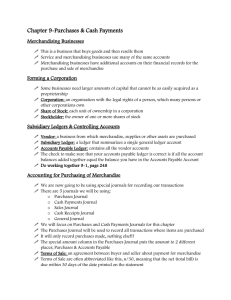

UNIT 7 ACCOUNTING SYSTEMS

advertisement

UNIT 7

ACCOUNTING

Accounting Systems are designed to eliminate much of

the duplication involved in a manual accounting system.

Using carbonized receipts, special journals as shown

here, and ledger cards allow for much of the accounting

SYSTEMS

work to be accomplished as receipts are processed and

checks written. Special journals are important because

they provide the basis for computerized accounting

systems.

Special Journal:

Purchases Journal is used for Credit Purchases

Sales Journal is for Credit Sales

Cash Payments Journal is used when Cash is Credited

Cash Receipts Journal is used when Cash is Debited

Note: The following transactions were originally recorded in the General Journal

on page 30. In this section, when possible, they have been recorded in special

journals. The abbreviation of the journal used follows each transaction.

1/3

1/7

1/11

1/12

1/14

1/18

1/24

Purchased merchandise for $4,000 on credit from L. Company,

invoice dated 1/1, terms 2/10,n30. PJ

Return $500 of defective merchandise purchased 1/1 from

L. Company. GJ

Paid L. Company for purchases of 1/1 less return

and discount. CPJ

DA'IE

Recorded Cash Sales of $2,000. CRJ

1/3

Sold $5,000 of merchandise to M. company termS

2/10,n30. SJ

2/2

M. Company returned $100 of merchandise purchased

1/14. GJ

M. Company paid for sale of 1/14 less return and

discount. CRJ

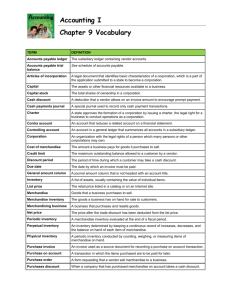

Note: Only credit

purchases are

allowed in the

Purchase Journal.

PURCHASES

JOURNAL

ACCOUNT

Page 1

'IERMS

POST

REF.

AMOUNT

,/

4,000

2/10,n30

1/10,n30

L. Company

Z. Company

./

7,960

(51)

(31)

CASH PA"2MENTS JOURNAL

I

DATE I EXPLANATIOO

1/11

2/28

Paid

Paid

L. Co.

Z. Co.

2/28

3/5

Paid

Paid

Trans.

Travel

II

- In

I'RRTl

TS

DEBITS

POST

PURCHASE

ACCOUNTS

CASH DISCOUNTS REF.

1

2

3

4

I

50

--ZQQ

7,680

PAYABLE

./

./

70

3,430

4,000

PURCHASES

TRAVEL

EXPENSE

(53)

I

I

OTHER

DEBITS

REF.

POST

Purchase

Discount

Lost

Trans. In

3,500

3,960

70

(1)

Page 1

7,460

2QQ.

200

(31)

(68)

AMOUNT

I

70

55

40

50

I

90

I

Note: When posting, place the number of the ledger account below the amount posted. A check (./)

should be placed in the Post Reference Column to indicate posting to a Subsidiary Ledger.

GENERAL LEDGER

(1)

CASH

ACCOUNTS

RECEIVABLE

11,000

Bal.

15,122

22.802

(3)

f.5.1l

PURCHASES

10,900

I

--1.Q.Q.

I

7.680

7,960

PURCHASE

I

RETURNS

I

(52)

500

ACCOUNTS RECEIVABLE

SUBSIDIARY LEDGER

PURCHASE

PIi~

M

5,000

CO!!1PaIl¥

A

6.000

It~gg

{531

CO!!1Pany

I

6.000

I

TRANS~iArCN-TN (0<1

TRAVEL EXPENSES

200

I

PURCHASE DISCOUNT

40

36

(68)

I

LOST

(70)

-

used.PJ

2/2 Purchase

$4,000of merchandisefrom Z. Company,terms 1/10,n30 Net Method

2/28 Paid Z. Company for purchase of 2/2 plus purchase discount lost. CPJ

2/28 Paid transportation charges of $50 for merchandise purchased 10/2. CPJ

Addi tiona.1

Signed a $10,000 Note Payable with First Bank Corporation, cash deposited today. CRJ

Sold $6,000 of merchandise to A. Company terms 2/10,n30. SJ

Paid Travel Expense of $200. CPJ

A. Company paid today. CRJ

Note: The General Journal is used for

entries that do not easily fit into

special journal.

Also included are

Adjusting,

Closing, Reversing,

and

Correcting Entries.

Note: Only Credit Sales are

allowed in the Sales Journal.

SALES

DATE

ACCOUNT

1/14

3/2

DATE

1

2

J'

J'

5,000

1/7

Accounts

Payable

Purchase

Returns

11,000

(3) (41)

1/18

Sales Returns

Accounts

Receivable

M. Co.

CASH RECEIPTS

JOURNAL

I

Weekly Sales

M. Company

Signed Note

A. Company

CASH

2,000

4,802

10,000

22,802

(1)

POST

REF.

SALES

DISCOUNTS

NOTES PAYABLE

I

J'

ACCOUNTS

I

i

i

I

4,000

SALES

I

Notes

Payable

....hQ.QQ

100

I

AMOUNT

32

10,000

10,000

2,000

(40)

10,900

(3)

Darin

I

I

I

(32)

11,000

I

=~ir

3.960

31

I

s Music

Emporium

Trial Balance

March 31, 1996

(41)

10,000

3.960

100

OTHER I POST

CREDITS

REF.

CASH

SALES

2,000

f.Ul

4.000

42

3

(40)

SALES RETURNS

AND ALLOWANCES (42)

100

~

-

500

4,900

I

98

(43)

I

ACCOCINTSPAYABLE

SUBSIDIARY LEDGER

L. CO\1:Pany

Z. Corqpany

500

2,000

CREDIT

(32)

31

52

- L. Co.

CR

Page 1

RECEIVABLE

J'

98

I

(31)

DR

('R1<TIIT

CASH SALES

ACCOUNTS PAYABLE

7,460

I 7,960

~

~

Bal. -0-

PR

EXPLANATION

AMOUNT

a

Page1

JOURNAL

POST

REF.

DEBT'i'

EXPLANATION

1/12

1/24

3/1

3/30

GENERAL

INVOICE

NUMBER

M. Conpany

A. Company

I

Page1

JOURNAL

I

3/1

3/2

3/5

3/30

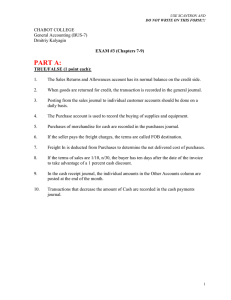

Transactions

Cash

$ 15,122

Purchases

Purchase Returns

Purchase Discounts

7,960

500

70

$

Transportation-In

TravelExpense

50

200

Purchase Discount Lost 40

Notes Payable

Cash Sales

Credit Sales

Sales Returns and

100

Allowances

Sales Discounts

~

~5JQ

10,000

2,000

11,000

~570