File a tax return

advertisement

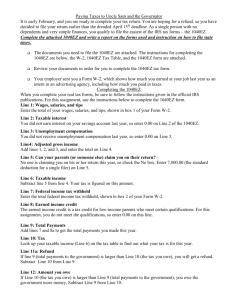

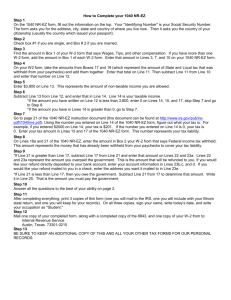

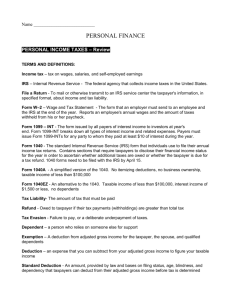

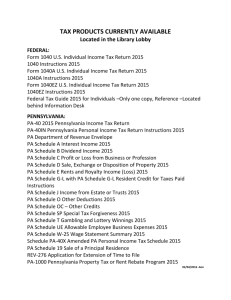

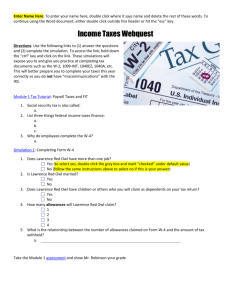

5.2 What’s a tax return? Simply put, this is a set of forms to help you calculate your tax obligation. Note: Not everyone must file a tax return. If you make less than a certain amount, you are not required to file. Tax notes continued… Things you might want to know Filing a tax return is the only way to have funds returned to you if you either owe no tax, or too much was withheld from your income. Sometimes what was withheld wasn’t enough to cover your taxes, in which case you must send the remaining amount to the government. You alone are responsible for the accuracy of your return, no matter how you file your taxes. Sources of information for your tax return: FORM W-2 This comes from your employer. It is a summary of earnings and withholdings for the year. You should have one for every job you held throughout the year (your employer also sends a copy to the IRS). The government requires a copy of your W-2 when you file your taxes as well. Not reporting your earnings will earn you a visit from the IRS. Refer to pg. 164 for an example W-2 Sources of information for your tax return: FORM 1099-INT You get this for any interest you earned on money in the bank. The bank sends a copy to the IRS and to you. Types of Income Tax Forms: 1040 and 1040A There are 3 types of forms most often used when filing taxes, all of which are available online, or at a post office or library. The 1040 and 1040A forms allow you to itemize deductions to reduce the amount you owe. This is helpful if you: Own a home Have children Invest in the stock market Run a business Types of Income Tax Forms: 1040EZ To use the 1040 EZ you must: be single or married and filing together Under the age of 65 Not blind Have income of less than $100,000 Earned less than $1500 in interest Have no income other than, wages, interest, tips, scholarships or unemployment compensation Refer to pg. 167 for a sample 1040EZ. Completing a 1040EZ Step 1: Identify yourself This includes things like your name and social security number. Completing a 1040EZ Step 2: Identify your income This includes: total wages/salaries/tips (usually found on your W-2). Note: if you held more than one job, you will need to add your earnings from all your jobs. taxable interest income (this comes from your 1099-INT) unemployment compensation (only if you filed, otherwise leave blank) What do you get when you add these 3 together? This: adjusted gross income (this is what you get when you add lines 1, 2, and 3 together). It’s recorded on line 4. Next up? Deductions. Completing a 1040EZ continued: Step 3: Deductions You may only claim yourself if no one else can claim you (like a parent or guardian). Note: As a young person, there is typically someone else claiming you (since they are supporting you by providing food ,shelter, etc.) If you cannot claim yourself, complete the worksheet on the back of the form, there may still be a limited amount you can deduct, even if someone else is claiming you. If no one can claim you, you qualify for a standard deduction (listed on the form based on how you are filing). Completing a 1040EZ continued: Step 4: Your taxable income When you subtract line 5 (your deductions) from line 4 (your adjusted gross income), you get line 6: Your taxable income. This is the figure used to determine your taxes. Refer to pg. 167 for a sample of 1040EZ Completing a 1040EZ continued: Step 5: Payments and Tax Let’s start with the federal income tax withheld. On line 7 you will enter the amount of tax that was already withheld by your employer (this is on your W-2, in box 2). Don’t forget, if you had more than one job, you must add the amounts withheld from ALL W-2s to calculate an accurate total. Next comes earned income credit. If you had a really low income, you may be eligible for another tax credit (which is treated as if it were a tax payment). On line 8 you add what was already withheld from your pay along with any income credits. This tells you the taxes you have already paid. Completing a 1040EZ continued: Step 6: Tax Each form contains a table with the amount of tax you owe for the year. Remember, your taxable income is listed on line 6. You must find where your taxable income falls in that table, looking at the number that pertains to you (single or married filing jointly). A sample of this tax table can be found on page 168. Getting a refund, or paying Uncle Sam? Since taxes are withheld from your paycheck throughout the year, most of your taxes have probably been paid. If more was withheld than necessary, you get that money back Write the amount on line 11a. Note: Refunds can be issued electronically, and deposited directly into your checking account. Refund If you owe more than has already been withheld, you will need to pay the rest of what is owed. Write the amount on line 12. Note: Don’t forget to sign your return, whether you are receiving a refund or making a payment! Paying Uncle Sam (ie. Amount You Owe) Don’t forget to sign your return! Checking For Accuracy It’s important to remember that submitting a tax return with a mistake can cost YOU. The IRS can issue a penalty to pay, or you could receive a lower refund than you are owed. You may pay the IRS via check or credit card, although credit payments cost a fee of about 2.5% Deadline for paying taxes each year is April 15th! Self Employment Tax 1040 required When you don’t have an employer withholding taxes throughout the year, you must use another method to ensure taxes are still being paid. Paying on a quarterly basis when you work for yourself, you pay your estimated taxes every 3 months. • this helps business owners avoid taxes and penalties • Schedule C (1040) Self employed business owners must file this (also known as C-EZ, Schedule C, or 1040) • SEBOs still pay income tax, social security, and Medicare • Electronic Filing There are advantages to filing online: You get your refund faster 2) The software only costs a small fee to file (Turbotax and Taxcut are examples) 3) Helps organize your information Caution: You may qualify for a tax refund loan 1)