TAXES

advertisement

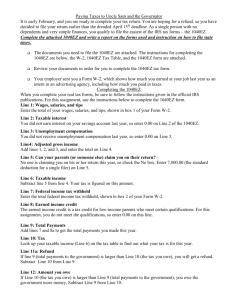

TAXES By Stevie VanDeVelde Topics Purpose of taxes Different types of taxes What taxes you can expect to pay How to calculate the amount of federal income tax you owe Complete a 1040EZ What is the purpose of taxes Support schools Support building Maintain roads Provide for the nation’s defense Tax Required contribution of money Ultimately paid to the government Raise revenue to pay the cost of government Direct Tax Paid directly to the government Examples: income tax and property tax Indirect Tax Shifts the tax burden Example buy gasoline, cigarettes – then pay tax on them Direct Tax Can Become An Indirect Tax Landlords property taxes increase (direct tax) Your rent increases due to it (indirect tax) Types of Taxes Income Tax – – – – Paid based on the money you earn and profits a business makes Paid to Federal, State and sometimes Local Government Paid on salary, wages, tips and savings and investment income Pay for the overall costs of governments Types of Taxes - Continued Payroll Tax – – – – Paid to support Soc. Security taxes Both you and your employer make a contribution Help provide you with retirement income/benefits Some occupations (teachers and government workers) pay into a state retirement program rather than Soc. Security Types of Taxes - Continued Sales Tax – – – State and Local Governments Tax is added to the cost of the items Sales tax in Illinois is 6.25% Types of Taxes - Continued Estate, Inheritance and Gift Tax – – – – – Estate tax – assessed on the value of the deceased’s property before it is passed on Inheritance tax – taken out of each person’s share of the will Federal – Estate Tax State (some) – both Inheritance and estate tax Gifts up to a certain amount are tax free. Over that amount a gift tax is imposed Income Tax History – – – – 1913 – Federal Income tax imposed The 16th amendment gave the government the right to tax Wisconsin – 1st state to administer an income tax By mid-1970’s – almost all states have an income tax Federal Income Tax Who Must Pay? – – – – – – Individuals Corporations Trusts Estates Business owners (pay through their individual income taxes) Citizens of other countries who earn income in the U.S. Federal Income Tax Who Doesn’t Have to Pay? – – – Low Income Families Nonprofit Organizations (churches, charities) Some hospitals Federal Income Tax Part of being a good citizen Graduated income tax – – Seen as fairest type of tax Those who earn more – pay a higher percentage Graduated Income Tax State Income Tax Most have a graduated income tax Some use a flat rate – Your income is $25,000 and your spouse’s income is $35,000, therefore, you would pay 6% on all income or $3,600 Taxable Income Your total income Adjustments to Income (paid alimony, contributions to IRA) = Your adjusted gross income Deductions and Exemptions = Taxable Income Reduction of Income Tax Tax laws: Those who meet certain requirements can reduce the amount of income which is taxed Determining Your Deductions Mortgage Interest Property Taxes Contributions to Charities and Churches Tax-Free Income Allows a certain level of tax-free income – – Marital status Number of dependents Thus, – – Larger families generally pay less tax Married couples generally pay less tax Determining Your Exemptions Yourself (if not claimed by your parents) Any Dependents Taxable Income Your total income Adjustments to Income (paid alimony, contributions to IRA) = Your adjusted gross income Deductions and Exemptions = Taxable Income Taxable Income and Tax Table Use Taxable Income Determine the Amount of Tax you Owe Taxable Income and Tax Table Taxable income $15,235 Tax (single) $1,919 Your Turn Based on the table, how much tax does a married couple filing jointly owe on an income of $15,742? How much does a single person owe on the same amount? Tax Credits May Reduce Your Figure from the Tax Table Amount of tax due may reduce by any tax credits – Child Care Compare Tax Owe to Tax Paid If too much withheld – refund If too little withheld – owe difference Tax Form Due April 15 Sign Interest and Penalty if late “Filing” Process of completing and submitting an income tax return Can be simple or complex Not Filing = Tax Evasion Eligibility for filing a 1040EZ Filing status – single or married filing jointly No dependents No student loan interest deduction or an education credit Not age 65 or over (you or your spouse) Taxable Income less than $100,000 Eligibility for filing a 1040EZ – Cont. Only had wages, salaries, tips and taxable scholarships, unemployment compensation, qualified state tuition program earnings or Alaska Permanent Fund dividends AND your taxable interest income was not more than $1,500. Did not receive any Advance earned income credit payments Did not owe any household employment taxes on wages you paid to a household employee Filing a 1040EZ On paper Telephone Computer IRS Web Site www.irs.gov John Nye – Class Activity Preparing a 1040EZ Introduction In 2005, John Nye worked after school and all day Saturday at Rudden’s Ice Cream Parlor. In late January 2006, John received a W-2 Wage and Tax Statement from his employer. John went to the post office and picked up a Form 1040EZ and the instructions for completing this form. (You can also download them from the web site). Introduction - Continued John also received a 1099-int – Interest income earned from from his local bank. He had earned $63.00 in interest income. With this information he was able to complete his 1040EZ. John’s W2 John’s 1040EZ Other Types of 1040’s 1040A – – Dividend and Capital Gains from Stock Deductible Student Loan Interest 1040 – – Itemize rather than taking the standard deductions Receive income from rental property Let’s Do Some Calculations! Suppose you make $370 a week. Each year you pay $2,884 in federal income tax, $578 in state income tax, $262 in sales tax, $88 in property tax, $1,472 in FICA tax, and $158 for other taxes. How much do you pay for taxes during the year? How many weeks must you work just to pay taxes? Calculation #2 Suppose you earned an annual salary of $27,000 and your spouse earned $32,000. If there were a flat tax on income of 5%, how much income tax would your family have to pay? Calculation #3 Using the tax table, determine the amount of tax you owe, if your wages were $15,178.00, tips were $1,132.00 and interest income was $220.00. The amount of tax withheld from your employer was $1,596.00. Review Questions What do taxes pay for? Name some types of taxes What is it called if you have earned income and fail to file an income tax return? If you are married, can you use form 1040EZ to file your federal income tax return? What is a Graduated Income Tax? Review Questions - Continued What is a flat rate tax? What are deductions? What are exemptions? What date must you file your taxes by?