Special Journals: Sales and Cash Receipts

advertisement

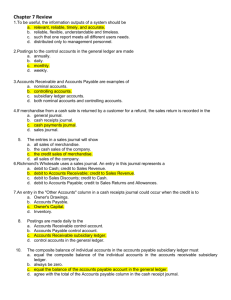

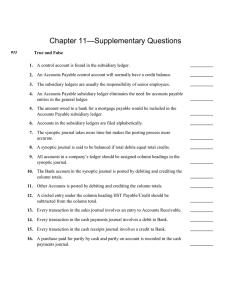

Special Journals: Sales and Cash Receipts Chapter 9 9- 1 Special Journals Specialized journals speed up the process of recording sales and cash receipts in a manual accounting system. 9- 2 Classifying Business Organizations Service businesses provide services. Merchandise businesses sell products. Manufacturing businesses make products. 9- 3 Tracking Sales and Cash Collections for Credit Customers The cash receipts journal reduces the amount of daily posting required. It provides a check and balance system. The sales journal provides an efficient way to track credit sales. Using both journals provides a better internal control system for sales and cash receipts. 9- 4 Merchandising Company – – – – – What does a merchandising company do? buys merchandise from wholesalers resells the goods at a higher price called the retail price must keep track of merchandise inventories has to present a longer income statement than a service company does usually has credit customers 9- 5 Learning Objective 1 Journalizing sales on account in a sales journal. 9- 6 Learning Unit 9-1 Gross sales = Amount of units sold × Sales price per unit Amount is credited to the Revenue account. Normal balance is a credit. 9- 7 Learning Unit 9-1 Assume that Chou’s Toy Shop had $3,000 in sales. $1,800 were cash sales and $1,200 were charges. A customer received a $10 price reduction for defective merchandise. How can these transactions be explained? 9- 8 Learning Unit 9-1 Accounts Affected Category Cash Asset Accounts Receivable Asset Sales Revenue Rules Dr. 1,800 Dr. 1,200 Cr. 3,000 9- 9 Gross Sales Debits Date Cash Accts. Rec. July 19 1,800 1,200 Credits Account Title Sales Gross 3,000 9- 10 Learning Unit 9-1 Sales returns and allowances = Amount allowed for defective merchandise Amount is debited in the journal entry. Normal balance is a debit. 9- 11 Learning Unit 9-1 Accounts Affected Category Sales Returns and ContraAllowances revenue Accounts Receivable Asset Rules Dr. 10 Cr. 10 9- 12 Learning Unit 9-1 What is a sales discount? It is a percent decrease in the amount collected from credit customer. This deduction is given as an incentive to the accounts receivable (credit) customer to pay bills early. 9- 13 Learning Unit 9-1 What is the meaning of the term 2/10, n/30? It means a customer will be granted a 2% discount if the account is paid in 10 days. Otherwise, the full amount (n = net) is to be paid in 30 days. 9- 14 Cash Receipts Journal – Page 90 Debits Credits Date Cash Disc. Accts. Rec. July 19 39.20 .80 40.00 Account Title Michelle Reese 9- 15 Learning Unit 9-1 What is sales tax payable? It is a percent multiplied by the gross amount of the sale collected from customers. The business has a liability to the taxing authority for the amounts collected. 9- 16 Learning Unit 9-1 Usually, the full amount is submitted to the state even if there is also a city sales tax. States collect the tax, divide it, and remit the amounts to the city or county. 9- 17 Learning Objectives 2 and 3 Posting from a sales journal to the general ledger. Recording to the accounts receivable subsidiary ledger from a sales journal. 9- 18 Learning Unit 9-2 Sales journal records sales of merchandise on account. Cash receipts journal records receiving cash from any source. 9- 19 Learning Unit 9-2 Credit sales make record keeping more complicated. A separate record for each customer must be set up. These records are called a subsidiary ledger. 9- 20 Learning Unit 9-2 Recorded sales are posted in total to the Sales account and the Accounts Receivable account. They are also recorded as debits to individual customer accounts. 9- 21 Learning Unit 9-2 Sales journal records sale of merchandise on account. Cash receipts journal records cash received. Purchases journal records buying merchandise or other items on account. Cash disbursements journal records payments. 9- 22 Learning Unit 9-2 Sales transaction amounts are posted to each credit customer in the subsidiary ledger. This process allows up-to-date records of credit customer balances. The amount and age of the account balance is shown. 9- 23 Learning Unit 9-2 The sales journal records all sales on account (credit sales only). Each credit sale transaction is posted to each credit customer as a debit. The totals of the Accounts Receivable, Sales Tax Payable, and Sales columns are posted to each of these general ledger accounts. 9- 24 Learning Objective 4 Preparing, journalizing, recording, and posting a credit memorandum. 9- 25 Learning Unit 9-3 What is a credit memorandum? It shows amounts that were deducted from the balance the customer owes. They are contra-revenue accounts with a normal debit balance. These are recorded in the general journal and posted to a subsidiary ledger. 9- 26 Sales Returns and Allowances Journal Date 200x April 12 Credit Account Memo No. Credited 1 BW Co. PR Sales Ret. and Allow. – Dr. Accts. Rec. – Cr. 600.00 9- 27 Learning Objective 5 Journalizing and posting transactions using a cash receipts journal, as well as recording to the accounts receivable subsidiary ledger. 9- 28 Learning Unit 9-4 The cash receipts journal records the receipt of cash from any source. The number of columns varies with each business, depending upon the frequency of certain types of transactions. The cash receipt journal speeds up the posting process because a total is debited to cash. 9- 29 Learning Unit 9-4 Debit Column Cash Sales Discount Credit Column Accounts Receivable Sales Sundry 9- 30 End of Chapter 9 9- 31