History of the Stock Market

History of the

Stock Market

Mr. Henry

AP Economics

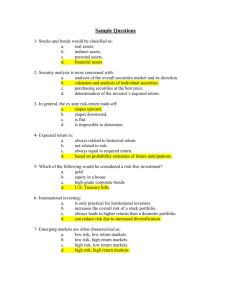

Part I: Quiz

• # your whiteboard #1-14

• Write down the correct letter to each Q

#1

• Where's the oldest stock exchange in the world?

A Lyon, France

B Barcelona, Spain

C Hamburg, Germany

D Toulouse, France

E Antwerp, Belgium

F Geneva, Switzerland

#2

• Where was the first stock exchange in the

United States?

A Boston, Mass.

B New York, N.Y.

C Philadelphia, Pa.

D Washington, D.C.

#3

• The founders of the New York Stock Exchange took inspiration from which country's stock market?

A Great Britain

B France

C Italy

D Spain

#4

• What was the first listed company on the

NYSE?

A Nationwide Insurance

B Prudential

C Bank of New York

D Merrill Lynch

#5

• What's the largest stock exchange in the world, in terms of market capitalization (basically, the total value of all listed companies)?

A New York Stock Exchange

B Tokyo Stock Exchange

C NASDAQ

D Bombay Stock Exchange

E London Stock Exchange

F Hong Kong Stock Exchange

#6

• What's the name for the method of communications used by stock traders frantically running around a trading floor and using hand signals?

A verbal auction

B open outcry

C hand dealing

#7

• Which of the following is an example of a defensive stock?

A a weapons manufacturer

B a utility company

C an auto manufacturer

#8

• What does it mean when a trader flashes four fingers parallel to the floor, palm out?

A sell four shares

B sell nine shares

C buy four shares

D buy nine shares

#9

• What was the first totally electronic stock market?

A NASDAQ

B London Stock Exchange

C NYSE

D Tokyo Stock Exchange

#10

• How many companies are in the Dow Jones

Industrial Average?

A 10

B 30

C 50

D 100

E 130

#11

• Which company is NOT a member of the Dow

Jones Industrial Average?

A Verizon

B Amazon

C Hewlett-Packard

D Wal-Mart

E Pfizer

F Home Depot

G Boeing

H American Express

#12

• What do we call a strong economy -- a bull or bear market?

A bull

B bear

#13

• Which federal agency is responsible for regulating the stock markets?

A Federal Trade Commission

B Securities and Exchange Commission

C Federal Reserve System

#14

• What historic agreement rang in the start of the New York Stock Exchange in 1792?

A Buttonhole Agreement

B Cottonwool Agreement

C Clothespin Agreement

D Buttonwood Agreement

E Cottonclub Agreement

#1

• Where's the oldest stock exchange in the world?

E) Antwerp, Belgium The Antwerp Bourse opened its doors in 1460 and kept going until 1997.

#2

• Where was the first stock exchange in the

United States?

C) Philadelphia, Pa. New York is where all the action is today, of course, but the Philadelphia Stock

Exchange, founded in 1790, predated it by two years.

#3

• The founders of the New York Stock Exchange took inspiration from which country's stock market?

D) Spain The value of the dollar had been based on the Spanish real, so the NYSE founders looked to

Spain for inspiration for their stock market, too.

Long story, but the Spanish real is also the reason for all the fractional stock prices in the NYSE.

#4

• What was the first listed company on the

NYSE?

C) Bank of New York Shares of the Bank of New York were traded under the fabled buttonwood tree on

Wall Street in 1792.

#5

• What's the largest stock exchange in the world, in terms of market capitalization

(basically, the total value of all listed companies)?

A) New York Stock Exchange The NYSE tops the list here.

#6

• What's the name for the method of communications used by stock traders frantically running around a trading floor and using hand signals?

B) open outcry Open outcry is the (perhaps soon-tobe extinct) way to communicate transactions through shouting and hand signals.

#7

• Which of the following is an example of a defensive stock?

B) a utility company A defensive stock is so named because its value doesn't fluctuate much. So a good example of defensive stock would be utility stocks.

#8

• What does it mean when a trader flashes four fingers parallel to the floor, palm out?

B) sell nine shares Palm out means sell. Four fingers at a 90-degree angle indicates nine (four upright fingers would indicate four).

#9

• What was the first totally electronic stock market?

A) NASDAQ has been electronic (meaning, no trading floor) ever since its inception in 1971. All other stock markets have lagged far behind, although they're getting there.

#10

• How many companies are in the Dow Jones

Industrial Average?

B) Very simply put, the Dow Jones Industrial

Average is the average stock value of 30 very large, industrial companies.

#11

• Which company is NOT a member of the Dow

Jones Industrial Average?

B) Amazon.com is a member of the NASDAQ-

100, not the Dow Jones.

#12

• What do we call a strong economy -- a bull or bear market?

A) A bull market indicates a strong economy.

#13

• Which federal agency is responsible for regulating the stock markets?

B) Securities and Exchange Commission The SEC is in charge of the securities industry and the stock markets.

#14

• What historic agreement rang in the start of the

New York Stock Exchange in 1792?

D) The historic Buttonwood Agreement, which was signed by 24 of the most prominent bankers, brokers and merchants of the time, described a plan for trading stocks and securities through a common clearing house.

Part II: History

• Foundings

• During the Revolutionary War, the new U.S. government did not have the funds to pay for the war effort. To gain funds, the government issued bonds with a promise of repayment in the future. The bond purchasers were given promissory notes on paper.

After the war, those in control of the bonds began trading them for immediate compensation. Merchants recognized the need for a place to exchange these bonds as well as commodities; this gave rise to commercial centers, which eventually became the stock exchanges of America.

NYSE

• In the last decade of the 18th century, 24 of the top members of the New York financial community recognized the need for an exchange. They created what was then called the Security Exchange Office. This name persisted until 1863; after that year, the exchange was referred to as the New York Stock Exchange. Since its inception, the NYSE has set limits on the minimum amount of shares that had to be offered, along with other requirements, if corporations wished to have their stock traded on the exchange. The exclusive nature of the exchange led to its becoming the premier exchange in America. During the economic boom of the early 20th century, every emerging company wanted to have its shares traded on the NYSE. Today the NYSE is the largest exchange in the United States.

Amex

• The early days of the American Stock Exchange saw trades taking place on the streets of New York City’s financial district. Stockbrokers would meet outdoors on the streets to discuss trades and negotiate deals.

Eventually these brokers formed the New York Curb

Exchange, the name by which it was known until 1953.

The American Stock Exchange was long the place for companies that could not meet the standards set forth by the NYSE. As the AMEX gained support, however, they put standards in place as well. This increased the reputation of the American Stock Exchange; since then, the American Stock Exchange has become the third largest exchange in the United States.

NASDAQ

• The NASDAQ was founded by the National

Association of Securities Dealers. Founded in the early 1970s, the NASDAQ was the world's first electronic market. The NASDAQ has since partnered with a Swedish exchange called OMX and purchased the Philadelphia Stock Exchange.

The NASDAQ has grown quickly, and it is today the largest electronic trading market in the world with thousands of companies listed. It is also the second largest trading market in the United

States.

The Great Depression

• The depression originated in the U.S., after the fall in stock prices that began around

September 4, 1929, and became worldwide news with the stock market crash of October

29, 1929 (known as Black Tuesday).

• The Great Depression had devastating effects in countries rich and poor. Personal income, tax revenue, profits and prices dropped, while international trade plunged by more than 50%. Unemployment in the U.S. rose to 25%, and in some countries rose as high as 33%.

• Cities all around the world were hit hard, especially those dependent on heavy industry. Construction was virtually halted in many countries. Farming and rural areas suffered as crop prices fell by approximately 60%. Facing plummeting demand with few alternate sources of jobs, areas dependent on primary sector industries such as cash cropping, mining and logging suffered the most.