File

advertisement

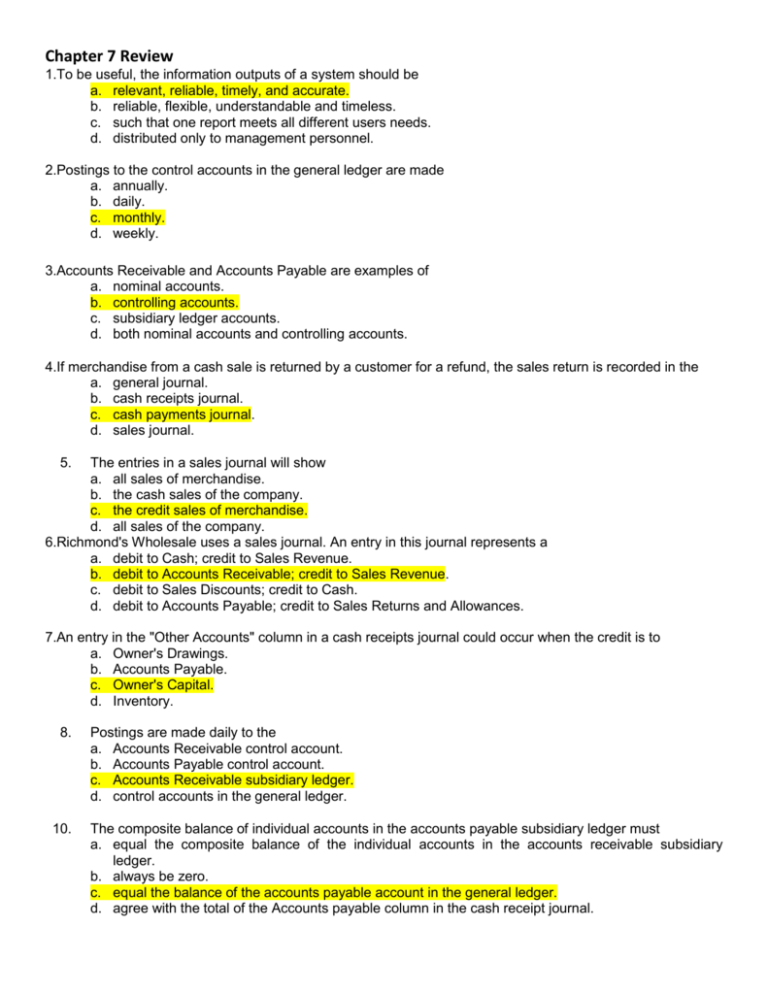

Chapter 7 Review 1.To be useful, the information outputs of a system should be a. relevant, reliable, timely, and accurate. b. reliable, flexible, understandable and timeless. c. such that one report meets all different users needs. d. distributed only to management personnel. 2.Postings to the control accounts in the general ledger are made a. annually. b. daily. c. monthly. d. weekly. 3.Accounts Receivable and Accounts Payable are examples of a. nominal accounts. b. controlling accounts. c. subsidiary ledger accounts. d. both nominal accounts and controlling accounts. 4.If merchandise from a cash sale is returned by a customer for a refund, the sales return is recorded in the a. general journal. b. cash receipts journal. c. cash payments journal. d. sales journal. 5. The entries in a sales journal will show a. all sales of merchandise. b. the cash sales of the company. c. the credit sales of merchandise. d. all sales of the company. 6.Richmond's Wholesale uses a sales journal. An entry in this journal represents a a. debit to Cash; credit to Sales Revenue. b. debit to Accounts Receivable; credit to Sales Revenue. c. debit to Sales Discounts; credit to Cash. d. debit to Accounts Payable; credit to Sales Returns and Allowances. 7.An entry in the "Other Accounts" column in a cash receipts journal could occur when the credit is to a. Owner's Drawings. b. Accounts Payable. c. Owner's Capital. d. Inventory. 8. 10. Postings are made daily to the a. Accounts Receivable control account. b. Accounts Payable control account. c. Accounts Receivable subsidiary ledger. d. control accounts in the general ledger. The composite balance of individual accounts in the accounts payable subsidiary ledger must a. equal the composite balance of the individual accounts in the accounts receivable subsidiary ledger. b. always be zero. c. equal the balance of the accounts payable account in the general ledger. d. agree with the total of the Accounts payable column in the cash receipt journal. 11.In which journal would a customer's partial payment on account be recorded? a. Sales journal b. Cash receipts journal c. General journal d. Cash payments journal 12.If a transaction cannot be recorded in a special journal a. the company must refuse to enter into the transaction. b. it is recorded in the general journal. c. it is recorded directly in the accounts in the general ledger. d. it is recorded as an adjustment on the work sheet. BE 1 Richey Company maintains four special journals and a general journal to record its transactions. Using the code below, indicate in the space provided the appropriate journal for recording the transactions listed. Code S CR CP P G Journals Sales journal Cash receipts journal Cash payments journal Single-column purchases journal General journal CR __1.Mr. Richey invested cash in the business. G ___2.Purchased store supplies on account. S ___3.Sold merchandise to customer on account. CP __4.Purchased a 2-year fire insurance policy for cash. CR __5.Received a check from a customer as payment on account. CP __6.Paid for store supplies purchased in transaction 2. P ___7.Purchased merchandise on account. G ___8.Issued a credit memorandum to a customer who returned defective merchandise previously sold on account. CP __9.Purchased office equipment for cash. G ___10. Made an adjusting entry for store supplies used during the period. BE 2 Indicate in which journal each of the following transactions is recorded. 1. Cash purchase of merchandise. ___CP___________ 2. Owner investment of cash. __CR________________ 3. Sale of merchandise on account. ___S_________________ 4. Purchase of supplies for cash. __CP________________ 5. Credit purchase of merchandise. P________________ 6. Collection on account from customers. _CR________________ Ex. 124 Mangino Company has a balance in its Accounts Receivable control account of $15,000 on January 1, 2012. The subsidiary ledger contains three accounts: Jones Company, balance $6,000; Black Company, balance $2,500 and Denny Company. During January, the following receivable-related transactions occurred. Jones Company Black Company Denny Company Credit Sales $11,000 9,000 8,500 Collections $8,000 2,500 7,000 Returns $ -02,000 -0- Instructions (a) What is the January 1 balance in the Denny Company subsidiary account? (b) What is the January 31 balance in the control account? (c) Compute the balances in the subsidiary accounts at the end of the month. (d) Which January transaction would not be recorded in a special journal? (a) $6,500 [$15,000 – ($6,000 + $2,500)]. (b) $26,000 [$15,000 + ($12,000 + $9,000 + $8,500) – ($8,000 + $ 2,500 + $6,000) – $2,000]. (c) Jones ($6,000 + $12,000 – $8,000) $ 10,000 Black ($2,500 + $9,000 – $2,500 – $2,000) 7,000 Denny ($6,500 + $8,500 – $6,000) 9,000 $26,000 (d) The sales return ($2,000) would be recorded in the general journal. Ex. 123 Maldanado Company has a balance in its Accounts Payable control account of $10,500 on January 1, 2014. The subsidiary ledger contains three accounts: Smith Company, balance $3,000; White Company, balance $2,500 and Marino Company. During January, the following payable-related transactions occurred. Smith Company White Company Marino Company Purchases $8,500 5,250 6,100 Payments $6,000 2,500 6,250 Returns $ -01,500 -0- Instructions (a) What is the January 1 balance in the Marino Company subsidiary account? (b) What is the January 31 balance in the control account? (c) Compute the balances in the subsidiary accounts at the end of the month. (d) Which January transaction would not be recorded in a special journal? (a) $5,000 [$10,500 – ($3,000 + $2,500)]. (b) $14,100 [$10,500 + ($8,500 + $5,250 + $6,100) – ($6,000 + $ 2,500 + $6,250) – $1,500]. (c) Smith ($3,000 + $8,500 – $6,000) $ 5,500 White ($2,500 + $5,250 – $2,500 – $1,500) 3,750 Marino ($5,000 + $6,100 – $6,250) 4,850 $14,100 (d) The purchase return ($1,500) would be recorded in the general journal.