File

advertisement

Investments and Personal Finance

Introduction to Economics

Johnstown High School

Mr. Cox

Why invest? Now vs Later

Jim invests $100 a month ($1,200/year) at age 25 for 10

years at 10.00% compounded monthly (compounding continues after

age 35)

Sam invests $100 a month ($1,200) at age 35 for 30 years at

10.00% compounded monthly

Who has more money at age 65?

Time Is Money

$450,000

$409,736

$400,000

$350,000

$300,000

$227,930

$250,000

$200,000

$150,000

$100,000

$50,000

$1

5

10

15

20

YEARS

25

30

35

40

Where Can You Put Your Money?

Under your mattress

Little risk, no room for capital gain

Savings

bank holds your money

CDs (Certificate of Deposit)

bank holds your money, time specified

Money Market

short term

Bonds

“loan”, lower risk (usually)

Where Can You Put your Money?

Stocks

“ownership”, risk varies

Mutual Funds

“pool”, risk varies

ETF’s

“index”, risk varies

What Programs are Available for Retirement

Savings?

What are they, how do they work, and what are the

underlying investments

Traditional IRA

Roth IRA

403 (b)

401 (k)

IRA (Individual Retirement Account)

After-Tax Maximum annual contribution cannot be more

than gross income

Account grows tax deferred

Taxes paid once distributions are taken

Roth IRA

Maximum annual contribution cannot be more than gross

income

Taxes are applied before investment

How to choose? Why one or the other?

https://investor.vanguard.com/ira/roth-vstraditional-ira

403(b)

Section of IRS tax code for public employees

Schools, colleges, state agencies

Immediate vesting

2009 max contribution $15500

Portable/Movable to other accounts

401(k)

Section of IRS tax code for private employees

Corporations, LLC’s, self-employed

Employer sponsored

Matching/vesting schedules

2008 max contribution $15500

Portable? Maybe..

How To Manage Risk

Consult an investment professional

Match your investments with your time frame

Pick funds managed by experienced professionals

Invest regularly - in good times and bad

Diversify!

Large, mid, small companies

Aggressive when young, conservative when older

How To Get Started.

Talk to an advisor

Start doing research

Tips to help get started

Begin planning

401(k) - go to employer

IRA - Bank/ mutual funds/ETFs

do own investments

T. Rowe Price, Vanguard, Fidelity, etc

use a financial advisor

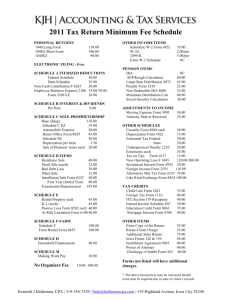

Be sure to think about taxes……….

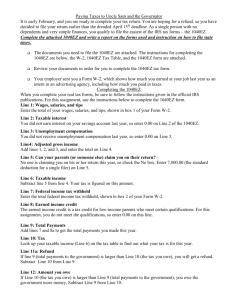

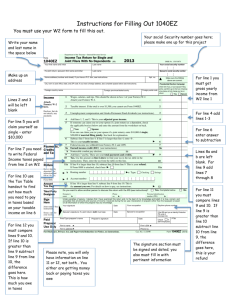

Completing Your Taxes

For you as teenagers, you will more than likely be

completing the 1040EZ form

1040 is basic income allowance sheet

1040ez is filing for low income/minors/dependents/single

Reports income and other financial information to federal government

Separate forms used for state/local governments

Use W-2 form to fill out

I’ve Got A Job!

What’s an I-9

and a W-4?

14

Form I-9 – Employment Eligibility Verification

Proves you aren’t an illegal alien

Penalty if not one on file for each employee

Keep 3 years after employee is gone

Acceptable documents used to prove citizenship:

Passport

Voter’s registration

School or military ID

Driver’s license

Social security card

15

16

So What Is A W-4?

New employees fill out this form

Tells employers how much federal income tax to withhold

from paycheck

17

Filling Out the W-4 Correctly

If don’t fill out correctly:

Owe money when taxes are due April

15

Could be taking out too much tax from

paycheck

Lose potential interest

18

A Few Key Terms You Need To Know

WITHHOLDING:

Represents money that an employer deducts from paycheck to

pay all or part of employee’s taxes

However, depending how much make for the year, you may

not have to pay federal income tax. If this is you, you would

be EXEMPT from paying

19

Can you put Exempt on your W4?

You can put “Exempt” if:

1.

2.

3.

4.

Weren’t required to pay federal income tax last year

Don’t expect to this year either (made less than $6100 {std

deduction - base amount of income that is not taxed})

If under 19 or a full-time student (or until 24 yr/full time)

CAN parent(s) claim you as a dependent?

DEPENDENT: A person who relies on another taxpayer for at least

half of his or her support (food, shelter, clothing, education, etc.)

If divorced

o

o

20

Custodial parent (has child 1 more day than other)

One makes more money

Examples:

If you live with parents and under 19, you can be claimed as

a dependent regardless of how much you make.

While your parents may not choose to claim you, test is

whether they CAN.

If they can claim you and you are under 19, and expect to

make under $6100 in the calendar year, you will likely NOT

have to pay federal income tax.

Note: If you are at least 19 but under 24, parents can still claim you as

a dependent as long as you are a FULL-TIME Student!

21

I don’t qualify for Exempt status – now

what?

Need to fill out the personal allowances worksheet on the W-

4 form!

The more exemptions (allowances) you claim, the _____ tax

withheld from paycheck

Claim “____” will result in the largest amount of tax to be

withheld

22

What if I Make a Mistake?

Claim exempt and make more than $6100?

More than likely have to owe taxes!

If you don’t claim exempt (0 allowances)

More than likely break even or receive a

refund!

23

The Paycheck Stub

Miscellaneous Information

Gross Income

Deductions

May get refund on Fed and State

No refund on SS or Medicare

Net Income

24

The W-2

Must receive these by January 31st from your employer

Summarizes

How much you made during the year (Earned

Income)

How much you paid in for taxes

Use to help fill out tax return

If error, see employer to fix

25

W-2 continued

W-2 – will have 3 copies

Your records

Attach to state tax return

Attach to federal tax return

26

Fill out w wb

1099-INT

Receive this form from your bank

Shows interest earned for year

Remember: Interest is considered “unearned

income” and may have to pay tax on it!

28

Fill out w wb

Am I Required to

File a Tax

Return?

30

25

Am I Required to File a

Tax Return (as a dependent)?

Due April 15!

Required? Depends…

OR if…

3.

Filing Requirement Worksheet for Most Dependents

*Your income for the year

1.

*If parents can claim you, you

must file if:

2.

1.Your unearned income was

over $1000

2.Your earned income was over

$6100

Enter dependent's earned income plus $350

Minimum amount

3.

$1000

Compare lines 1 and 2. Enter larger amt

(Adjusted Earned Income)

4.

Maximum Amount

5.

Compare lines 3 and 4. Enter the smaller

amount

6.

Enter the dependent’s gross total income. If line

6 is more than line 5, the dependent MUST

FILE an income tax return.

$6100.00

27

http://www.irs.gov/uac/Do-I-Need-to-File-a-Tax-Return%3F

Am I Required to File a Tax Return?

Jill Williams, 18, had

two jobs during the past

year. She worked as a

waitress at La Fogata,

where she earned $6800

and as a summer

counselor, where she

earned $2400. Jill also

made $375 in interest.

Filing Requirement Worksheet for Most Dependents

1.

Enter dependent's earned income plus $350

2.

Minimum amount

$1000

3.

Compare lines 1 and 2. Enter larger amt

(Adjusted Earned Income)

4.

Maximum Amount

5.

6.

$6100.00

Compare lines 3 and 4. Enter the smaller

amount

Enter the dependent’s gross total income. If line

6 is more than line 5, the dependent MUST FILE

an income tax return.

Do I have to file return WS

Forms?

1040EZ – simplest to file

1040 – most lengthy to file

33

How Do I File the

1040EZ?

34

How Do I File the 1040EZ?

Must meet requirements to use EZ:

Single

Claim no dependents

Taxable income < $100,000

No income other than wages, salaries, and tips (shown

on W-2)

Up to $1500 taxable interest (shown on 1099INT)

35

Filling out the 1040EZ

Terminology:

Adjusted Gross Income (AGI)

Sum of wages and taxable interest

Deduction

Amount tax payers may subtract from their AGI before

tax is determined (reduction in income)

Taxable Income

Part of income you must pay taxes on

Credit

Direct reduction of taxed owed

36

Fill out 1040EZ wb

Now it is your turn to try!

Print your name, address and Social Security Number.

Using the sample W-2 form, complete the Income section

and calculate your taxable income.

Complete the payments and tax section and then go to the

booklet (sheet) provided in the handouts to calculate your

tax.

Continued

Find out whether you will get a refund (Line 11a) or you

owe money to IRS (Line 12).

If you are getting a refund, you can have your refund mailed

to you or directly deposited into your bank account.

If you owe money, you have to write a check.

Be sure to sign your return and add in additional information

as required.

Good Luck!!

Sending in the Return

Photocopy the EZ form for record

Mail in W-2 & 1099 INT with return

If owe

payable to “United States Treasury”

39

Don’t Want to Pay? What could you

have done differently?

If you don’t choose to pay, IRS will add 5% to what

you owe for each month you don’t pay!

W-2

Claimed “0” rather than exempt so take taxes out

Watch out for scam artists!

40