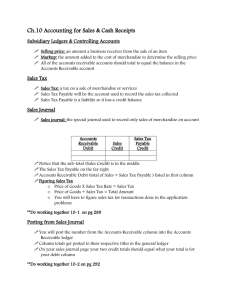

Accounting for Sales and Receipts

advertisement

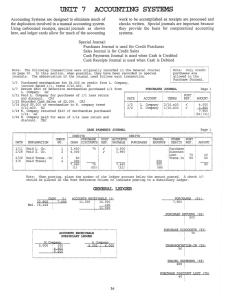

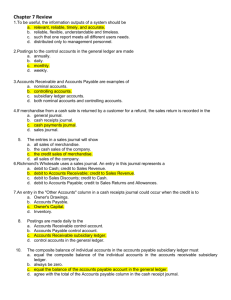

Chapter 14 The Operating Cycle of a Merchandising Business Retailer – a business that sells to the final user (consumer). Wholesaler – a business that sells to retailers. Pg 380 New and Different Accounts Change Fund Petty Cash Fund Allowance for Uncollectible Accounts Notes Receivable/Payable Interest Receivable Merchandise Inventory Prepaid Insurance Delivery Equipment Accumulated Depreciation • Bankcard Fees Expense • Cash Short and Over • Depreciation Expense • Insurance • Interest Expense • Loss/Gain on Disposal of Plant Assets • Uncollectible Accounts Expense Discount on Notes Payable Sales Tax Payable Capital Stock Retained Earnings Sales Sales Discount Sales/Purchases Returns and Allowances Interest Income Purchases Transportation In Purchases Discount Pg 381 Pg 381 Accounts Used by a Merchandising Business Merchandise – goods bought for resale. Inventory – merchandise on hand for resale Merchandise Inventory Account – Asset Account Increased with a debit and decreased with a credit Sales Account – When a retailer sells goods to a customer the amount of the merchandise sold is recorded in the Sales account. Sales is a revenue account Increase with a credit and decrease with a debit Both cash sales and sales on account are recorded here Pg 382 Analyzing Sales Transactions Sales on account Credit cards (store and bank) Sales Slip – a form that lists date of sale, customer account identification and description, quantity, and price of the items sold. Sales slips are pre-numbered to help businesses keep track of all sales made on account Sales Tax – most states and some cities tax the retail sale of goods and services. Sales taxes are periodically sent to the state (or city). Until they are sent, the business holds them in a Sales Tax Payable account. Credit Terms – The sales slip usually has a spot for credit terms on it. n/30 means net amount due in 30 days Pg 385 The Account Receivable Subsidiary Ledger Small businesses with few Accounts Receivable accounts usually list them individually in the General Ledger. Large businesses with many Accounts Receivable accounts keep a separate Accounts Receivable Subsidiary Ledger with the individual accounts listed and then have an Accounts Receivable (controlling account) listed in the General Ledger that is a total of all individual accounts in the subsidiary ledger. Pg 385 Pg 387 Sales Returns and Allowances Sales Return – Any merchandise returned for credit or cash refund Sales Allowance – a price reduction granted for damaged goods kept by the customer. Credit Memorandum – If the sales return or allowance occurs on a charge sale, the business usually prepares a credit memo. It lists the details of a sales return or allowance and the customer’s account is credited for the amount returned or allowed. Pg 388 • Sales Returns and Allowances Account – decreases the total revenue earned by a business. • Contra Account – an account that offsets or decreases another account • Sales Returns and Allowances is a contra account to Sales • Contra accounts have the opposite normal balance sides as the accounts they offset. Pg 389 Journalizing a Return from an On Account Sale Pg 390 the Accounts Receivable Subsidiary Ledger Pg 391 Cash Transactions Cash Receipt – a transaction in which money is received by a business. Cash Sales – full payment at the time of sale Charge Customer Payments – When a customer comes in to pay on their account, the employee prepares a receipt. The receipt number is the source document. Bankcard Sales – the bank pays the store and then the bank collects at a later date from the customer Other Cash Receipts – bank loans, sale of assets Pg 393 Cash Discounts Cash discount or Sales discount is the amount a customer can deduct from the amount owed for Pg 395 purchased merchandise if payment is made within a certain time. This is to encourage customers to pay promptly. 2/10, n/30 means 2% discount it paid within 10 days if not the entire amount is due in 30 days. 1. Merchandise Sold X Discount Rate = Discount $1500 X .02 = $30 2. Sales Slip Amount - Discount Amount = Amount Paid Within Discount Period $1500 $30 = $1470 Payment from a Charge Customer Pg 396 Cash Discount Payments Pg 397 Cash Sales Pg 398 Bankcard Sales Pg 399 Other Sales Pg 400 Pg 400