Current Rates and Portfolio Strategy

advertisement

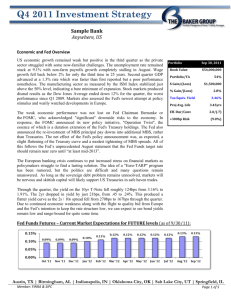

Q1 2011 Investment Strategy Sample Bank Anywhere, US Economic and Fed Overview The 4th Quarter of 2010 was an eventful three months for Fed Policy, market behavior, and the economy generally. The first notable event was news that the Fed would pursue a second round of quantitative ease (QE2) with a plan to purchase $600 billion in medium term Treasury Notes. Bond market reaction to that news resembled classic “buy the rumor/sell the fact” price action. In anticipation of the Fed’s move, the 10yr yield fell below 2.4% in early October. Once QE2 was confirmed, the market reversed and traded back up to 3%. Then, as the holidays approached, the President and Congress agreed to a surprise compromise on fiscal policy. This compromise exceeded what markets had originally anticipated with an additional $300 billion (2% of GDP) in stimulus from a payroll tax cut among other things. This caused most analysts to revise growth expectations for the coming year. Bond yields rose accordingly and eventually settled in a range between 3.20 – 3.50% as year-end arrived. Going forward, it is the effect of these two events, QE2 and the fiscal stimulus, which will drive the economy in 2011. Economists generally expect GDP growth of 3-3.5% for the coming year, as opposed to 2.5-3.0% previously. Still, the economy will be facing severe obstacles in the form of stubborn joblessness, depressed housing, and a continuing debt overhang which will keep growth somewhat restrained for years. Many economists believe yields may return to the range that predominated during the first half of 2010, but no major trend reversal or bear market for bonds. A test of the 2010 highs (roughly 4% on the 10yr yield) is certainly a possibility, but any rise in rates will be somewhat self-limiting as US households continue to struggle with massive debt burdens, weak home prices, and limited income growth in the face of continuing distress in the labor market. The economy in 2011 will grow at a stronger relative pace to be sure, but still nothing that could be considered a robust recovery. Ultimately, consumption will be held back by weak household balance sheets and the threat of further deterioration in home prices. Still half of all mortgage borrowers don’t have the 20% equity generally required to refinance at lower rates or to move, and almost a quarter of borrowers are in negative equity. Until these macro-economic imbalances are corrected, growth and inflation will be weaker than normal. Portfolio Book Value Dec 31, 2010 $47,000,000 Portfolio/TA $ Gain/(Loss) 47.0% $352,500 % Gain/(Loss) 0.75% Tax Equiv. Yield 3.70% Proj Avg. Life 4.12yrs Eff. Dur/Conv 2.36/(.68) +300bp Risk (10.12%) Fed Funds Futures – Current Market Expectations for FUTURE levels (as of 12/31/10): Austin, TX | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 1 of 4 Q1 2011 Investment Strategy March 2016 Current Rates and Portfolio Strategy Yields across the curve fell to fresh yearly lows in the middle of the 4th Quarter before rising sharply to finish the year near 6 month highs. The rise in yields was more dramatic on the long end with the 10-year up 80bp to 3.30% while the 2year was up less than 20bp to 0.60%. The result is one of the steepest yield curves on record with the 2- to 10-year spread widening to within 20bp of the February high. As a result of the rise in yields, the portfolio gain dropped from 2.5% to 0.8% during the quarter and the projected average life of the portfolio extended from 3.3yrs to 4.1yrs as prepayment projections slowed and some agencies were no longer expected to be called. Unfortunately, the rise in yields was not enough to slow the drop in the overall portfolio yield, which fell 23bp to 3.70%. Effective duration rose slightly during the quarter and remains within the Bank’s “just above neutral” target (2.25-2.50). The rise in long-term yields and resulting drop in portfolio value reinforces the Bank’s plan to maintain defensive strategies and not be tempted to chase yield in the wrong sectors. However, the near record steep yield curve also presents The Bank with a better opportunity to continue building a modified barbell strategy that will be a combination of high-cash flow, short duration taxable securities and longer tax-free municipal securities. Longer maturity tax-exempt securities suffered steeper price declines than many other sectors and provides excellent value as long as The Bank continues to thoroughly analyze municipal credit risk. Given the governments continued support for FNMA and FHLMC (GSEs), the Bank will continue to emphasize the current mix of taxable investments in core GSE securities while also adding GNMA issues when prudent. With cash still earning virtually zero, the Bank will continue to make efficient deployment of all idle funds and evaluate all options for enhancing income through the portfolio in a defensive manner. Sector Distribution CMO, 15% MBS, 35% Other, 2% Agency 22% Muni, 24% Tax Muni, 3% Historical U.S. Treasury Yield Curves 5.0% 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% 3/31/2010 6/30/2010 9/30/2010 12/31/2010 Austin, TX | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 2 of 4 Q1 2011 Investment Strategy March 2016 Sector Strategies Agencies As Treasury yields pushed higher at the end of the 4th Quarter, the Agency yield curve steepened relative to Treasuries causing tighter spreads (~5 basis points) on maturities less than 3 years and wider spreads (~10 basis points) for maturities 5 years and longer. Longer-term economic and interest rate uncertainty will continue to preclude the Bank from chasing yield with longermaturity, negatively-convexed callable agency products. The Bank will moderate sector duration by primarily purchasing securities with 3 to 7-year maturities. Favored structures will be premium one-time callable securities with at least one year, if not more, of call protection. The Bank will look to take advantage of the pull-back in rates by adding deeply-discounted (<97 $price) 1x callable agencies with call dates shorter than 1 year. Such securities will provide a large yield kick if rates fall and they are called, and if not called will become highly liquid bullets. Step-ups with 1x call, 1x step structures will also be utilized when the step coupon provides sufficient probability of call. The Bank will also look to pick up additional yield to call by adding 1x step-ups with canary call structures (quarterly callable for 1 to 3 years until the step-up date, and then a bullet thereafter). Again, the Bank will only purchase Canary Step-up securities with a step coupon that provides sufficient probability of being called. Step-up issuance remains high and with a varying range of structures – the Bank will avoid the uncertainty of multisteps in favor of the one-time steps with higher back-end coupons. The Bank will continue to look for opportunities to sell short maturities and deploy the proceeds on the intermediate portion of the curve. Agency % Current Target 22% 15-25% Eff. Duration / Convexity Current Target 2.08/(0.85) 1.5-2.5/(0.5)(1.0) Municipals Municipals have also come under pressure during the 4th quarter. Recent news of the extension of the Bush tax cuts, elimination of the Build America Bonds, and the “bank qualified” limit reverting back to $10 Million has pushed municipal yields back 75 bps to 100 bps in the 10 to 20 year sector. Recent media reports have added to concerns of the financial stability of many larger (e.g. State) municipalities. The Bank has made an extensive effort to analyze and monitor the credit metrics of all municipal holdings and will be very diligent in reviewing the creditworthiness of all future purchases. Given prudent credit analysis, the environment continues to offer excellent opportunities to add to the Municipal sector. As the Bank begins to employ a barbell strategy, the Bank will maximize longer municipal holdings and explore opportunities to swap out of shorter maturities and deploy the proceeds out on the preferred range of the curve. The Bank will also purchase BABs with 5-10 year maturities, preferring shorter maturities because they do not have the reduced duration benefit as the tax-free issues. The Bank will carefully review the creditworthiness of all municipal issuers in addition to assessing the strength of the bond insurer. Preferred insurers of municipal holdings will be the Texas PSF, Nevada PSF, Berkshire Hathaway, AGM, Assured Guarantee as well as State Aid Withholding , Qualified School Bond Funds and issues rated AA or better on their own. Municipal % Current Target 24% 20-30% Eff. Duration / Convexity Current Target 3.80/(0.05) 3.5-4.0/0(0.5) Taxable Municipal % Current Target 3% 5-10% Eff. Duration / Convexity Current Target 6.36/0.35 5.0-7.0/0.25(0.25) Austin, TX | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 3 of 4 Q1 2011 Investment Strategy March 2016 MBS The mortgage industry experienced record lows in fixed mortgage rates during the 1st week of November 2010. As a result, Agency MBS touched their all-time high in prices midway through the 4th Quarter. Subsequently, the MBS market saw a rapid correction, with lower coupon MBS falling as much as 5% in value. Alternatively, higher coupon MBS proved to be much more defensive and realized as little as 0.50% to 1% declines in prices. Record low mortgage rates brought about an increase on prepayments over the quarter. The primary instruments that have felt the brunt of the increase in prepayments have been newer issue, lower coupon (4% - 5%) securities. The #1 loan attribute to curtail extreme prepayments continues to be pools comprised of lower loan balance mortgages. Throughout 2010, prepayments have been a tale of the “haves” versus the “have nots”. The mortgage market is still very difficult to enter as only those with 750+ FICO scores and 50% LTV ratios seem to be able to access refinancing options. As a result, voluntary prepayment speeds for lesser credit MBS pools continue to come in far below historic norms, as extremely tight underwriting standards, declining home prices, and increasing refinancing costs more than offset the impact of the historically low 30-year mortgage rates. Ongoing hurdles to access the best mortgage rates combined with the nearly 100bp rate increase (to almost 5%), has prompted a rapid 50% drop in the Mortgage Bankers Association Refinance Index to a reading of just over 2,000. The end result should be prepayments slowing significantly over the 1st half of 2010. To balance extension and prepayment risks, the Bank will continue to focus on higher coupon (>=5%) specified agency MBS pools with one or more of the following loan characteristics: 1) seasoned underlying mortgages (e.g. 2005 and earlier origination), 2) pools with particular loan attributes that should provide prepay protection (e.g. low loan balance, investor properties, NY, FL, TX geographic concentrations, etc.), and 3) short weighted average maturities (e.g. WAM <100 months). Given the dramatic drop in prices of lower coupon MBS, the Bank may selectively purchase a few lower coupon "total return" MBS pools. MBS ARM: The Bank’s MBS ARM sector continues to be quite small. With any increase in origination and/or relative value, the Bank will evaluate new 3x1 and 5x1 Hybrid ARMs (preferably GNMA) to enhance short-term cash flow and lower duration. MBS % Current Target 35% 35-45% Eff. Duration / Convexity Current Target 1.80/(0.92) 1.5-2.0/(.75)(1.25) CMO The steep yield curve in 2010 resulted in increased Agency CMO origination (particularly GNMA) over the year. The swell in production allowed the Bank to take advantage of additional supply in shorter cash flow structures, resulting in growth of the CMO sector to 15% of the total portfolio at the end of 2010. As supply dictates, the Bank will continue to purchase issues with cash flow structures that should provide either short-term or “locked-out” cash flows in the 2-7 year range. To diversify MBS prepayment exposure, additional CMO collateral types of focus will be seasoned 30yr FNMA/FHLMC as well as newer origination 30yr GNMAs. All CMO’s will be prudently analyzed for both extension and call risks and will pass all FFIEC stress tests. CMO % Current Target 15% 10-20% Eff. Duration / Convexity Current Target 1.37/(1.15) 1.0-1.5/(.75)(1.25) Austin, TX | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 4 of 4