Stock Market

advertisement

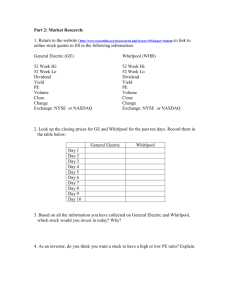

Stock Market and Investments Terms/Tracking History 1531- stock market emerged, in Antwerp, Belgium. “…the first stock market, sans stock.” 1600′s- Britain, France, and the Netherlands all chartered voyages to the East Indies. limited liability companies were formed to raise money from investors, who received a share of profits commensurate with their investment. History September of 1599 – London merchants created corporation which would limit each member’s liability to the amount they personally invested. 1600- Queen Elizabeth I approves – East India Trading Company 1602- Dutch East India Trading Company -first to issues stocks to public -Amdsterdam Stock Exchange Facts Wall Street was laid out behind a 12-foot-high wood stockade across lower Manhattan in 1685. The stockade was built to protect the Dutch settlers from British and Native American attacks. The New York Stock Exchange (NYSE) began in 1817 as the brokers formed the New York Stock & Exchange Board (NYS&EB), renting rooms at 40 Wall Street Facts NYSE The first listed company on the NYSE was the Bank of New York It is fourth largest in terms of listings behind the Bombay Stock Exchange, the London Stock Exchange, and the NASDAQ. On December 1st, 2005, the highest price was paid for membership in the NYSE at $4 million. There are currently 1,366 seats available on the NYSE. On February 27th, 2007, the NYSE has its largest volume day of record at over 4 billion shares. Facts Dow Jones Industrial Average an index that shows how 30 large, publicly owned companies based in the United States have traded during a standard trading session in the stock market founded on May 26, 1896 General Electric only original left on index Facts NASDAQ The NASDAQ was created in 1971 and was the first electronic stock exchange, focusing on the trading of OTC stocks. "over-the-counter" stocks that trade via a dealer network as opposed to on a centralized exchange. NASDAQ stands for “National Association of Securities Dealers Automated Quotation.” The highest price per share stock on the NASDAQ is none other than Google. http://www.econedlink.org/less ons/index.php?lid=292&type=st udent Terms: Types of Investments Basic Investment Considerations Risk and Return Higher return for a riskier investment How much risk are you willing to take? Investment Objectives Reason for investing Retirement- long term Vacation fund- easily liquidated Steady stream of income- bonds Considerations Consistency Consistent investment generates more wealth than amount invested at one time Avoid Complexity Stick with what you know #1 rule- if too complicated let it go! Bonds Long-term investment that pays interest for a specified number of years Coupon- stated interest Maturity- life of the bond Principal(par value =$amt) amount that will be repaid to lender at maturity Ex. 20- year $1000 bond with 6% interest -- owner receives $30 semianually -- at end of 20 years, owner gets $1000 Bond Prices Bond is a financial asset that will pay interest 2x year plus final value at maturity Investor determine their price based on future interest rates, risk, supply demand, etc. Other Financial Assets Certificate of Deposit (CD) Common form Loans investors make to financial institutions that return with interest after specific period of time Jumbo CD’s = $100,000 + Municipal Bonds State and local gov’ts Finance highways, stadiums, civic improvements Safe, taxing power to pay the interest, tax exempt Financial Assets Government Savings Bonds Federal gov’t Low denominations, non-transferable Purchased at a discount and not full value for several years depending on interest rate Interest built into redemption price Easy to obtain, no risk Treasury Notes/Bonds Treasury Notes and Bonds Fed gov’t borrows funds for more than 1 year = T-Note and Bonds T-Note: maturities 2-10 years T-Bond: maturities 10-30 years Regarded as safest of all financial assests Have lowest return Treasury Bills T-bill: short-term obligation with maturity of 13, 26, 52 weeks in min of $10,000 No interest directly, sold at discount and collects total amount at maturity $10,000 T-bill purchased at $9300 will be repaid at $10,000. Return of $700 in shortterm