Students Who Have Taxable Scholarship: Step by Step Instructions

advertisement

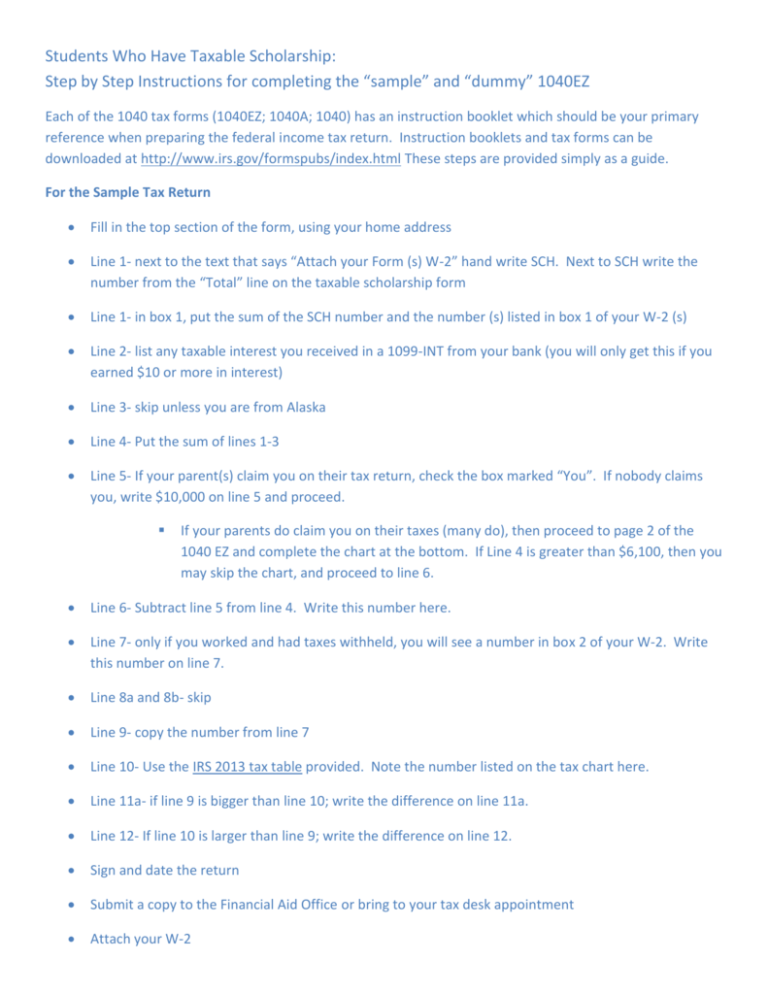

Students Who Have Taxable Scholarship: Step by Step Instructions for completing the “sample” and “dummy” 1040EZ Each of the 1040 tax forms (1040EZ; 1040A; 1040) has an instruction booklet which should be your primary reference when preparing the federal income tax return. Instruction booklets and tax forms can be downloaded at http://www.irs.gov/formspubs/index.html These steps are provided simply as a guide. For the Sample Tax Return Fill in the top section of the form, using your home address Line 1- next to the text that says “Attach your Form (s) W-2” hand write SCH. Next to SCH write the number from the “Total” line on the taxable scholarship form Line 1- in box 1, put the sum of the SCH number and the number (s) listed in box 1 of your W-2 (s) Line 2- list any taxable interest you received in a 1099-INT from your bank (you will only get this if you earned $10 or more in interest) Line 3- skip unless you are from Alaska Line 4- Put the sum of lines 1-3 Line 5- If your parent(s) claim you on their tax return, check the box marked “You”. If nobody claims you, write $10,000 on line 5 and proceed. If your parents do claim you on their taxes (many do), then proceed to page 2 of the 1040 EZ and complete the chart at the bottom. If Line 4 is greater than $6,100, then you may skip the chart, and proceed to line 6. Line 6- Subtract line 5 from line 4. Write this number here. Line 7- only if you worked and had taxes withheld, you will see a number in box 2 of your W-2. Write this number on line 7. Line 8a and 8b- skip Line 9- copy the number from line 7 Line 10- Use the IRS 2013 tax table provided. Note the number listed on the tax chart here. Line 11a- if line 9 is bigger than line 10; write the difference on line 11a. Line 12- If line 10 is larger than line 9; write the difference on line 12. Sign and date the return Submit a copy to the Financial Aid Office or bring to your tax desk appointment Attach your W-2 Completing a Dummy Return: If you worked in 2014 and had Federal Tax withheld,(box 2 of your W2(s)) Follow the above instructions above, except omit your scholarship from line 7. Use only the amounts from Box 1 of your W2(s) complete a dummy return that will never be mailed to the IRS. Completing the second page of the taxable scholarship worksheet: Step 1, note what is listed on your actual tax return (Line 11 or 12). Step 2, note what is listed on your Dummy tax Return. If your dummy return shows a larger IRS refund than your actual tax return, the Tax Help Desk will credit your student account for the difference. If your dummy return shows a refund, but you owe the IRS on the actual return, the Tax Help Desk will credit your student account (for what would have been your refund) and cut a check to the IRS for the amount due. If you owe the IRS on your dummy return, and owe an even larger amount on your actual return, The Tax Help Desk will cut a check to the IRS for the additional amount due.