Accounting-Chapter

advertisement

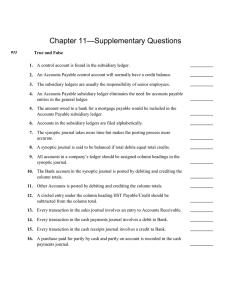

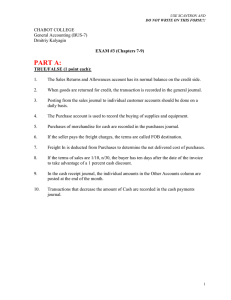

Ch.10 Accounting for Sales & Cash Receipts Subsidiary Ledgers & Controlling Accounts Selling price: an amount a business receives from the sale of an item Markup: the amount added to the cost of merchandise to determine the selling price All of the accounts receivable accounts should total to equal the balance in the Accounts Receivable account Sales Tax Sales Tax: a tax on a sale of merchandise or services Sales Tax Payable will be the account used to record the sales tax collected Sales Tax Payable is a liability so it has a credit balance Sales Journal Sales journal: the special journal used to record only sales of merchandise on account Accounts Receivable Debit Sales Credit Sales Tax Payable Credit Notice that the sub-total (Sales Credit) is in the middle The Sales Tax Payable on the far right Accounts Receivable Debit (total of Sales + Sales Tax Payable ) listed in first column Figuring Sales Tax o Price of Goods X Sales Tax Rate = Sales Tax o Price of Goods + Sales Tax = Total Amount o You will have to figure sales tax for transactions done in the application problems **Do working together 10-1 on pg 289 Posting from Sales Journal You will post the number from the Accounts Receivable column into the Accounts Receivable ledger Column totals get posted to their respective titles in the general ledger On your sales journal page your two credit totals should equal what your total is for your debit column **Do working together 10-2 on pg 292 Cash Receipts Journal Sales discount: this is when we give our customers a discount for paying early The company will not do deposits every day, so once or twice a week they will record cash and credit card sales Sales discount rate is going to be between 1-3% Figuring the sales discount: Sales Invoice Amount X Sales Discount Rate = Sales Discount You will have to figure the sales discount amount for the transactions in the application problems ** Do working together 10-3 pg 301 Posting & Proving your Cash Receipts Journal Individual amounts from the general and accounts receivable columns will get posted individually All special amount column totals will get posted to their respective titles in the general ledger Proving cash will done the same as it was in previous chapters Once you have posted all your individual and total amounts you will prepare a Schedule of Accounts Receivable Schedule of Accounts Receivable: a list of all customers and their amounts due The total you get from the Schedule of Accounts Receivable should match the total you get in the general ledger for Accounts Receivable **Do working together 10-4 pg 309 ** Do application problems 10-1, 10-2 10-3, 10-4 & 10-M ** Test over Chapter10