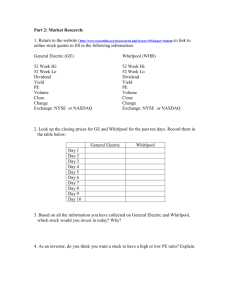

Lecture 16: Brokerage and ECNs

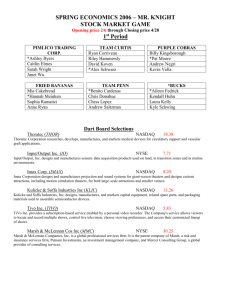

advertisement

Lecture 17: Brokers, Dealers, Exchanges & ECNs Brokers, Dealers Exchanges & ECNs • Brokers deal with public. Example: Merrill Lynch • Dealers execute trades • Exchanges are places where dealers operate. Examples: NYSE, Nasdaq, Arizona Exchange • Electronic Communications Networks (ECNs) allow investors to communicate with each other, and to exchange. Examples: Island, Instinet (now Inet) Brokers • Deal with public, know potential buyers and sellers • Churning versus providing information • SEC penalizes “rogue brokers” who churn. • Stockbroker Robert Magnan was convicted of criminal offense of churning, and barred from securities industry for life, 1999. • Magnan’s clients had an annual turnover rate of 11, and investments would have had to earn annual return of 50% to pay transactions costs. Dealers • Stand ready to buy and sell at posted prices, bid and asked • Analogy to antiques dealers • Why are antiques dealers’ bid-asked spreads so much wider than stock dealers? Exchanges • New York Stock Exchange, established 1792 by the Buttonwood Agreement among 24 brokers. • Exchanges provide standards and codes of ethics for broker members, standards for stocks. • Regional Exchanges: American Stock Exchange, Philadelphia Exchange • Listing requirements for stocks. Delisting too. • NASDAQ –National Association of Securities Dealers Automatic Quotation System, 1971, first electronic exchange, replaced old “pink sheet” system for over-the-counter stocks. Markets to Lend (Not Sell) Shares • “Loan Crowd” on floor of NYSE 1926-33 led active market • Wall Street Journal reported “Loan Rate” often negative (Charles Jones & Owen Lamont) • J. Edgar Hoover, Crash of 1929 • Equilend was established in 2001 (http://www.equilend.com/) sponsored by Barclays Global Investors, Bear Stearns, Goldman Sachs, JP Morgan, etc. Equilend Model New Exchanges • NASDAQ in 1971 did not require that stocks have ever made a profit before listing, listed IPOs immediately. • Intel, Microsoft refused NYSE switch • Foreign imitators of NASDAQ: Neuer Markt, Germany, Mothers, Japan • Neuer Markt shut down 2002 ECNs • Instinet: for professionals. Until 1999, it was the biggest ECN • Island: for individuals, became the biggest ECN. In 1999 it did 4.9% of all Nasdaq trading volume, compared with 3.0% for Instinet • Other ECNs: Redi-Book, Bloomberg, Archipelago Intermarket Trading System (ITS) • Securities Act of 1975 called for a national market system • In response to this act, the ITS, an electronic system, was opened in 1978. Displays quotes on all exchanges where a stock is listed. • Today the ITS is a relic, too slow to be of much use. Payment for Order Flow • Brokers drum up orders, deal with customers • Brokers sell the order flow to crossing networks, who profit from the order flow. • November 2000 SEC posted rules that brokers must post composite statistics on fraction of order flow going to various places. • Firms must also report statistics on their orderexecution quality The Battle of the Platforms • • • • Exchanges merge to try to gain critical mass Rumors of possible NYSE-Nasdaq merger Euronext merges European stock exchanges Instinet buys Island 2002 (to form Inet.com). Offered automatic trading facilities that Nasdaq lacked. (Nasdaq responds with Supermontage) • The Pacific Exchange acquires Archipelago.com 2000, then REDIBook. ArcaEx trading system Shares Traded per Day (Dec. 2003) • • • • New York Stock Exchange 1.3 billion Nasdaq 886 million Inet 586 million Pacific Exchange 526 million Limit Order Book • The Island ECN shows its book on the web from 2002, example of Dell is at right. • Color blocks indicate orders at same price • Orders are expressed in dollars and cents • Island was the first US exchange to list go to pennies • Inside spread is 35.625 to $35.73 Central Limit Order Book • Island Exchange shows only its own orders. • Nasdaq Level 1 shows only inside spread, few have Level 2 • In January 1997 SEC forced NASDAQ to list ECNs orders on its order book, among dealers’ quotes Kinds of Orders • Market Order • Limit Order • Stop Loss Order – Market orders dangerous for thinly-traded stocks – Island did not allow market orders The “Book” on NASDAQ • NASDAQ’s book is visible to everyone who orders NASDAQ Level 2 service • NYSE says it has plans to make its specialist’s book more widely available Gambler’s Ruin Problem • Starting with $S, betting $1 on heads on a coin toss with probability p of coming up heads, continuing to toss until ruin, probability of eventual ruin equals 1 if p is less than or equal to one half, otherwise equals: 1 p p S Gambler’s Ruin Derivation • Call probability of ever failing, playing forever, given that one has S dollars today Pr(S). Then, Pr( S ) p Pr( S 1) (1 p) Pr( S 1) Pr(0) 1 1 p Pr( S ) p S Optimal Bid-Asked Spread • Dealer must set a bid-asked spread in consideration of the ultimate probability of ruin and dealer’s utility weighting of this outcome • Dealer has inferior information, expects to be “picked off” by superior traders. • Must set bid-asked spread so that the amount of gain from spread offsets the expected loss. NYSE: The Specialist’s Post, Book and the Crowd • NYSE specialist maintains a book like Island’s, but it is not public, yet. • NYSE, AMEX, and Montreal are about the only remaining specialist exchanges • Specialist has obligation to maintain an orderly market • NYSE Rule 390 (prohibiting members from trading off exchange) abolished May 5, 2000 The Crowd, NYSE • Floor brokers cluster around specialist post, and trade among themselves • About 50% of NYSE share volume (though only about 10% of trades) go through floor brokers, not through specialist’s book • In addition to the crowd, there are the “upstairs traders” who handle very large orders. Myth: Stock trading is going all electronic • Electronic trading remains a venue for small trades • If they close the NYSE floor, the floor traders will just go upstairs. • Frankfurt, London, Paris, Toronto electronic exchanges: between 40% to 60% of trades were never orders on the book (though trade may be ultimately reported there.) • Books have too much transparency, large orders tip their hand too much by putting it on book. Criticism of NASDAQ • William Christie & Paul Schultz , Journal of Finance, Dec. 1994, pointed out that “odd eighths” spreads were rare on NASDAQ: dealers rarely quote prices ending in 1/8, 3/8, 5/8 and 7/8. • Therefore inside spread is always at least ¼. • Day after study reported in news, spreads narrow. • Authors interpret as evidence of tacit collusion. • Federal class action lawsuit against NASDAQ won $1.03 billion in 1998. Disadvantage to Limit Orders • Placing a limit order is being a sitting duck. If more in-the-know investors realize stock price is higher than in your sell order, they will buy from you at your price. In an expected value sense, your orders can be filled only in this unfortunate case. • Problem is enhanced by decimal trading. When a specialist has the slightest inkling that there is greater demand for the stock, can pick up shares selling for just pennies above market. “Getting pennied by the specialist.” The CNBC Effect • Successor of Financial News Network 1983 • NYSE trades above, color indicates direction of trade • NASDAQ trades below The CNBC Effect • Rapid Dissemination of financial innovation • CnnFn, Bloomberg New are the two cable TV competitors to CNBC • Claims that because of CNBC, markets respond much more rapidly to information. • But viewership on a typical day is no more than a few hundred thousand.