Period 1 - Ursuline High School

advertisement

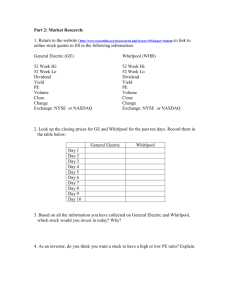

SPRING ECONOMICS 2006 – MR. KNIGHT STOCK MARKET GAME Opening price 2/6 through Closing price 4/28 1st Period PIMLICO TRADING CORP. *Ashley Byers Caitlin Elmes Sarah Wright Janet Wu TEAM CURTIS Ryan Corriveau Riley Hammersly David Koven *Alex Schwarz PURPLE COBRAS Billy Kingsborough *Pat Moore Andrew Negri Kevin Vella FRIED BANANAS Mia Cakebread *Hannah Meinken Sophia Ramatici Anne Ryan TEAM PENN *Benito Cardenas Chris Donahue Chess Lopez Andrew Saltzman *BUCKS *Aileen Fedrick Kendall Huhn Laura Kelly Kyle Schwing Dart Board Selections Thoratec (THOR) NASDAQ 19.38 Thoratec Corporation researches, develops, manufactures, and markets medical devices for circulatory support and vascular graft applications. Input/Output Inc. (IO) NYSE 7.71 Input/Output, Inc. designs and manufactures seismic data acquisition products used on land, in transition zones and in marine environments. Imax Corp. (IMAX) NASDAQ 8.20 Imax Corporation designs and manufactures projection and sound systems for giant-screen theaters and designs custom attractions, including motion simulation theaters, for both large-scale attractions and smaller venues. Kulicke & Soffa Industries Inc (KLIC) NASDAQ 11.26 Kulicke and Soffa Industries, Inc. designs, manufactures, and markets capital equipment, related spare parts, and packaging materials used to assemble semiconductor devices. Tivo Inc. (TIVO) NASDAQ 5.83 TiVo Inc. provides a subscription-based service enabled by a personal video recorder. The Company's service allows viewers to locate and record multiple shows, control live television, choose viewing preferences, and access their customized lineup of shows. Marsh & McLennan Cos Inc (MMC) NYSE 30.25 Marsh & McLennan Companies, Inc. is a global professional services firm. It is the parent company of Marsh, a risk and insurance services firm, Putnam Investments, an investment management company, and Mercer Consulting Group, a global provider of consulting services. Team Selections PIMLICO TRADING CORP. FedEx Corp. (FDX) NYSE 98.45 FedEx Corp. is comprised of a family of companies, providing transportation, e-commerce, and supply chain management services for customers. The Company provides worldwide express delivery, ground small-parcel delivery, less-than-truckload freight delivery, supply chain management services, customs brokerage services, and trade facilitation and electronic commerce solutions. “We chose this because it is a ‘risk buy’, and from what we have observed it will continue to grow due to upcoming major holidays.” *BUCKS Starbucks (SBUX) NASDAQ 33.50 Starbucks Corporation retails, roasts, and provides its own brand of specialty coffee. The Company operates retail locations worldwide and sells whole bean coffees through its sales group, direct response business, supermarkets, and on the World Wide Web. “The cold weather is increasing sales so that would make the stock go up. It is a national enterprise and well-known which makes it a good buy.” TEAM PENN Marathon Oil Company (MRO) NYSE 72.280 Marathon Oil Corporation, through its subsidiary, Marathon Oil Company, is an integrated oil firm with operations worldwide. The Company explores for and produces crude oil and natural gas on a worldwide basis. Marathon also conducts operations in the refining, marketing, and transportation of petroleum products in the United States. “We are selecting this company because over the past year this stock has been successful and we think that it will continue to rise these next three months because gas prices are rising and therefore the oil prices are.” FRIED BANANAS Google Inc. (GOOG) NASDAQ 382.730 Google Inc. provides a web based search engine through its Google.com website. The Company offers a wide range of search options, including web, image, groups, directory, and news searches. “We chose this company because it is a very popular search engine. The company is growing and creating new aspects of the internet as more people gain access to the internet. TEAM CURTIS Boeing (BA) NYSE 70.650 The Boeing Company, together with its subsidiaries, develops, produces, and markets commercial jet aircraft, as well as provides related support services to the commercial airline industry worldwide. The Company also researches, develops, produces, modifies, and supports information, space, and defense systems, including military aircraft, helicopters and space and missile systems. “It has been soaring recently and the weather will only be getting better, not to mention Valentines Day and Easter are right around the corner. We expect it to continue its positive trend.” PURPLE COBRAS Schlumberger Ltd. (SLB) NYSE 124.440 Schlumberger Limited is an oil services company consisting of two business segments. Schlumberger Oilfield Services provides technology, project management and information solutions to the international petroleum industry. WesternGeco, which is jointly owned by Baker Hughes, is a seismic company that provides advanced acquisition and data processing surveys. “It is the most profitable discoverer of fossil fuels. It’s used by all major energy companies and famous for immense oil and natural gas fields.” Expert Selections Eric Satchel, Investment Counselor – Bank of America Corp. Apple Computer Inc. (AAPL) NASDAQ 72.02 Apple Computer, Inc. designs, manufactures, and markets personal computers and related personal computing and communicating solutions. “Apple has been down roughly 20% and most likely will turn that around in the short run.” Hale Knight, retired President – Westamerica Bancorp Trust Company Pfizer (PFE) NYSE 25.21 Pfizer Inc. is a research-based, global pharmaceutical company that discovers, develops, manufactures, and markets medicines for humans and animals. “Its 12 month price spread is $20.71 - $29.21. Current price as I write (1/27) is $25.94. so it has not shown any great price activity over the past year. However, in this mornings Wall Street Journal an article said that the FDA has approved 2 new drugs that could well become big sellers. The whole health care field is in transformation. There is no way of knowing what the outcome will be but PFE sells more prescription drugs than any other drug company and will surely survive what may happen in the drug care field.” Dan Knight, Economics Teacher - Ursuline High School Kronos Inc./MA (KRON) NASDAQ 39.76 Kronos Incorporated designs, develops, manufactures, and markets hardware and software systems that collect and process information designed to increase productivity in the workplace. “Kronos is consistently listed among the best small businesses in the country. It has a reputation for strong management and it is in the process of expanding its customer base.” John Evans, Vice President-Investments, Smith-Barney Group Amgen Inc. (AMGN) NASDAQ 74.42 Amgen Inc. discovers, develops, manufactures, and markets human therapeutics based on cellular and molecular biology. The Company focuses its research on secreted protein and small molecule therapeutics, with particular emphasis on neuroscience and cancer. “Amgen is the largest biotech company in the country, with several late stage trials underway for key pipeline products.” Peter Kingston, Director of Finance & Operations, Ursuline High School Toyota Motor Corp. (TM) NYSE 103.00 Toyota Motor Corporation manufactures, sells, leases, and repairs passenger cars, trucks, buses, and their related parts worldwide. “On Friday (2/3) their stock was down for the year, but rising. Their Hybrid technology was just endorsed in an article in the Economist, and mentioned in the State of The Union speech. Also I just bought one of their Hybrids after research that suggested Toyota has a strong product line.” Brad Pighin, Financial Advisor, Merrill Lynch Private Client Group American International Group Inc (AIG) NYSE 65.50 American International Group, Inc., through its subsidiaries, provides a variety of insurance and insurance-related services in the United States and overseas. The Company writes property and casualty and life insurance, as well as provides financial services. “It’s a company that is well diversified within the financial sector. It’s forecasted for substantial earning per share growth for 2006/07. It had a relatively poor performance last year and I don’t think we’ll see a 3% decline this year. As we see interest rates stabilizing this year they’ll have a better idea what their cost per capital is going to be. It should do well especially since forecasted for later in the year we might even see interest rates start to drop. It’s well positioned for the next 12 weeks.”