.

Specifically, the FOMC anticipates that the current exceptionally low range for the federal funds rate will be appropriate at least as long as:

-The unemployment rate remains above 6.5%

-Inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2% longer-run goal; and

-Longer-term inflation expectations continue to be well anchored.

The Fed expects inflation to remain quiet until the output gap is closed and the unemployment rate is well below 6.5%, which will require years of above-trend growth.

Based on the FOMCs central tendency forecast, which sees the unemployment rate reaching 6.5% in 2015 and hitting full employment in 2016. It will require 185K to 200K in monthly payroll gains on average for the next three years for the Fed’s unemployment rate forecast to prove correct.

Throughout 2012, the 10yr T-Note traded within a yield range of 1.39 – 2.37%, and averaged 1.79%. It is unlikely that the next 12mos will see much different. The greater focus should be on relative value between and among bond market sectors as yield spreads on various bond-types may be much more volatile in 2013.

Portfolio

Book Value

Portfolio/TA

$ Gain/(Loss)

% Gain/(Loss)

Tax Equiv. Yield

Proj Avg. Life

Eff. Dur/Conv

+300bp Risk

Dec 31, 2012

$54,000,000

54%

$1,301,400

2.41%

2.88%

3.81yrs

2.12/(0.7)

(9.3%)

Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL

Member: FINRA & SIPC Page 1 of 7

Q1 2013 Investment Strategy

April 2020

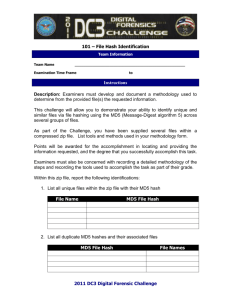

Fed Funds Futures – Current Market Expectations for FUTURE levels (as of 12/31/12):

0.20% 0.16% 0.15% 0.14%

0.13% 0.13% 0.13% 0.13% 0.13% 0.14% 0.14% 0.14% 0.14%

0.10%

0.00%

Jan '13 Feb '13Mar '13Apr '13May '13Jun '13 Jul '12 Aug '13Sep '13 Oct '13 Nov '13Dec '13

Current Portfolio Position and Strategy

The Federal Reserve implemented yet another round of unprecedented asset purchases by buying $45b/month of Treasuries in addition to the $40b/month of agency MBS purchases already underway. Those purchases helped to keep the

“great range trade” intact with the 10-year Treasury yield trading within a very narrow range of 1.5% and 1.85% during the 4th quarter. For the quarter, the yield curve steepened modestly with the long end of the curve rising about 13bp and the short end falling slightly.

Low yields and low yield volatility also mean tight spreads and minimal reinvestment opportunities for the bond portfolio. As a result, the Bank’s overall yield fell another 13bp to a new cycle low of 2.88% as higher yielding bonds continue to roll off the portfolio and there is very little opportunity to replace that lost income. The Bank has continued to resist the urge to “chase yield” in higher risk securities and this strategy has maintained a +300bp price risk around 9%.

Portfolio average life and duration have also fallen as MBS/CMO prepayments have risen with record low mortgage rates. The Bank may need to work hard to maintain duration in the face of faster prepayments and the rising numbers of

Agency bonds being called. With continued strength in deposit growth and relatively tepid loan demand, a top priority will be to fully deploy excess liquidity, while building a diversified portfolio that fits within the Bank’s overall balance sheet risk.

Yield spreads on Agency bonds remained relatively flat during the quarter while

MBS spreads rebounded from the record lows following the Fed announcement in

September that they would be buying $40 billion a month of Agency MBS. Market yields on certain Fixed Rate MBS have now fallen to a point where some Hybrid

ARMs may provide better relative value and the Bank will consider building that sector. Municipal bonds sold off toward the end of the quarter on expectations that the administration may limit the benefit of the muni tax-exemption for high net worth individuals. In the end, the tax deal that was passed did not limit the muni tax-exemption and raised the top tax rate to 39.6% for incomes above

$450,000. Add in the 3.8% Medicare surtax that was passed as part of the

Affordable Care Act (Obamacare) and the top rate used to determine municipal bond TEYs jumps to 43.4%, significantly increasing the benefit of munis to holders in that tax bracket. Needless to say, high-credit municipal bonds continue to offer

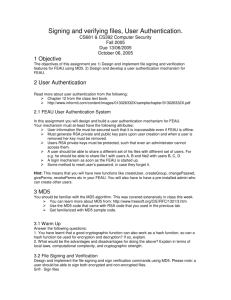

Sector Distribution

MBS,

41%

Other,

CMO,

4%

10%

Agency

16%

Tax

Muni,

3%

Muni,

28%

Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL

Member: FINRA & SIPC Page 2 of 7

3.5%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

Q1 2013 Investment Strategy

April 2020 the best relative value to maintain yield and duration in the bond portfolio.

Municipal purchases will continue to be focused on the long-end, assuming risk and tax positions warrant.

With an understanding that the worst bonds are normally purchased at peaks and troughs in interest rates, security selection has never been more critical and the

Bank will avoid high risk securities. Purchase decisions will be focused on structure, credit, loan attributes, cashflow volatility, price risk and optimal relative value between and among sectors.

The Bank will seek to build a cash flow barbell with a short-to-intermediate range ladder of taxable combined with longer maturity tax-exempt municipals. The liquidity ladder should be anchored with well-structured MBS pass-throughs, short-to intermediate maturity agencies, and clean CMO tranches. Portfolio allocations will be managed based on anticipated needs for liquidity, cashflow and earnings. Overall portfolio yield will likely continue to fall in the coming months as older bonds pay off or mature. Current re-investment rates remain at historic lows making it difficult to maintain earning asset yield targets. This simply underscores the necessity of keeping excess liquidity deployed. The cost of sitting in fed funds becomes greater the longer we remain locked in the low rate environment.

Historical U.S. Treasury Yield Curves

3/31/2012

6/30/2012

9/30/2012

12/31/2012

Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL

Member: FINRA & SIPC Page 3 of 7

Q1 2013 Investment Strategy

April 2020

Sector Strategies

Agencies

Agency spreads to Treasuries remained tight in Q4 as the treasury curve steepened; 2-year bullet agencies are +5 basis points to treasuries and 5-years are

+14 basis points. The Bank will continue to moderate sector duration by primarily purchasing securities with 3- to 7-year maturities. Favored structures will continue to be premium one-time callable securities with at least one year of call protection. Step-ups with 1x-call, 1x-step structures will also be utilized when the step coupon provides sufficient probability of call. The Bank will also look to add multi-step structures with mid-term maturities when the step coupon schedule provides ample cushion and the yield pickups warrant. Step-up issuance remains high and with a varying range of structures. The Bank will avoid chasing yield and refrain from buying longer maturity bonds in favor of shorter maturity

1x-step, and 1x-callable bonds with higher back-end coupons. The Bank will continue to look for opportunities to sell short maturities and deploy the proceeds on the intermediate portion of the curve. In general, the Bank will look to take advantage of market fluctuations by adding slightly longer duration instruments when rates rise, and focusing on premium 1x-calls in the lower part of the trading range.

CDs

The bank’s CD sector remains quite small. However, with Agency yields and spreads near all-time lows, the Bank will add to the sector as appropriate securities become available. The Bank will focus on buying short-to-mid-term marketable FDIC-insured CDs, where it can expect to pick up 5-20 bps vs. 2-year maturity and 10-40 bps vs. 5-year maturity bullet agencies. Like agencies, the

Bank will avoid longer-maturity, option-heavy structures. FDIC insurance covers up to $250,000 per issuer, including accrued interest. The bank will limit holdings of CDs under these constraints per issuer. The supply of unique issuers remains limited, so the Bank will look to take advantage quickly when new opportunities arise.

Municipals

Municipals continued to be attractive to investors in the fourth quarter as demand outpaced issuance and this trend should continue in the future. Congress passed new tax legislation creating a top tax rate of 39.6%. This rate will create increased demand up and down the municipal curve pushing down yields for the coming months. The Bank has made an extensive effort to analyze and monitor the credit metrics of all municipal holdings and will be very diligent in reviewing the creditworthiness of all future purchases. Given prudent credit analysis, the environment continues to offer excellent opportunities to add to the Municipal sector. As the Bank continues to employ a barbell strategy, the Bank will maximize longer municipal holdings and explore opportunities to swap out of shorter maturities and deploy the proceeds out on the preferred range of the curve.

Agency %

Curr/Last

14%/15%

Target

15-25%

Eff. Duration / Convexity

Curr/Last Target

2.0/(1.0)

1.9/(0.9)

1.5-2.5

/(0.5)-

(1.0)

CD %

Curr/Last

2%/1%

Target

0-5%

Eff. Duration / Convexity

Curr/Last

1.2/(0.3)

1.1/(0.3)

Target

1.5-

2.5/(0.5)-

(1.0)

Municipal %

Curr/Last Target

28%/26% 20-30%

Eff. Duration / Convexity

Curr/Last

3.4/(0.5)

3.4/(0.4)

Target

3.5-4.0/0-(0.5)

Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL

Member: FINRA & SIPC Page 4 of 7

Q1 2013 Investment Strategy

April 2020

The Bank will continue to buy general obligation municipals and will purchase essential-purpose revenue municipals with a minimum of 1.25x coverage and preferring a 1.50x or higher coverage. The Bank will also purchase taxables with

5-10 year maturities, preferring shorter maturities because they do not have the same reduced duration benefit as the tax-free issues. The Bank will carefully review the creditworthiness of all municipal issuers in addition to assessing the strength of the bond insurer. Preferred insurers of municipal holdings will be the

Texas PSF, State Aid Withholding and Qualified School Bond Funds, and issues rated A or better on their own. The Bank will purchase municipals with AGM or

Assured Guaranty insurance that have an A or better underlying rating.

MBS

The Federal Reserve continues to dominate purchases in the MBS market. As announced last September, the Fed is executing open-ended quantitative easing measures (QE3) by investing $40 Billion per month in agency MBS while also continuing to reinvest portfolio cash flows into Agency MBS securities. This program has been extended until the FOMC believes the unemployment rate has fallen to an acceptable level. Market participants expect it to continue throughout

2013, meaning the Fed will purchase approximately $500 Billion Agency MBS this year. On one hand, the White House continues to push stimulative packages to drive down mortgage rates and implement lax refinancing programs to allow more homeowners to refinance. Specifically, the HARP 2 program allows eligible homeowners to take advantage of a tremendous opportunity to obtain an artificially low cost mortgage. Specifically, borrowers with no delinquencies over the past 12 months and an underwater loan (>80LTV) originated before June 1,

2009, have the opportunity to streamline refinance, with very low costs, through

Dec 31, 2013. Currently, almost 40% of all mortgage refinancing is through the

HARP 2 program. The Home Affordable Refinance Program (HARP 2) has been very successful, financing over 1 million homeowners. The program is expected to continue to gain traction and keep the general level of prepayments elevated in through at least early 2013. More recently, the FHA has initiated a similar refinancing program, commencing June 11, 2012, to provide incentives to refinance borrowers with loans also originated prior to June 1, 2009. These specific FHA loans are grandfathered from having to pay a 70 basis points increase in annual Mortgage Insurance Premiums (MIPs) and the upfront premium is only

1 basis point (vs. 1.75% for non-grandfathered loans). At the same time, the cost of getting a Government guarantee to securitize residential loans continues to get more expensive as the FHFA and FHA continue to raise costs for guarantee fees and government mortgage insurance premiums (MIP). In 2012, the FHFA raised the Guarantee fee by 20 basis points and appear to be on a path to raise it another

10-20bp in 2013. The FHA, in an effort to shore up its reserve fund, has more than doubled mortgage insurance premiums, from 50/55 basis points to 120/125 basis points since 2011. Additionally, they have announced plans to raise the fee another 10 basis points in 1Q 2013.

Taxable Municipal %

Curr/Last

3%/3% 5-10%

Eff. Duration / Convexity

Curr/Last

5.4/0.2

5.6/0.2

Curr/Prev

34%/35%

Target

Target

5.0-7.0/0.3-(0.3)

MBS %

Target

35-45%

Eff. Duration / Convexity

Curr/Prev

1.4/(0.8)

1.2/(0.8)

Target

1.5-2.0/

(0.7)-(1.3)

The role of the MBS portfolio continues to be to provide steady front-end cash flow while maximizing risk/reward benefits. Record low mortgage rates and sustained Feb buying of MBS rates reinforces our strategy to balance both contraction and extension risk in all mortgage related investments. Over the

Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL

Member: FINRA & SIPC Page 5 of 7

Q1 2013 Investment Strategy

April 2020 fourth quarter, MBS holdings declined another 1%, and sits just below the low end of the target, while sector duration extended slightly from 1.2 to 1.4. Throughout

2012, the Bank reviewed all holdings in the MBS portfolio and liquidated all securities deemed to be negatively impacted by Government refinance programs.

Specifically, the portfolio was filtered to find loans originated after 2003 (+ before

June 1, 2009) with >80% estimated current LTV. Of those securities, pools with longer terms (e.g. 30yr), higher loan balances (>$150k), higher FICO scores (>700) were liquidated as deemed necessary. The Bank has performed a similar review of all GNMA holdings to determine if any items should be liquidated prior to any accelerated prepayments resulting from the new program. Prepayments on FHA

HARP eligible loans have accelerated at a very fast pace (starting with August payments.

Over the past few years of elevated refinance activity, the Bank has strived to hold securities that provide consistent prepay protection while offering more defensive price volatility characteristics. The #1 loan attribute to curtail fast prepayments, and also provide higher base case turnover rates, continues to be pools comprised of lower loan balance mortgages. These loan holders have less economic incentive to refinance into lower rates when they are low but have increased mobility due to smaller loan sizes when rates are higher. To balance extension and prepayment risks, the Bank will continue to focus on shorter-term (<=20yr) and relatively higher coupon (>=3.5%) specified agency MBS pools. With current production coupons now falling to 2.5% to 3.5%, this is becoming more difficult to do. Pools will be selected with one or more of the following loan characteristics that should provide prepay protection: 1) low loan balance, 2) investor and vacation properties, 3) NY, TX, NJ, FL geographic concentrations, 4) Higher LTV (>90%), and 5) FHA Loans (GNMAs) originated after June 1, 2009 and prior to April 2011.

MBS ARM

As fixed rate MBS yields continue to fall, the Bank has increased emphasis on the

MBS ARM sector. The yield differential between fixed and floating rate instruments has continued to narrow significantly, leading to potential opportunities to enhance future rate sensitivity with minimal yield give up.

Specifically, throughout 2012, the Bank has added newer GNMA 3x1 and 5x1

Hybrid ARMs. GNMA hybrids ARMs have been the primary focus of the ARM strategy as the underlying FHA loans have shown to provide similar prepayment protection offered by GNMA 30yr fixed mortgages (Post June1, 2009 origination).

Longer first resets provided by these structures, 24-60 months, could coincide well with the FOMC stated bias toward keeping short term rates into 2015.

Additionally, the Bank will continue to evaluate lower coupon FNMA and FHLMC

7x1 and 10x1 hybrid ARMS. With a focus on newer production loans, these instruments could provide some prepayment protection in the near-term, while escalating cash flows towards future reset dates could provide liquidity in harmony with forward rates.

MBS ARM %

Curr / Prev Target

7%/5% 10-20%

Eff. Duration / Convexity

Current / Prev

0.8/(0.5)

0.8 / (0.3)

Target

1.0-1.5/

(0.3)-(0.8)

Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL

Member: FINRA & SIPC Page 6 of 7

Q1 2013 Investment Strategy

April 2020

CMO

After peaking at 15% of portfolio allocation in Q3 2011, the CMO sector has declined 4% to stand at 11% of the total portfolio. With the continued drop in mortgage rates and government refinancing programs driving prepayments higher, the effective duration of the CMO portfolio has contracted to 1.3 from 1.7 at the beginning of 2012. Given the growing impact of HARP 2 and the FHA HARP program, CMO structures must continue to be evaluated with heightened scrutiny towards faster prepayment rates over the near term. The Bank will continue to pursue CMO structures that have 3-5 year projected average lives with limited extension risk. Additionally, very short average life CMOs (1-2yrs) will be utilized to provide a spread to cash alternatives over the next 24-30 months while the Fed keeps short-term rates anchored. To diversify mortgage prepayment exposure and take advantage of the more stable prepayment characteristics, 30 year GNMA

MBS (post June1, 2009 origination) will be the preferred CMO collateral.

Foremost, FHA loans originated after June 1, 2009 are not eligible to refinance under the FHA HARP program. FHA loans originated prior to April 2011 (and after June 1, 2009) have provided excellent prepayment protection as the FHA has increased the annual Mortgage Insurance Premium by 70bps. The increased premium results in an additional rate incentive needed for an FHA borrower to achieve the required 5% Net Tangible Benefit to refinance. Furthermore, GNMA collateral can offer superior extension protection as base case turnover should remain brisk due to ongoing buyouts of lesser credit FHA borrowers. Preferred

FNMA/FHLMC collateral will have underlying loan attributes as stressed in the

MBS sector (low loan balance, investor and vacation properties, NY, TX, NJ, FL geographic concentrations, higher LTV MHA loans, etc.) that should provide prepay protection. In the latter part of 2012, the market has experienced a significant number of CMO securities being liquidated at depressed levels because they have experience an large increase in prepayments as a result of the

FNMA/FHLMC HARP II or the FHA HARP programs. The Bank will evaluate and consider those CMO structures that may have elevated cash flows, but are now trading and much lower premiums. All CMO’s will be prudently analyzed and continually monitored for both extension and call risks and will managed to maximize risk/reward benefits.

CMO %

Curr/Prev Target

11%/12% 10-20%

Eff. Duration / Convexity

Current/Prev

1.3/(0.7)

1.3/(0.6)

Target

1.2-1.7/

(0.5)-(1.2)

Austin, TX | Birmingham, AL | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL

Member: FINRA & SIPC Page 7 of 7