How Nasdaq Works…

advertisement

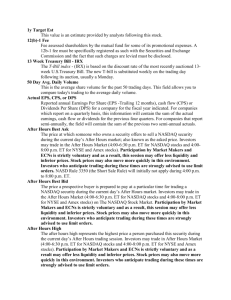

How Nasdaq Works… Trifonopoulos Christos Dimakis Dimitris Nasdaq offers formal company listing requirements electronic surveillance of trading real-time dissemination of quotations trade reports order-routing and execution systems limit-order display Structure of Nasdaq… How Nasdaq operates Stock Name buy ABCD 10 1/4 sell 10 3/8 EFGH 11 5/8 11 7/8 XYZ 9 3/8 10 1/8 SelectNet ECNs Internet Investors Advantages of NASD… Depth of market The number of shares of a security that can be bought or sold at the bid and ask prices near the market without causing a dramatic change in price. Liquidity The liquidity of a stock is the ease with which the market can absorb volume buying or selling, without dramatic fluctuation in price. Price efficiency Better prices which are ensured by competition Transparency The degree to which trade and quotation information is available to the public on a current basis Spread The difference between the bid price at which a Market Maker will buy a security, and the ask price at which a Market maker will sell a security. Electronic Any electronic system that widely disseminates to third Communication parties orders entered by an exchange Market Maker or Network (ECN) OTC Market Maker, and permits such orders to be executed against in whole or in part. What is a Market Maker? A firm It maintains a firm bid and offer price in a given security It stands ready to buy or sell at publicly-quoted prices The Nasdaq Stock Market is a decentralized network of competitive Market Makers 10% of NASD firms are Market Makers Market Maker’s Job… It processes orders for its own customers… and for other NASD broker / dealers It buys securities from issuers for resale Nasdaq’s electronic life 1976 NASD purchases Nasdaq from Bunker-Ramo. 1980 Harris terminal introduced. Actual inside bid and offer displayed. 1987 Nasdaq Workstation introduced allowing any DOS-based PC to serve as a terminal. 1990 SelectNet introduced 1994 Nasdaq Workstation II introduced. Nasdaq’s electronic life timeline Harris terminal Workstation NASD purchases Nasdaq from Bunker-Ramo. SelectNet Workstation II 1976 1980 1987 1990 1997 2000 Some facts and figures (1/3) Some facts and figures (2/3) Some facts and figures (3/3) ECN Network Participants Some ECNs ECNs are run by companies ECNs provide access to Nasdaq’s central network