Principles of Finance – Fall 2012

(FIN 3403)

Instructor: Nina Schmidt, Ph.D.

OUTLINE:

Welcome & Introduction

Syllabus, Blackboard and Connect

Chapter 1

0

1

Chapter 1

Introduction to Corporate Finance

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

Chapter Outline

•

•

•

•

•

Financial Management

The Agency Problem

Forms of Business Organization

Financial Markets

Class Overview

3

Financial Management

• Def of Finance:

the study of money

• The goal of the financial manager:

maximize market share or profits?

best: “optimize shareholder value”

4

Financial Management

• The Three Main Decisions (Functions)

of the financial manager:

1. Capital budgeting or investment decisions

2. Capital structure or financing decisions

3. Working capital management or day to

day cash management decisions

(note: we will focus on the corporate world)

5

Sample Organizational Chart

6

The Agency Problem

• An agency relationship is also called

a fiduciary relationship. In an agency

relationship the

represents the

.

• An agency problem exists when a

exists between the agent and

the principal.

• The solution for the agency problem:

tie management compensation to stock price

performance

• Corporate Scandals and Sarbanes Oxley Act

7

of 2002.

Forms of Business

Organization

Sole

Proprietorship

Characteristics:

Partnership

(General or

Limited)

Corporation

Life of Business

Ability to Raise

Cash

Taxation

Liability

Transfer of

Ownership

8

Forms of Business

Organization

• Two forms of business organization

that take advantage of the benefits of

a corporation but avoid double

taxation: S-Corp and LLC.

• Legal information can be found on

legal websites, such as:

www.nolo.com

www.legalzoom.com

9

Financial Markets:

Cash Flows between the Firm and the

Financial Markets

10

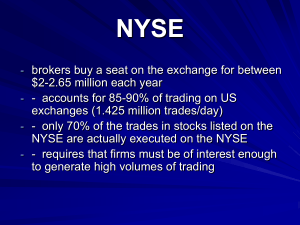

Financial Markets

• Primary vs. Secondary Markets

• Secondary Markets:

Dealer vs. Auction Markets

- Dealer Market: No physical location

(over the counter OTC)

for example: NASDAQ

-

Auction Market: Physical location

for example: NYSE, AMEX, CBOT

11

“NYSE in the Digital Age”

Sarasota Herald Tribune, Feb 18th, 2007, Page D 1

Traders on the NYSE trading floor

in November 2006.

Traders on a crowded NYSE trading floor in

November 1968

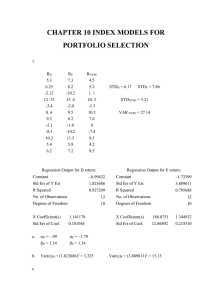

Class Overview:

Principles of Finance

Goal of Financial Manager:

Optimize Shareholders’ Wealth

Three Main Decisions

Long Term

Short Term

Capital Budgeting

Capital Structure

Investing = Spending Money

Financing = Getting Money

Ch 1: Introduction

Ch 2 & 3: Financial Statements,

Ratios, Cash Flows

Ch 5 & 6: Time Value of Money

→ Exam I

Working Capital

Management

Ch 7: Bond Valuation

Ch 8: Stock Valuation

Ch 9: NPV and other

Investment Criteria

Ch 10: Making Capital

Investment Decisions

Ch 12: Capital Market History

Ch 13: Risk, Return and the Capital

Asset Pricing Model

Ch 14: Cost of Capital & WACC

Ch 16: Financial Leverage and

Capital Structure

→ Exam II

→ Cumulative Final Exam

13