PART A:

advertisement

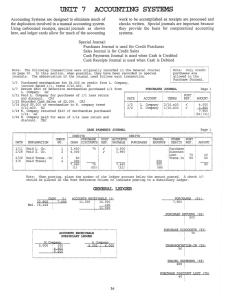

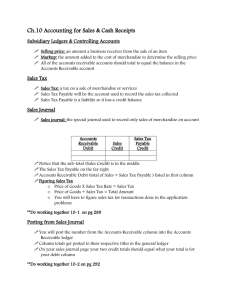

USE SCANTRON AND DO NOT WRITE ON THIS FORM!!! CHABOT COLLEGE General Accounting (BUS-7) Dmitriy Kalyagin EXAM #3 (Chapters 7-9) PART A: TRUE/FALSE (1 point each): 1. The Sales Returns and Allowances account has its normal balance on the credit side. 2. When goods are returned for credit, the transaction is recorded in the general journal. 3. Posting from the sales journal to individual customer accounts should be done on a daily basis. 4. The Purchase account is used to record the buying of supplies and equipment. 5. Purchases of merchandise for cash are recorded in the purchases journal. 6. If the seller pays the freight charges, the terms are called FOB destination. 7. Freight In is deducted from Purchases to determine the net delivered cost of purchases. 8. If the terms of sales are 1/10, n/30, the buyer has ten days after the date of the invoice to take advantage of a 1 percent cash discount. 9. In the cash receipt journal, the individual amounts in the Other Accounts column are posted at the end of the month. 10. Transactions that decrease the amount of Cash are recorded in the cash payments journal. 1 USE SCANTRON AND DO NOT WRITE ON THIS FORM!!! MULTIPLE CHOICE (2 points each): 11. Accounts Receivable and Accounts Payable are controlling accounts that can be found in: a. The general ledger. b. The source documents. c. The account receivable subsidiary ledger. d. None of the above. 12. The purpose of an accounts receivable ledger is a. To provide information about the amount of money owed to the firm by each individual charge customer. b. To provide information to be used in preparing a schedule of accounts receivable. c. To provide detailed information for charge customers who call about the amount owed. d. All of the above. 13. If a customer purchases goods for $560 on account and later is issued a credit memorandum to receive credit for the return of $160 of goods, then the balance due is: a. $160. b. $560. c. $400. d. $720. 14. The total of the schedule of accounts receivable must be equal to: a. The total of the sales on account for the month. b. The balance of the accounts receivable controlling account. c. The total of all sales for the month. d. Sales on account less cash sales for the month. 15. An accounts receivable ledger is also known as a. Subsidiary ledger. b. A general ledger. c. A controlling ledger. d. A departmental ledger. 16. The entries from the sales journal must be posted daily and individually to: a. The Accounts Receivable and Sales accounts. b. The accounts receivable subsidiary ledger. c. The Sales account. d. The purchases journal. 2 USE SCANTRON AND DO NOT WRITE ON THIS FORM!!! 17. Discount from the buyer’s standpoint is known as: a. Purchases discount. b. Sales discount. c. Company discount. d. Allowance. 18. The total of the Schedule of Accounts Payable must be equal to: a. The total of the Purchases column in the Purchases Journal. b. The total of Sales column in the Sales Journal. c. The balance of AR account in the General Ledger. d. The balance of the AP account in the General Ledger. 19. An internal document used to request the purchasing department to order something is a. The purchase order. b. The purchase requisition. c. The credit memo. d. The purchase invoice. 20. Cho Co. bought goods from Lay Corporation with shipping terms FOB destination. Which of the following statements correctly identifies who is to pay the freight bill? a. Lay Corporation is responsible for paying transportation. b. Lay Corporation prepays transportation but later is reimbursed by Cho Company. c. Cho Company is responsible for paying transportation. d. None of the above. 21. When goods previously purchased on account are returned for credit, the journal entry is: a. Debit Purchases Returns and Allowances and credit Accounts Payable. b. Debit Accounts Receivable and credit Purchases Returns and Allowances. c. Debit Accounts Payable and credit Purchases Returns and Allowances. d. Debit Purchases and credit Purchases Returns and Allowances. 22. The discount on an invoice for $590 dated 07/20 and paid 07/29 with terms 2/10, n/30 is: a. Zero. b. $578.90. c. $6.70. d. $11.80. 23. A CD player has a list price of $675 and trade discount of 25%. What is the net price after discount? a. $506.25. b. $168.75. c. $625.00. d. None of the above. 3 USE SCANTRON AND DO NOT WRITE ON THIS FORM!!! 24. Which of the following business transactions will NOT be recorded in the cash receipts journal? a. Sale of services for cash. b. Sale of merchandise on credit. c. Investment by the owner. d. Collection of a promissory note with interest. 25. Which of the following section of the Income Statement will contain the amount of the Freight In account? a. Revenues. b. Assets. c. Liabilities. d. Cost of Goods Sold. 26. Which of the following business transactions will NOT be recorded in the cash payments journal? a. Payment of salaries. b. Sold merchandise for cash. c. Payment of the telephone bill. d. Withdrawal by the owner. 27. Which of the following is (are) an advantage(s) of a cash receipts journal? a. Speed and simplicity. b. Audit trail. c. Division of labor. d. All of the above. 28. Which of the following is an example of a chain discount? a. 20/15/10. b. 2/10, n/30. c. 2/10, EOM, n/75. d. None of the above. 29. An endorsement that includes only a signature of the payee is known as: a. A special endorsement. b. A qualified endorsement. c. A blank endorsement. d. A restrictive endorsement. 30. Which of the following statements is TRUE about the Petty Cash Fund? a. It enables a company to make small immediate payments when it is not worthwhile to write a check. b. Each petty cash payment is entered separately in the CP journal. c. It is a liability. d. The fund is debited every time we withdraw cash. 4 USE SCANTRON AND DO NOT WRITE ON THIS FORM!!! PART B: PROBLEMS (various points - see below - total of 55 pts, including 5 extra points): 1. Use a checkmark to indicate the journal in which each of the following transactions should be recorded (10 pts): Transaction SJ PJ CRJ CPJ GJ a. Issued Ck. No. 1054 for $875 for the month's rent. b. Purchased merchandise, invoice no. 1025, $1,326, agreeing to pay in 30 days. c. Bought office supplies on account, $88. d. Sold services amounting to $1,865 for cash. e. Sold merchandise on account, $1,580. f. Received $381 from charge customers to apply on account. g. The owner withdrew $5,000 for personal use. h. Journalized end-of-the-year closing entries. i. Purchased merchandise for $1,750 in cash. k. Received a credit memo for merchandise returned. 2. Bradley's Appliance Store had the following transactions during the month of May 2005. Record the transactions on page 5 of a sales journal and page 8 of a general journal (use the forms on the next page). Total, prove and rule the sales journal as of May 31, 2005 (15 pts). May 5 6 8 15 20 25 Sold a refrigerator to Mary Wilson. Issued Sales Slip 452 for $650 plus sales tax of $32.50. Sold a freezer to Samantha Lee. Issued Sales Slip 453 for $900 plus sales tax of $45. Gave Mary Wilson an allowance for scratches on her refrigerator sold on May 5, Sales Slip 452. Issued Credit Memorandum 118 for $57.75, which includes $2.75 of sales tax. Sold a portable television to Jill Hanna. Issued Sales Slip 454 for $345 plus sales tax of $17.25. Sold a microwave over to Salema Miryam. Issued Sales Slip 455 for $175 plus sales tax of $8.75. Accepted a return of a defective microwave oven from Salema Miryam. The oven was originally sold on May 20, Sales Slip 455. Issued Credit Memorandum 199 for $183.75, which includes sales tax of $8.75 5 USE SCANTRON AND DO NOT WRITE ON THIS FORM!!! SALES JOURNAL SALES SLIP NO. DATE CUSTOMER'S ACCOUNT DEBITED PAGE ____ POST. REF. ACCOUNTS RECEIVABLE DEBIT SALES TAX PAYABLE CREDIT SALES CREDIT GENERAL JOURNAL Page ______ DATE 3. DESCRIPTION POST. REF. DEBIT CREDIT 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9 10 10 11 11 12 12 13 13 14 14 Record the following transactions for the month of April 2005 on page 4 of a cash receipts journal (use the form below). Total, prove and rule the cash receipts journal as of April 30 (15 pts). Apr 3 Collected $350 from Margo Daub, a credit customer on account. 8 Kevin Sharp, the owner, invested additional $5,000 cash in business. 9 Received a cash refund of $30 for damaged supplies. 15 Had cash sales of $5,500 plus sales tax of $385. There was a cash overage of $5. 18 Received $800 from Brian Cobb, a credit customer, in payment of his account. 20 Received a check from Phil Stout to pay his $700 promissory note plus interest of $42. 6 USE SCANTRON AND DO NOT WRITE ON THIS FORM!!! 30 Had cash sales of $3,800 plus sales tax of $266. There was a cash shortage of $5. CASH RECEIPTS JOURNAL DATE DESCRIPTION 4. POST. REF. ACCTS RECEIVABLE CREDIT SALES TAX PAYABLE CREDIT SALES CREDIT Page____ OTHER ACCOUNTS CREDIT POS ACCOUNT NAME T. AMOUNT REF. CASH DEBIT On October 5, 2005, the balance of Creative Solutions, Inc's checkbook and Cash account was $16,622. The balance shown on the bank statement on the same date was $14,922.50 (15 pts). Notes a. The following checks were issued but have not been yet paid by the bank: Check 128 for $150.00, Check 132 for $70.00. b. The firm's records indicate that a deposit of $1,800.00 made on September 28 does not appear on the bank statement. c. A service charge of $7.50 and a debit memorandum of $112.00 covering an NSF check from a credit customer, Julia Anderson, have not yet been entered in the firm's records. Instructions 1. Prepare a bank reconciliation statement for the firm as of September 30, 2005 (use the form on page 4). 2. Record journal entries for any items on the bank reconciliation statement that must be journalized (use the general journal form on page 4). Date the entries October 5, 2005. 7 USE SCANTRON AND DO NOT WRITE ON THIS FORM!!! Creative Solutions, Inc. Bank Reconciliation Statement September 30, 2005 GENERAL JOURNAL DATE DESCRIPTION POST. REF. DEBIT CREDIT 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9 10 10 11 11 12 12 13 13 14 14 8